Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

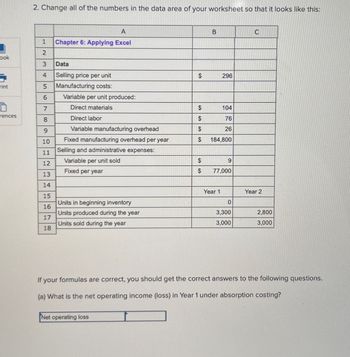

Transcribed Image Text:2. Change all of the numbers in the data area of your worksheet so that it looks like this:

A

1

Chapter 6: Applying Excel

2

ook

3

Data

rint

456

Selling price per unit

Manufacturing costs:

Variable per unit produced:

B

C

$

296

7

Direct materials

$

104

rences

8

9

10

11

B12345

Direct labor

$

76

Variable manufacturing overhead

$

26

Fixed manufacturing overhead per year

$

184,800

Selling and administrative expenses:

Variable per unit sold

$

9

Fixed per year

$

77,000

Units in beginning inventory

16

Units produced during the year

17

Units sold during the year

18

Year 1

Year 2

0

3,300

2,800

3,000

3,000

If your formulas are correct, you should get the correct answers to the following questions.

(a) What is the net operating income (loss) in Year 1 under absorption costing?

Net operating loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Info in imagesarrow_forwardCan you help me find the blanksarrow_forwardYPLUS Kimmel, Accounting, 7e Help | System Announcements CALCULATOR PRINTER VERSION 1 BACK NEXT National Corporation needs to set a target price for its newly designed product M14-M16. The following data relate to this new product. RESOURCES OMEWORK --05 -07 -09 -11 a-b Per Unit Total Direct materials $21 -16 Direct labor $41 --01A -02A -03A Variable manufacturing overhead Fixed manufacturing overhead $14 $1,264,000 Variable selling and administrative expenses $ 4 Fixed selling and administrative expenses $ 1,106,000 Its by Study These costs are based on a budgeted volume of 79,000 units produced and sold each year. National uses cost-plus pricing methods to set its target selling price. The markup percentage on total unit cost is 40%. Compute the total variable cost per unit, otal fixed cost per unit, and total cost per unit for M14-M16. Variable cost per unit 2$ Fixed cost per unit Total cost per unit 24 MacBookarrow_forward

- 2. Change all of the numbers in the data area of your worksheet so that it looks like this: A 1 Chapter 3: Applying Excel 2 3 Data 4 Allocation base 5 Estimated manufacturing overhead cost Estimated total amount of the allocation base Actual manufacturing overhead cost 8 Actual total amount of the allocation base 6 7 Predetermined overhead rate Machine-hours $ B $ с 409,200 62,000 machine-hours 418,200 60,000 machine-hours If your formulas are correct, you should get the correct answers to the following questions. (a) What is the Predetermined overhead rate? (Round your answer to 2 decimal places.) per machine-hourarrow_forwardCan you help me find the blanksarrow_forwardUsing the data in P4-2 and Microsoft Excel: 1. Separate the variable and fixed elements. 2. Determine the cost to be charged to the product for the year. 3. Determine the cost to be charged to factory overhead for the year. 4. Determine the plotted data points using Chart Wizard. 5. Determine R2. 6. How do these solutions compare to the solutions in P4-2 and P4-3? 7. What does R2 tell you about this cost model?arrow_forward

- NOWV2 | Online teach x + O SOFTWARE UPDATE eAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress%3false macOS Big Sur 11.3.1 is available and will be in later tonight. O eBook Show Me How E Print Item Activity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,167,450, divided into four activities: fabrication, $507,000; assembly, $210,000; setup, $245,700; and inspection, $204,750. Bardot Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by each activity are as follows: Fabrication Assembly Setup Inspection Speedboat 9,750 dlh 31,500 dlh 70 setups 122 inspections Bass boat 29,250 10,500 515 853 39,000 dlh 42,000 dlh 585 setups 975 inspections Each product is budgeted for 5,500 units of production for the year. a. Determine the activity rates for each activity. Fabrication $ per direct labor hour Assembly 5 V per…arrow_forwardHello tutor solve this problem not use aiarrow_forward1. Assign Overhead Costs to Activity Cost Pools 国日 First-Stage Allocation to Activity Cost Pools - Excel Sign In FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Calibri -A A 10 Paste BIU - A - Alignment Number Conditional Format as Cell Cells Formatting - Table - Styles - Clipboard Font Styles A1 fx A C E F G 1 == 2 Total costs and distribution of resource consumption across activity cost pools: 3 4 Activity Cost Pools Customer Product Customer Total Cost Orders Development Relations Other Total 6 Production Department: 7 Indirect factory wages $ 400,000 50% 30% 15% 5% 100% Factory equipment depreciation Factory utilities 10 Factory property taxes and insurance 8 150,000 55% 30% 0% 15% 100% 9 120,000 59% 34% 0% 7% 100% 75,000 57% 33% 0% 10% 100% 11 12 General Administrative Department: Administrative wages and salaries Office equipment depreciation 13 275,000 20% 10% 40% 30% 100% 14 40,000 32% 16% 15% 37% 100% 15 Administrative property taxes and insurance 60,000 0% 0% 0% 100%…arrow_forward

- S Kimmel, Accounting, 7e Help | System Announcements CALCULATOR PRINTER VERSION 1 BACK NEXT National Corporation needs to set a target price for its newly designed product M14-M16. The following data relate to this new product. Per Total- Unit Direct materials $26 Direct labor $44 Variable manufacturing overhead $15 Fixed manufacturing overhead $1,377,000 Variable selling and administrative expenses $ 5 Fixed selling and administrative expenses $ 1,053,000 These costs are based on a budgeted volume of 81,000 units produced and sold each year. National uses cost-plus pricing methods to set its target selling price. The markup percentage on total unit cost is 40%. Compute the total variable cost per unit, total fixed cost per unit, and total cost per unit for M14-M16. Variable cost per unit $4 Fixed cost per unit Total cost per unit MacBook Airarrow_forwardsd subject-Accountingarrow_forwardgagenown/ilm/takeAssignment/takeAssignmentMain.do?invoker=&ta... A Q eBook Activity Fabrication Assembly Setup Inspecting Production scheduling Purchasing Activity Rate $24 per machine hour $13 per direct labor hour $50 per setup $28 per inspection $14 per production order $11 per purchase order The activity-base usage quantities and units produced for each product were as follows: Elliptical Machines Treadmill 1,687 419 53 Activity Base Machine hours Direct labor hours Setups Elliptical Machines Treadmill 4 Product Costs using Activity Rates Hercules Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: C 101 Print Item % 15 5 732 $ Inspections Production orders Purchase orders 198 Units produced 286 Use the activity rate…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College