FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:gagenown/ilm/takeAssignment/takeAssignmentMain.do?invoker=&ta... A Q

eBook

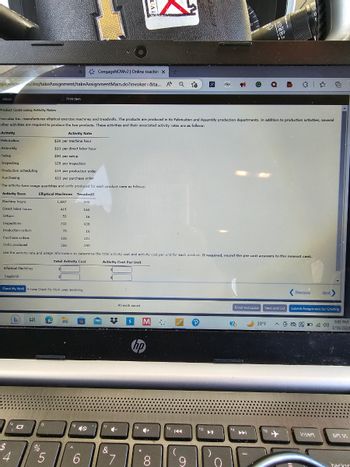

Activity

Fabrication

Assembly

Setup

Inspecting

Production scheduling

Purchasing

Activity Rate

$24 per machine hour

$13 per direct labor hour

$50 per setup

$28 per inspection

$14 per production order

$11 per purchase order

The activity-base usage quantities and units produced for each product were as follows:

Elliptical Machines

Treadmill

1,687

419

53

Activity Base

Machine hours

Direct labor hours

Setups

Elliptical Machines

Treadmill

4

Product Costs using Activity Rates

Hercules Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several

other activities are required to produce the two products. These activities and their associated activity rates are as follows:

C

101

Print Item

%

15

5

732

$

Inspections

Production orders

Purchase orders

198

Units produced

286

Use the activity rate and usage information to determine the total activity cost and activity cost per unit for each product. If required, round the per unit answers to the nearest cent.

Total Activity Cost

Activity Cost Per Unit

78

Check My Work 4 more Check My Work uses remaining.

16

995

А

163

6

16

439

CengageNOWv2 | Online teachin X

16

121

192

40

17

&

+

7

All work saved.

M

hp

fg

4+

8

Y

(

O

R

P

F10

▶II

Po

(?

MEXH

f11

TH!

LO

INT I

¡OFF

+ 1x

►

O

Email Instructor Save and Exit

n

112

0

Previous Next >

39°F MBC回后场

Submit Assignment for Grading

€

insert

1:05 PM

3/16/2023

prt sc

backer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Product-Costing Accuracy, Consumption Ratios Plata Company produces two products: a mostly handcrafted soft leather briefcase sold under the label Maletin Elegant and a leather briefcase produced largely through automation and sold under the label Maletin Fina. The two products use two overhead activities, with the following costs Setting up equipment: $6,000 Machining 22,000 The controller has collected the expected annual prime costs for each briefcase, the machine hours, the setup hours, and the expected production. Line Item Description: Elegant Fina Direct Labor $9,000 $3,000 Direct materials $3,000 $3,000 Units $3,000 $3,000 Machine Hours $500 $4,500 Setup Hours $100 $100 1. Conceptual Connection: Do you think that the direct labor costs and direct materials costs are accurately…arrow_forwardTelecom uses activity - based costing to allocate all manufacturing conversion costs. Telecom produces cellular telephones; each phone has $20.00 of direct materials, includes 50 parts and requires 3 hours of machine time. Additional information follows: Activity Materials handling Machining Assembling Packaging What is the cost of machining per phone? A. $6 B. $9 C. $200 O D. $175 Allocation Base Number of parts Machine hours Number of parts Number of finished units Cost Allocation Rate $3.50 per part $2.00 per machine hour $4.00 per part $3.00 per finished unitarrow_forwardThis section has a nine-part comprehensive problem with multiple questions to address. Download the Chapter 9 Comprehensive Problem Template below to complete all parts. You will need your Bergevin and MacQueen book for reference. Redlands Inc. reported standard and actual costs for the product that it manufactures: Item Direct material price Direct materials quantity Direct labor price Direct labor quantity Factory overhead cost Machine hours per unit Number of finished products made Number of finished products sold Sales price per unit Standard $3 per lb. 2 lbs. $5 3 hours $2 per machine hour 2 machine hours 10 10 $40 Actual $2 per lb. 4 lbs. $7 2 hours 3 machine hours 12 11 $40arrow_forward

- of 3 bok nt ant ences Required information Gable Company uses three activity pools. Each pool has a cost driver. Information for Gable Company follows: Activity Pools Machining Designing costs Setup costs Number of machine hours Number of design hours. Number of batches Total Cost of Pool $ 222,420 55,900 72,726 Product A Product B Product C Cost Driver Number of machine hours Number of design hours Number of batches Suppose that Gable Company manufactures three products, A. B, and C. Information about these products follows: Product A 24,000 Product C 9,400 2,600 60 2,400 265 Total Overhead Assigned Product B 34,000 1,500 180 Required: 1. Using activity proportions, determine the amount of overhead assigned to each product. Note: Do not round your intermediate calculations. Round your final answers to nearest whole number. Estimated Cost Driver 67,400 6,500arrow_forwardPlease help mearrow_forwardQ8 Lens Care Incorporated (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 3.60 per part Manufacturing supervision Hours of machine time $ 14.92 per hour Assembly Number of parts $ 3.90 per part Machine setup Each setup $ 57.10 per setup Inspection and testing Logged hours $ 46.10 per hour Packaging Logged hours $ 20.10 per hour LCI currently sells the B-13 model for $4,475 and the F-32 model for $4,580. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 165.10 $ 76.08 Number of parts 172 132 Machine hours 8.50 4.32 Inspection…arrow_forward

- Please help me with all answers thankuarrow_forwardSubject- accountarrow_forwardSupport Department Cost Allocation—Reciprocal Services Method Blue Africa Inc. produces laptops and desktop computers. The company’s production activities mainly occur in what the company calls its Laser and Forming departments. The Cafeteria and Security departments support the company’s production activities and allocate costs based on the number of employees and square feet, respectively. The total cost of the Security Department is $242,000. The total cost of the Cafeteria Department is $490,000. The number of employees and the square footage in each department are as follows: Employees Square Feet Security Department 10 520 Cafeteria Department 28 2,400 Laser Department 40 3,200 Forming Department 50 2,400 Using the reciprocal services method of support department cost allocation, determine the total costs from the Security Department that should be allocated to the Cafeteria Department and…arrow_forward

- Product Costs using Activity Rates Hercules Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $30 per machine hour Assembly $35 per direct labor hour Setup $90 per setup Inspecting $20 per inspection Production scheduling $19 per production order Purchasing $5 per purchase order The activity-base usage quantities and units produced for each product were as follows: Activity Base Elliptical Machines Treadmill Machine hours 600 400 Direct labor hours 190 223 Setups 30 30 Inspections 15 25 Production orders 40 30 Purchase orders 318 85 Units produced 500 320 Use the activity rate and usage information to determine the total activity cost and activity cost per unit for each product. Total…arrow_forwardSupport Department Cost Allocation—Reciprocal Services Method Blue Africa Inc. produces laptops and desktop computers. The company’s production activities mainly occur in what the company calls its Laser and Forming departments. The Cafeteria and Security departments support the company’s production activities and allocate costs based on the number of employees and square feet, respectively. The total cost of the Security Department is $267,000. The total cost of the Cafeteria Department is $240,000. The number of employees and the square footage in each department are as follows: Employees Square Feet Security Department 10 550 Cafeteria Department 28 2,400 Laser Department 40 4,800 Forming Department 50 800 Using the reciprocal services method of support department cost allocation, determine the total costs from the Security Department that should be allocated to the Cafeteria Department and to…arrow_forward< Multiple Versus Single Overhead Rates, Activity Drivers Deoro Company has identified the following overhead activities, costs, and activity drivers for the coming year: Expected Cost Activity Driver Activity Capacity Number of setups Number of orders Activity Setting up equipment Ordering costs Machine costs Receiving Receiving hours Deoro produces two models of dishwashers with the following expected prime costs and activity demands: Direct materials Direct labor Units completed Direct labor hours Number of setups Number of orders Machine hours Receiving hours $464,550 Required: 336,300 747,000 424,200 Model A Machine hours $604,000 498,000 17,000 5,800 410 Model B $804,000 456,000 8,700 1,500 6,200 23,500 3,800 The company's normal activity is 7,300 direct labor hours. 160 11,500 18,000 6,300 570 17,700 41,500 10,100 1. Determine the unit cost for each model using direct labor hours to apply overhead. Round intermediate calculations and final answers to nearest cent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education