FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Oscar's Red Carpet Store maintains a checking account with Academy Bank. Oscar's sells carpet each day but makes

bank deposits only once per week. The following provides information from the company's cash ledger for the month

ending February 28, 2021.

Date

Amount

No.

Date

Amount

$ 2,300 Checks:

1,900

2,800

3,700

1,200

$ 11,900

$ 4,300

600

321

322

323

324

Deposits:

2/4

2/11

2/18

2/25

2/26-2/28

2/2

2/8

2/12

2/19

2/27

2,100

1,800

400

Cash receipts:

325

326

2/28

900

1,500

$11,600

327

2/28

Balance on February 1

$ 6,400

Receipts

Disbursements

11,900

(11,600)

$ 6,700

Balance on February 28

Information from February's bank statement and company records reveals the following additional information:

a. The ending cash balance recorded in the bank statement is $10,390.

b. Cash receipts of $1,200 from 2/26-2/28 are outstanding.

c. Checks 325 and 327 are outstanding.

d. The deposit on 2/11 includes a customer's check for $400 that did not clear the bank (NSF check).

e. Check 323 was written for $2,800 for advertising in February. The bank properly recorded the check for this amount.

f. An automatic withdrawal for Oscar's February rent was made on February 4 for $1,300.

g. Oscar's checking account earns interest based on the average daily balance. The amount of interest earned for

February is $160.

h. In January, one of Oscar's suppliers, Titanic Fabrics, borrowed $5,200 from Oscar. On February 24, Titanic paid $5,350

($5,200 borrowed amount plus $150 interest) directly to Academy Bank in payment for January's borrowing.

i. Academy Bank charged service fees of $120 to Oscar's for the month.

2. Record the necessary cash adjustments. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the

first account field. Total entries to the same account together when enterina in the iournal entry worksheet).

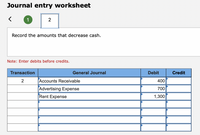

Transcribed Image Text:Journal entry worksheet

1

2

Record the amounts that decrease cash.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

2

Accounts Receivable

400

Advertising Expense

Rent Expense

700

1,300

Expert Solution

arrow_forward

Step 1

Sometimes There may be a difference in cash & passbook Balances. Usually Cash & Bank Pass book show same balances, But when there is difference, The Banker Prepares a Statement called Bank reconciliation statement.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $25,318 debit balance, but its July bank statement shows a $27,304 cash balance. b. Check Number 3031 for $1,360, Check Number 3065 for $456, and Check Number 3069 for $2,128 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,270 but was erroneously entered in the accounting records as $1,260. d. The July bank statement shows the bank collected $7,500 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $11 bank service…arrow_forwardPlease dont use any AI. It's strictly prohibited.arrow_forwardBlossom Company purchases various types of beach toys for sale to consumers. Listed below are the transactions for the month of June. Blossom uses a perpetual inventory system. June 1 Purchased 25 water tubes for $260 each terms n/30 FOB destination. 8 Returned 4 tubes purchased on June 1 due to defects. Received a full refund for the defective tubes. 10 Freight charges of $100 for the June 1 transaction are paid by the responsible party. 11 Made a complaint about competitive pricing. Received a $400 credit for the water tubes purchased on June 1. 15 Purchased 110 water tubes for $235 each on account, terms 2/10 n/30. 18 Made payment for the amount owing for the June 1 transaction. 20 Made payment for the amount owing for the June 15 transaction.arrow_forward

- Wildhorse Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the last part of 2025. Wildhorse had the following transactions related to notes payable Sept. 1 Sept. 30 Oct. 1 Oct. 31 Nov. 1 Nov. 30 Dec. 1 Dec. 31 Issued a $13,200 note to Pippen to purchase inventory. The 3-month note payable bears interest of 9% and is due December 1. (Wildhorse uses a perpetual inventory system) Recorded accrued interest for the Pippen note. Issued a $22,800, 9%, 4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Recorded accrued interest for the Pippen note and the Prime Bank note. Issued a $24,000 note and paid $7,600 cash to purchase a vehicle to transport clients to nearby climbing sites as part of a new series of climbing classes. This note bears interest of 6% and matures in 12 months. Recorded accrued interest for the Pippen note, the Prime Bank note, and…arrow_forwardshow calculations where neededarrow_forwardThe intangible assets section of Riverbed Company at December 31, 2022, is presented here. Patents ($70,000 cost less $7,000 amortization) Franchises ($44,800 cost less $17,920 amortization) Total Jan. 2 Sept. 1 The patent was acquired in January 2022 and has a useful life of 10 years. The franchise was acquired in January 2019 and also has a useful life of 10 years. The following cash transactions may have affected intangible assets during 2023. Oct. 1 $63,000 Nov.- Dec. 26,880 $89,880 Paid $21,600 legal costs to successfully defend the patent against infringement by another company. Paid $50,000 to an extremely large defensive lineman to appear in commercials advertising the company's products. The commercials aired in September and October. Acquired a franchise for $111,600. The franchise has a useful life of 50 years. Developed a new product, incurring $145,000 in research and development costs during December. A patent was granted for the product on January 1, 2024.arrow_forward

- Pharoah Stores is a new company that started operations on March 1, 2024. The company has decided to use a perpetual inventory system. The following purchase transactions occurred in March: Pharoah Stores purchases $9,200 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB shipping point. Mar. 1 2 The correct company pays $140 for the shipping charges. 3 21 22 23 30 31 Pharoah returns $1,100 of the merchandise purchased on March 1 because it was the wrong colour. Octagon gives Pharoah a $1,100 credit on its account. Pharoah Stores purchases an additional $11,500 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB destination. The correct company pays $160 for freight charges. Pharoah returns $500 of the merchandise purchased on March 21 because it was damaged. Octagon gives Pharoah a $500 credit on its account. Pharoah paid Octagon the amount owing for the merchandise purchased on March 1. Pharoah paid Octagon the amount owing for the…arrow_forwardPlease help me. Thankyou.arrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forward

- View Policies Current Attempt in Progress Carla Vista Company manufactures pizza sauce through two production departments: cooking and canning. In each process, materials and conversion costs are incurred evenly throughout the process. For the month of April, the work in process inventory accounts show the following debits: Beginning work in process inventory Direct materials Direct labour Manufacturing overhead Costs transferred in Cooking $-0- 26,900 7,350 32,800 Canning $3,750 7,620 7,490 26,000 52,200 I dit ontries Credit account titles are automatically indented when the anarrow_forwardOn July 15, 2024, the Niche Car Company purchased 2,800 tires from the Treadwell Company for $35 each. The terms of the sale were 2/10, ¹/30 . Niche uses a perpetual inventory system and the net method of accounting for purchase discounts.arrow_forwardAll reconciling items are used to determine the adjusted cash balance per books require the account owner to make adjusting entries to it’s cash account. True or false?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education