ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

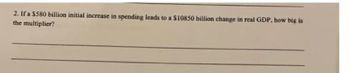

Transcribed Image Text:2. If a $580 billion initial increase in spending leads to a $10850 billion change in real GDP, how big is

the multiplier?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. When the following event occurs, the change in Real GDP = Event: The government increases its education funding by $60 billion; the marginal propensity to consume is 0.6. the multiplier.arrow_forward4. a) Draw a TP-TE (or Keynesian cross) graph for South Africa. Suppose Real GDP is $425 billion while the Real GDP where TE=TP is $475 billions. total, Expenditure (billions) TE-TH HEL th I 1 45 425 Q2 475 Q1 TP - TE total Production (billions) b) If Real GDP is $425 billion, what will happen to inventories, to firm's production and to the Real GDP? Inventories will decrease and Production will increase GDP increases to $475 billion and realarrow_forwardExercise 4. Imports and the multiplier. The consumption multiplier tries to capture the idea that individuals increase their consumption expenditures when their income increases, even when it is only a short-term increase and their life time income didn't change. However, individuals not only consume domestic products but also, they import part of their consumption. Therefore, if domestic consumption reacts to changes in current income, then it is natural to think that consumption of foreign goods should increase as well. For example, when the economy is booming, imports usually rise. To incorporate this channel into the model, suppose the import equation is given by Mt =āmīt + xm Ỹt Ỹt are described by equations in the previous exercise It = āƒŸt — b(R₁ − ñ) Yt, Ct =ācīt + x Ỹt Ỹt. The other categories of expenditures follow the same rules as in class. a) Derive the IS curve for this new specification. b) What is the economic explanation for why the parameter xm shows up in the…arrow_forward

- Multiplier Effect Question, Initial investment of 2 billion and getting 9 billion in total revenue after reinvestmentarrow_forwardK The following equations describe consumption, investment, government spending, taxes, and net exports in the country of Economika. In Economika, equilibrium GDP is equal to $. (Round your asnwer the nearest dollar.) If real GDP in Economika is currently $4,850, which of the following is true? A. There will be an unplanned decrease in inventories, and real GDP will increase next period. OB. There will be an unplanned increase in inventories, and real GDP will increase next period. OC. There will be an unplanned decrease in inventories, and real GDP will decrease next period. O D. There will be an unplanned increase in inventories, and real GDP will decrease next period. OE. There will be no unplanned change in inventories, and real GDP will stay the same next period. C=200+0.80(Y-T) 1=400 G=350 T=350 X = 100arrow_forward2. Determine the multiplier and the net effect of the following autonomous changes in spending: a. An influx of $100 billion in government spending when the marginal propensity to consume is 0.75. b. An influx of $250 billion in business investment when the marginal propensity to consume is 0.5. C. An influx of $180 billion in export sales revenue when the marginal propensity to consume is 0.8.arrow_forward

- What will be the impact on the spending multiplier if the marginal propensity to save (MPS) increases? A.The spending multiplier will increase. B.The spending multiplier will remain unaffected. C.The spending multiplier will decrease. D.The impact on the spending multiplier cannot be determined.arrow_forwardmultiplier? 3. Draw a graph representing a hypothetical economy. Carefully label the two axes, the S+ T+ IM curve, the I+G+ EX curve, and the equilibrium level of real GDP. Illustrate the effect of an increase in the level of autonomous saving.arrow_forwardIf an economy were already at its potential GDP (ie its full-employment GDP), what would happen to the value of the multiplier? please help asap thank uarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education