Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

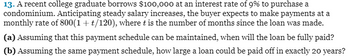

Transcribed Image Text:13. A recent college graduate borrows $100,000 at an interest rate of 9% to purchase a

condominium. Anticipating steady salary increases, the buyer expects to make payments at a

monthly rate of 800(1+t/120), where t is the number of months since the loan was made.

(a) Assuming that this payment schedule can be maintained, when will the loan be fully paid?

(b) Assuming the same payment schedule, how large a loan could be paid off in exactly 20 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 6 images

Knowledge Booster

Similar questions

- 2. Alanna plans to add an extension on to her home. She applied for a loan of $30 000. Loans are available for five years at 8.9% per year, compounded monthly.arrow_forwardA finance company offers a promotion on $8900 loans. The borrower does not have to make any payments for the first 4 years, however interest will continue to be charged to the loan at 24.6 % compounded continuously. a) What amount will be due at the end of the 4 years, assuming no payments are made? $ (Rounded to the nearest cent). b) If the promotion is extended an additional 4 years, and no payments are made, what amount will be due? S (Rounded to the nearest cent).arrow_forwardThe annuity will run out of funds after approximately 13 years 10 months. (b) Show that a continuous annuity with withdrawal rate N = $5000/year and interest rate r = 8%, funded by an initial deposit of P0 = $75,000, never runs out of money.arrow_forward

- 2. (2 pts) At an effective annual interest rate i, you are given: (a) the present value of an annuity-immediate with annual payments of 1 for n years is 40; and (b) the present value of an annuity-immediate with annual payments of 1 for 3n years is 70. Calculate the accumulated value of an annuity-immediate with annual payments of 1 for 2n years. Solution:arrow_forwardDetermine the outstanding principal of the given mortgage. (Assume monthly interest payments and compounding periods.) HINT [See Example 7.] a $100,000, 25-year, 4.3% mortgage after 10 years Step 1 Note that this question asks us to find the outstanding principal, after the first 10 years, on a 25-year, $100,000 mortgage. The present value formula can be used to calculate the outstanding principal on a mortgage, but to use this formula, the monthly payment on the mortgage must be known. To calculate the monthly payment PMT on a mortgage valued at PV dollars for n periods at an interest rate of i per period, use the formula PMT = PV The given mortgage is $100,000, so PV = 100000 The 4.3% annual interest rate as a decimal is 0.043, so the monthly interest rate is i = 12 Step 2 With PV = 100,000, i = If the investment is for 25 years with monthly payments, then the number of pay periods is n = 25. 12 = 300 nearest cent. PMT = PV PMT = = 1 − (1 + i)¯″¸ 100000 0.043 and n = "I 12 544.54…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,