ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

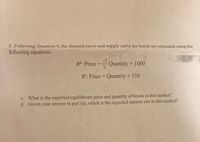

Transcribed Image Text:5. Following Question 4, the demand curve and supply curve for bonds are estimated using the

following equations:

-2

Bd: Price =

Quantity + 1000

5

B°: Price = Quantity + 550

c. What is the expected equilibrium price and quantity of bonds in this market?

d. Given your answer to part (a), which is the expected interest rate in this market?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardd)Assume that all the information given previously is the same and the defaultrisk premium for corporate bonds rated AAA is 1.5 percent, whereas it is4 percent for corporate bonds rated B. Compute the interest rates onAAA- and B-rated corporate bonds with maturities equal to one year, twoyears, three years, four years, five years, 10 years, 20 years, and 30 years.arrow_forwardNEED HELP WITH ALL PARTS PLZZZZZ!!!arrow_forward

- Everything else held constant, if the expected return on bonds falls from 10 to 5 percent and the expected relative return on GE stock rises from 7 to 8 percent, then the expected return of holding GE stock to bonds and the demand for GE stock falls; rises. rises; falls rises; rises. falls; fallsarrow_forwardE3arrow_forwardWhy is the relationship between price and yield negative?a. Because investors reward higher cash-flows with a lower price.b. Because governments regulation prohibits a positive relationship.c. Because an increase in the yield discounts cash flows at a higher rate and so their netpresent value decreases.d. Because cash flows are variable over a bond’s life.arrow_forward

- 26arrow_forward1. A security promises a future cash flow of exactly $4,200 in 5 years and $1,001 in 6 years. If the interest rate is 5%, then what is the present value of this security? 2.There are decreasing opportunities for businesses to make profitable investments. In the market for bonds we expect that the equilibrium price will and the equilibrium interest rate willarrow_forwardThe demand D (in billions of £) for a bond with coupon rate 5% and face value FV = 1000, and two years to maturity as a function of its price P is D = 4000 − 2P. The supply in (billions of £)as a function of the price of the bond is S = 2P + 400. b) Suppose that the yield to maturity of the bond is i = 0.05. What is the quantity demanded/supplied at this interest rate? What happens to the demand/supply of the bond as the interest rate increases? Explain why. c) What is the equilibrium interest rate? d) Suppose that the bond trades at premium. Is there excess demand or supply? Explain. e) There is a business cycle contraction, so both supply and demand shifts. After the shift, the new demand curve is given by: D = 4000 + X − 2P , whereas the new supply curve is S = 2P + 200. For which values of X will the interest increase/decrease? Which values of X are in line with empirical data?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education