ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

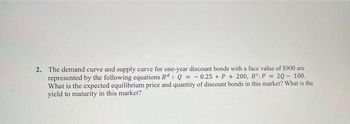

Transcribed Image Text:2. The demand curve and supply curve for one-year discount bonds with a face value of $900 are

represented by the following equations Bd: Q = = -0.25 P + 200, B³: P = 2Q- 100.

What is the expected equilibrium price and quantity of discount bonds in this market? What is the

yield to maturity in this market?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2.The present value (PV) of a certain monetary investment asset Mo, with yield Mt over a time period t, is given by the relationship: PV = Mt/(1+n)'. Explain the role that the parameter n plays in determining the eventual terminal value of this monetary investment.arrow_forwardPls don't copy from any other tutor site. Q.What is the present value of $5,000,000 fifteen years from now at a 7% interest rate with exponential discounting? With hyperbolic discounting? When would you choose to use hyperbolic discounting instead of exponential discounting in general?arrow_forwardBelow you will find the Demand and Supply Curves for $250,000 bonds that mature in 18 years: Qd = 400,000 – 2(P) Qs = 3(P) – 100,000 What is the current equilibrium interest rate in that bond market?arrow_forward

- Rework part (f), assuming that Annie holds the bond for 10 years and sells it when the required return is 7.0%. Compare your finding to that in part (f), and comment on the bond's maturity risk. PV= 1,000 N=10 I/Y= 7% Assume that Annie buys the bond at its current price of $983.80 and holds it until maturity. What will her current yield and yield to maturity (YTM) be, assuming annual interest? After evaluating all of the issues raised above, what recommendation would you give Annie with regard to her proposed investment in the Atilier Industries bonds?arrow_forwardExplain what the term "bond price elasticity" means. Would bond price elasticity indicate that zero-coupon or high-coupon bonds with the same yield to maturity have a greater price sensitivity? Why? What does this mean for the market value volatility of zero-coupon Treasury bonds vs high-coupon Treasury bonds in mutual funds?arrow_forwardd)Assume that all the information given previously is the same and the defaultrisk premium for corporate bonds rated AAA is 1.5 percent, whereas it is4 percent for corporate bonds rated B. Compute the interest rates onAAA- and B-rated corporate bonds with maturities equal to one year, twoyears, three years, four years, five years, 10 years, 20 years, and 30 years.arrow_forward

- NEED HELP WITH ALL PARTS PLZZZZZ!!!arrow_forwardWhat is the difference between (Fair Market Price) and (Current Market Price)? I struggle to understand how both relate to the (Required Rate of Return) and (Expected Rate of Return). Please correct me if I am wrong, my understanding is that if Fair Market Price is greater than the Current Market Price on security/stock, then I should buy more. In contrast, I have to sell when it's vice versa. I would appreciate it if you could illustrate with examples, i.e., numbers.arrow_forward31) Suppose in 2017 you buy two year $1,000 face-value 5% coupon bond for $1,000. In 2018, interest rates decrease to 2%. If you decide to sell your bond in 2018, what will be the selling price of your bond and one-year rate of return for you? A) $1,020; 7% B) $1,000; 2% C) $971; -2.1% D) $1,029.4; 7.9%arrow_forward

- Consider a U.S. Treasury Bill with 270 days to maturity. The face value is $100. If the annual yield is 4.7 percent, what is the price? (Note: Treat 270 days as 9 months, or 9/12 of a year using a 360-day year.)arrow_forwardSuppose an FI has a long position in zero-coupon bonds of seven years to maturity with a face value of $1,631,483. Today's yield on these bonds is 7.243 percent per year. These bonds are held as part of the trading portfolio. Suppose we define bad yield changes such that there is 1 chance in 20 (or a 5 percent chance) that the next day's yield increase (or shock) will exceed this given adverse move. Assuming normality and suppose that during the last year the mean change in daily yields on seven-year zero-coupon bonds was 0 percent while the standard deviation was 10 basis points. a) Estimate the dollar market value of position b) Potential adverse daily yield move c) Estimate price volatility d) Estimate daily earnings at risk e) Estimate value at risk over a period of 10 daysarrow_forwardHow much would you pay for a perpetual bond that pays an annual coupon of $200 per year and yields on competing instruments are 5%? You would pay $. Part 2 If competing yields are expected to change to 8%, what is the current yield on this same bond assuming that you paid $4,000? The current yield is %.(Round your response to the nearest integer.) Part 3 If you sell this bond in exactly one year, having paid $4,000, and received exactly one coupon payment, what is your total return if competing yields are 8%? Your total return is %.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education