ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

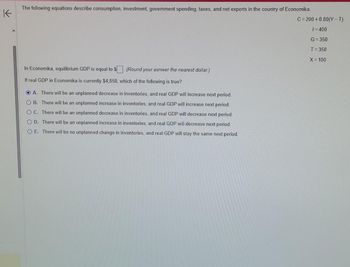

The following equations describe consumption, investment, government spending, taxes, and net exports in the country of Economika.

In Economika, equilibrium GDP is equal to $. (Round your asnwer the nearest dollar.)

If real GDP in Economika is currently $4,850, which of the following is true?

A. There will be an unplanned decrease in inventories, and real GDP will increase next period.

OB. There will be an unplanned increase in inventories, and real GDP will increase next period.

OC. There will be an unplanned decrease in inventories, and real GDP will decrease next period.

O D. There will be an unplanned increase in inventories, and real GDP will decrease next period.

OE. There will be no unplanned change in inventories, and real GDP will stay the same next period.

C=200+0.80(Y-T)

1=400

G=350

T=350

X = 100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Assume that imports into an economy equal $125 billion and exports equal $75 billion. Use the information in the following table, and information given on imports and exports, to determine the level of unplanned inventory at each level of real GDP. Possible Levels of Employment (Millions of workers) 40 45 50 55 60 65 70 Employment, Output, Consumption, and Unplanned Inventory Real GDP (Output) Equals Disposable Income (Billions of dollars) of net exports, the equilibrium real GDP is $ 325 375 425 475 525 575 625 Consumption (Billions of dollars) 300 325 350 375 400 425 450 Investment (Billions of dollars) 125 billion, and the equilibrium employment level is 125 125 125 125 125 125 Given the values of imports and exports, the effect of net exports (relative to the case where net exports are excluded) on this economy is to unplanned inventory investment at all levels of real GDP and to the level of real GDP at equilibrium. With the inclusion millions workers. Unplanned Inventory…arrow_forwardQuestion Aggregate expenditure is the total amount of spending in the economy that determines the level of the GDP. Components of aggregate expenditure are autonomous expenditure, planned private investments, government expenditure, and net exports. When autonomous expenditure increases or decreases, it has a multiplied effect on the GDP. Referring to the 10-year historical period that you chose for your final project, discuss an example of a change in autonomous spending. Research a government policy implemented during that time and discuss the multiplier effect it had on the economy. I have choosen 1980-1989 in the US. **This is not a research paper - it's just a quick brief for a discussion board**arrow_forward5:06 A & & & P M Page 4 of 5 QUESTION 4 The figure below shows the planned Aggregate Expenditure function for a hypothetical economy (AEp = 1,000 + 0.5 * Y). In this economy, taxes and transfers are equal to zero, so YD =Y. What is the value of unplanned investment expenditure (Iµ) when GDP = 3,000? Suppose that, next period, autonomous consumption increased by 100 and every thing else remained the same. Under these new circumstances, what would the value of unplanned investment be when GDP = 3,000? 5,000 4, 500 4, 000 3, 500 3,000 AEp = 1,000 + 0.5*Y 2, 500 2000 1, 500 1,a00 500 500 1,000 1, 500 2,000 2 500 3,000 3,500 4,000 4,500 5,000 REAL GDP Page 5 of 5 QUESTION A5 a. Suppose that some kind of significant economic event has occurred, and you learn that the event will de finitely cause the aggregate price level to decrease, but that its effect on short-run equilibrium real GDP cannot be determined without knowing the exact PLANNED AGGREGATE EXPENDITUREarrow_forward

- Q1:You are given the following income-expenditures model for an economy : Consumption C = 300 + .64Yd Tax (T) = $60 Government expenditure G = $100 Investment (I) = $120 From above data calculate the follows: 1. Equilibrium level of income 2. At the equilibrium level of income, what is the amount of consumption?arrow_forwardTHE AGGREGATE EXPENDITURE MODEL (IN THE SHORT RUN)YOU MUST SHOW YOUR CALCULATIONS IN THE SPACE BELOWFOR THE NEXT PROBLEM USE THE FOLLOWING FORMULA:CHANGE IN GDP = [ 1 / (1-MPC) ] * CHANGE IN GInitially, the economy is producing $13 trillion in goods and services and the government is spending $2 trillion.Then the government decides to increase its spending to $2.7 trillion. What is the value of the spending multiplier?arrow_forwardCalculate the value of consumption expenditure from the following:- National income = $6000 Autonomous consumption = $1000 Marginal propensity to consume = 0.80arrow_forward

- Question 3 of 16 Income and consumption changes for five people are shown in the table. Given this information, rank the marginal propensities to consume (MPC) for the five people from largest to smallest. Largest MPC Smallest MPC Answer Bank Bert Doug Eli Carter Al Name Income change Consumption change Al +$5,000+$5,000 +$3,000+$3,000 Bert +$2,500+$2,500 +$800+$800 Carter +$1,000+$1,000 +$800+$800 Doug −$2,500−$2,500 −$1,750−$1,750 Eli −$5,000−$5,000 −$2,000−$2,000arrow_forwardStiller 1. Suppose an economy is represented by the following equations. Consumption function C = 100 + 0.8Yd Planned investment I = 38 Government spending G = 75 Exports EX = 25 Imports IM= 0.05Yd Autonomous Taxes T = 40 Planned aggregate expenditure AE = C + I + G + (EX - IM) a. By using the above information calculate the equilibrium level of income for this economy, b. Calculate the value of expenditure multiplier. c. Suppose that government spending is increased by 5, what will happen to the equilibrium income level?arrow_forward4. a) Draw a TP-TE (or Keynesian cross) graph for South Africa. Suppose Real GDP is $425 billion while the Real GDP where TE=TP is $475 billions. total, Expenditure (billions) TE-TH HEL th I 1 45 425 Q2 475 Q1 TP - TE total Production (billions) b) If Real GDP is $425 billion, what will happen to inventories, to firm's production and to the Real GDP? Inventories will decrease and Production will increase GDP increases to $475 billion and realarrow_forward

- Below is some data for a hypothetical economy: C = -232 + 0.8Y XN = 107 - 0.1Y I = 100 T = 340 G = 340 Refer to the information above to answer this question. What is the value of the expenditure multiplier? a. 1.43 b. 4 c. 3.33 d. 2.43arrow_forwardUse the initial settings (or any other non-zero value) for the Change in Autonomous Spending and MPC. Click the "Spending Rounds" button at the top of the Settings window. Which of the following describes how the Change in Spending value in each row is related to the Disposable Income value in the same row? O In each row, Change in Spending is Disposable Income minus MPC*(Change in Autonomous Spending). Change in Spending in each row is MPC x Disposable Income for that row. O Change in Spending is always half of Disposable Income. O Change in Spending is Disposable Income times the spending multiplier.arrow_forwardCalculate investment expenditure from the following data about an economy which in equilibrium: National income =$1000 Marginal propensity to save=$0.25 Autonomous consumption expenditure=$200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education