Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

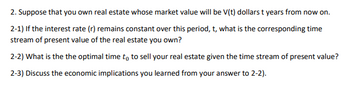

Transcribed Image Text:2. Suppose that you own real estate whose market value will be V(t) dollars t years from now on.

2-1) If the interest rate (r) remains constant over this period, t, what is the corresponding time

stream of present value of the real estate you own?

2-2) What is the the optimal time to to sell your real estate given the time stream of present value?

2-3) Discuss the economic implications you learned from your answer to 2-2).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- A payment of £8,000 will be received at time t=17. Calculate the value of this payment at t=0 years if the nominal rate of discount is 4.6% per annum convertible quarterly for the first 8 years, 4.9% per annum convertible monthly for the next 4 years, and 5.8% per annum convertible half-yearly for the remaining years. (correct answer = 3382.52, No tables, please, ONLY formulas)arrow_forwardA bond with face value F = $100 and annual coupons C = $5_maturing after three years (at T = 3) is trading at par. Find the implied continuous compounding rate. (Hint: By Proposition 8 in the notes, the annual compounding rate equals coupon rate.)arrow_forwardCan you please help me answer this with limited spacearrow_forward

- Assn #3 Pg 13 (1-10) And Works x em/?file=https://drive.google.com/uc?id%3D1CTEVTWK8MB4C_mgM7cZiHsSSPeOAZ 10&export%3Ddownload&filename%3DAttachment:%20PDF:%2 9. The balance in a bank account with an annual interest rate of 2%, compounded annually, can be represented using the function f(t) = 1000(1.02), where t is the time in years after opening the %3D 1 account. What was the approximate account balance 6 years and 3 months, or 6- years, after 4 the account was opened?arrow_forward2. (2 pts) At an effective annual interest rate i, you are given: (a) the present value of an annuity-immediate with annual payments of 1 for n years is 40; and (b) the present value of an annuity-immediate with annual payments of 1 for 3n years is 70. Calculate the accumulated value of an annuity-immediate with annual payments of 1 for 2n years. Solution:arrow_forward4. An insurer issues a 15-year annual premium-due endowment insurance of $100,000 benefit to life (50). The insurer charges an initial expenses of $ 1000 plus renewal expenses of 5% of each subsequent premium after the first premium payment. The premiums are made at the beginning of each year when (50) remains alive before reaching 70 and the benefit is paid at the end of K50 +1 years or when the person reaches the age 70 whichever occurs earlier. (a) Write down the gross future loss random variable L in terms of actuarial notations. (b) Calculate the gross premium-due G by using the Standard Select Survival Model with 5 % per year interest (Table D4) and the equivalence premium principle. 8 (c) Calculate the gross premium policy value V by using the equivalence premium G found in (b).arrow_forward

- 5. A bank account earns 5% interest compounded monthly. Suppose that $1000 is initially deposited into the account, but that $10 is withdrawn every month. (a) Show that the amount in the account after n-months is (1+) An-1 – 10, Ao = 1000. 0.05 12 An (b) How much money will be in the account after 1 year? (c) Suppose that instead of $10, a fixed amount d dollars is withdrawn each month. Find the value of d such that the amount in the account after each month remains $1000. (d) What happens if d is greater than this amount? (e) This problem deals with money and savings accounts. The concept behind this construction is much more general. Describe a further application, outside the realm of economics, where this model might be applied.arrow_forwardSolve the problem. 36) Suppose $14,000 is invested with 4% interest for 5 yr under the following compounding 36) options. Complete the table. Compounding Option n Value a. Daily b. Continuously A) B) C) D) Compounding Option n Value| 1 n/a a. Daily b. Continuously Compounding Option In Value| a. Daily b. Continuously Compounding Option In Value| 1 n/a a. Daily b. Continuously Result a. Daily b. Continuously Result $17,033.14 $17,783.62 Result 365 $17,099.45 n/a $17,783.62 Result $17,033.14 $17,099.64 Compounding Option In Value| Result 365 $17,099.45 n/a $17,099.64arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,