Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

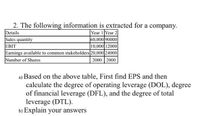

Transcribed Image Text:2. The following information is extracted for a company.

Details

Sales quantity

EBIT

Earnings available to common stakeholders 20,000 24000

Number of Shares

Year 1 Year 2

60,000 90000

10,000 12000

2000 2000

a) Based on the above table, First find EPS and then

calculate the degree of operating leverage (DOL), degree

of financial leverage (DFL), and the degree of total

leverage (DTL).

b) Explain your answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the equity multiplier (total assets / total equity) for the firm below. Make sure you do NOT convert your answer and keep 2 decimals for your final answer.....for examples, if you calculate 6,000/400 = 15, you should enter 15 into BB to be marked correct. Sales $5,000 COGS $1,200 Depreciation $800 Interest $500 Net Income $200 Total Assets 5000 Total Equity 1400arrow_forwardCalculate the Rate of Return on Assets (ROA) for 2011. Disaggregate ROA into the profit margin for ROA and total assets turnover components. Calculate the Rate of Return on Common Stockholders’ Equity (ROCE) for 2011. Disaggregate ROCE into the profit margin for ROCE, total assets turnover and capital structure leverage components.arrow_forwardProvide correct answer for this questionarrow_forward

- I need a and b answerarrow_forwardA) Dividend coverage = 1.22 b) Interest coverage = 7.75 C) P/E ratio = 1 D) gross profit margin = 92.25% E) return on assets = 16.9% f) Current ratio = 1.41 g) Quick ratio = 0.23 h) Earnings per share = 0.037 3. Analyzing and interpreting ratios 4. Based on your analysis and interpretation, prepare a detailed and effective report to management on the company's performance for 2022.arrow_forwardNeed answer with this questionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education