ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

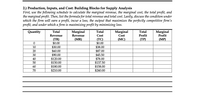

Transcribed Image Text:2.) Production, Inputs, and Cost: Building Blocks for Supply Analysis

First, use the following schedule to calculate the marginal revenue, the marginal cost, the total profit, and

the marginal profit. Then, list the formula for total revenue and total cost. Lastly, discuss the condition under

which the firm will earn a profit, incur a loss, the output that maximizes the perfectly competitive firm's

profit, and under which a firm is maximizing profit by minimizing loss.

Total

Cost

Marginal

Marginal

Profit

Quantity

Total

Marginal

Revenue

Total

Revenue

Cost

Profit

(TR)

$0.00

$30.00

$60,00

$90.00

$120.00

$150.00

$180.00

(MR)

(TC)

$0.00

$38.00

$87.00

(MC)

(ТР)

(МP)

10

20

30

$45.50

40

$78.00

$137,50

50

$158.00

$240,00

60

70

$210.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 7. You are economic consultant for Jack, who farms raw cotton in a perfectly competitive market. One day he gives you the following data at his present level of production: Output = 2000 pounds, market price = $5.00, total cost =$8000, fixed cost=$2000, marginal cost=$5. The minimum of AVC occurs at {1000 pounds at $2} and the minimum of ATC at {1500 pounds at $3.5}. Please help Jack with the following questions based on the above figures: a. Draw a graph for the raw cotton market and a graph for Jack’s farm current situation that includes MC, ATC, and AVC, labeling all relevant points on axes with numerical values. Is Jack maximizing the profit (minimizing the loss)? Why or why not? Label the total profit/loss area. b. Suppose more farmers enter the raw cotton market until the market price is $3.00 per pound. On the same graphs, show the effect of this change in the market place. Would you like to suggest Jack leaving the market in the short run? Explain your answearrow_forwardPLease show all steps clearly and please make the graph very clear so that i know in which numbers i have to draw the lines on so please write down each of the point in the line segments. Thank U! Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward11. Profit maximization using total cost and total revenue curves Suppose Edison runs a small business that manufactures shirts. Assume that the market for shirts is a competitive market, and the market price is $25 per shirt. The following graph shows Edison's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for shirts quantities zero through seven (inclusive) that Edison produces. TOTAL COST AND REVENUE (Dollars) 200 175 150 125 100 0 -25 Ho 0 ☐ 1 ☐ 2 ☐ ▬▬▬ 3 4 5 QUANTITY (Shirts) ■ 6 Total Cost 7 8 O Total Revenue Profit ?arrow_forward

- 3. Profit maximization using total cost and total revenue curves Suppose Madison operates a handicraft pop-up retail shop that sells phone cases. Assume a perfectly competitive market structure for phone cases with a market price equal to $25 per phone case. The following graph shows Madison's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for phone cases for quantities zero through seven (including zero and seven) that Madison produces. TOTAL COST AND REVENUE (Dollars) 200 175 150 125 100 75 50 0 * U 0 1 O 2 n D 0 3 QUANTITY (Phone cases) ■ Total Cost O Total Revenue Profit Calculate Madison's marginal revenue and marginal cost for the first seven phone cases they produce, and plot them on the following graph. Use the blue points (circle symbol) to plot marginal revenue and the orange points (square symbol) to plot marginal cost at each quantity.arrow_forwardSub : EconomicsPls answer very fast.I ll upvote. Thank Youarrow_forward4. Profit maximization in the cost-curve diagram Suppose that the market for candles is a competitive market. The following graph shows the daily cost curves of a firm operating in this market. Hint: After placing the rectangle on the graph, you can select an endpoint to see the coordinates of that point.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education