FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

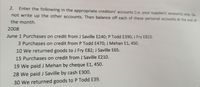

Transcribed Image Text:2.

Enter the following in the appropriate creditors' accounts (i.e. your suppliers' accounts) only. Do

not write up the other accounts. Then balance off each of these personal accounts at the end of

the month.

2008

June 1 Purchases on credit from J Saville E240; P Todd E390; J Fry E810.

3 Purchases on credit from P Todd E470; J Mehan E1, 450.

10 We returned goods to J Fry E82; J Saville E65.

15 Purchases on credit from J Saville E210.

19 We paid J Mehan by cheque E1, 450.

28 We paid J Saville by cash E300.

30 We returned goods to P Todd E39.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On May 10, Blossom Company sold merchandise for $11,600 and accepted the customer's America Bank MasterCard. America Bank charges a 4% service charge for credit card sales. Prepare the entry on Blossom Company's books to record the sale of merchandise. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date May 10 eTextbook and Media List of Accounts Save for Later Account Titles Debit Credit Attempts: 0 of 3 used Submit Answerarrow_forwarda. Sold merchandise on account to Troy Co., invoice no. 10, $50. The cost of the merchandise was $28. Begin by recording the sale portion of the entry. Do not record the cost of the sale yet. We will do that in the following step. a1. Account Titles Record the cost of the sale. a2. Debit Credit Account Titles Debit Credit b. Received check from Brown Co., $300, less 3% discount. (Assume $300 was the gross amount of the sale.) Account Titles Debit Credit b. c. Cash sales, $104. The cost of merchandise was $59. Begin by recording the sale portion of the entry. Do not record the cost of the sale yet. We will do that in the following step. Account Titles Debit Credit c1. Record the cost of the sale. Transactions a. Sold merchandise on account to Troy Co., invoice no. 10, $50. The cost of the merchandise was $28. b. Received check from Brown Co., $300, less 3% discount. c. Cash sales, $104. The cost of merchandise was $59. d. Issued credit memorandum no. 2 to Troy Co. for defective…arrow_forwardplease help mearrow_forward

- > Journalize the following transactions using the direct write-off method of accounting for Apr. 1 Sold merchandise on account to Jim Dobbs, $6,000. The cost of goods sold is $4,000. June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. Oct. 11 Reinstated the account of Jim Dobbs and received cash in full payment. If an amount box does not require an entry, leave it blank. Apr. 1 Apr. 1 June 10 Oct. 11 ctible receivables. Oct. 11 ?arrow_forwardHi can you post this transaction for me pleasearrow_forwardJournalize the following transactions using the allowance method of accounting for uncollectible receivables. Apr. 1 Sold merchandise on account to Jim Dobbs, $7,770. The cost of the merchandise is $3,885. If an amount box does not require an entry, leave it blank. Apr. 1 fill in the blank 95f337068076f92_2 fill in the blank 95f337068076f92_3 fill in the blank 95f337068076f92_5 fill in the blank 95f337068076f92_6 Apr. 1 fill in the blank 95f337068076f92_8 fill in the blank 95f337068076f92_9 fill in the blank 95f337068076f92_11 fill in the blank 95f337068076f92_12 June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. If an amount box does not require an entry, leave it blank. June 10 fill in the blank becc7c06d02c06d_2 fill in the blank becc7c06d02c06d_3 fill in the blank becc7c06d02c06d_5 fill in the blank becc7c06d02c06d_6 fill in the blank becc7c06d02c06d_8 fill in the blank…arrow_forward

- Sales-Related Transactions, Including the Use of Credit Cards Journalize the entries for the following transactions: a. Sold merchandise for cash, $22,060. The cost of the merchandise sold was $13,240. (Record the sale first.) fill in the blank 36fbb5ffffdef81_2 fill in the blank 36fbb5ffffdef81_3 fill in the blank 36fbb5ffffdef81_5 fill in the blank 36fbb5ffffdef81_6 fill in the blank 36fbb5ffffdef81_8 fill in the blank 36fbb5ffffdef81_9 fill in the blank 36fbb5ffffdef81_11 fill in the blank 36fbb5ffffdef81_12 b. Sold merchandise on account, $13,920. The cost of the merchandise sold was $8,350. (Record the sale first.) fill in the blank e95153f82fd6002_2 fill in the blank e95153f82fd6002_3 fill in the blank e95153f82fd6002_5 fill in the blank e95153f82fd6002_6 fill in the blank e95153f82fd6002_8 fill in the blank e95153f82fd6002_9 fill in the blank e95153f82fd6002_11 fill in the blank e95153f82fd6002_12…arrow_forwardEnter the following transaction in the ledger accounts and balance them October 2020: 1 Started in business with Ksh. 75,000 cash. 3 Bought goods for cash Ksh. 11,000. 7 Bought goods on credit Ksh. 32,000 from F Herd. 10 Sold goods for cash Ksh. 6,400. 14 Returned goods to F Herd Ksh. 4,600. 18 Bought goods on credit Ksh. 41,400 from D Exodus. 21 Returned goods to D Exodus Ksh. 3,100. 24 Sold goods to B Squire Ksh. 8,200 on credit. 25 Paid F Herd’s account by cash Ksh. 27,400. 31 B Squire paid us his account in cash Ksh. Ksh. 8,200.arrow_forwardBUS 038 : Business Computatns4. You buy goods on an invoice dated October 28, with terms of 2/20, n/45. What is the last day of the discount period?arrow_forward

- Nkome Traders, owner T Nkome, is a registered VAT vendor. The VAT rate applicable is 15%. Transactions: 20.3 February 3 Received and invoice (re-numbered to 20.3/105) from Bapela Wholesalers for merchandise purchased on credit for R18 975. 5 Some of the items to the value of R1 265 on invoice number 20.3/105 was not received. Issued a debit note for the amount. Bapela Wholesalers granted the claim and issued a credit note for the amount claimed. 10 Bought stationery, R1 035, from Big Stationers and received their invoice. 12 Received an invoice from Electronics Traders for the purchase of a new printer for R3 680. 17 Bought merchandise to the value of R21 965 from Bangani Wholesalers and received their invoice. Complete the given Purchases journal and Purchases returns journal for February 20.3.arrow_forwardEnter the following transactions in the appropriate journal (purchases journal and cash payment journal) *October 11 Purchased merchandise from Lafferty Company, $500 on account, credit terms 1/15, n/45. Invoice No. 65. *15 Purchased merchandise from Alsted, Inc., $400 cash. Check No. 751. * 21 Paid amount due Lafferty Company, less discount. Check No. 752.arrow_forwardOn April 3, a customer returned $600 of merchandise that had been purchased withcash to Ryan Supplies. Ryan’s cost of the goods returned was $200. Which journal entry orentries should Ryan prepare? (No sales discount was offered for early payment.)a. One entry to debit Cash and credit Sales Refunds Payable for $600; another entry todebit Inventory Returns Estimated and credit Inventory for $200.b. One entry to debit Sales Refunds Payable and credit Cash for $600; another entry todebit Inventory and credit Inventory Returns Estimated for $200.c. One entry to debit Sales Revenue for $600 and credit Cash for $600.d. One entry to debit Sales Revenue for $400, debit Refund Expense for $200, and creditCash for $600.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education