FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

11.

please help me and dont ask me to contact you for $3 charge

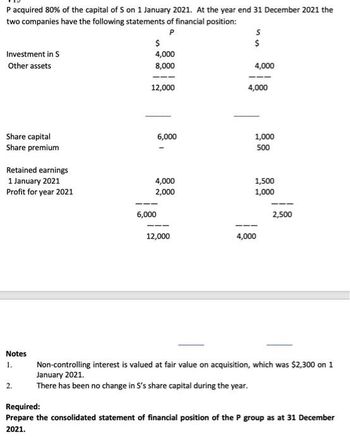

Transcribed Image Text:P acquired 80% of the capital of S on 1 January 2021. At the year end 31 December 2021 the

two companies have the following statements of financial position:

P

Investment in S

Other assets

Share capital

Share premium

Retained earnings

1 January 2021

Profit for year 2021

Notes

1.

2.

$

4,000

8,000

12,000

6,000

4,000

2,000

6,000

12,000

S

$

4,000

4,000

1,000

500

1,500

1,000

4,000

2,500

Non-controlling interest is valued at fair value on acquisition, which was $2,300 on 1

January 2021.

There has been no change in S's share capital during the year.

Required:

Prepare the consolidated statement of financial position of the P group as at 31 December

2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The last three questions are showing as incorrect. Please help? see attachment. Thank you!arrow_forwardNOVA Lanes is a bowling alley. Review the following financial information as of December 31, 2022. Services revenues (lane and shoe rental) $131,500 Dividends $9,000 Sales revenues (from pro shop) 28,000 Notes payable 58,000 Accounts payable 13,700 Administrative expenses 137,000 Cash 14,600 Supplies 2,500 Equipment 106,500 Common stock 35,000 Retained earnings (1/1/2022) 5,400 Compute net income for NOVA Lanes for 2022.arrow_forwardnts & Tests - FINA222 E Sign In in Connect M MHE Reader X + https://player-ui.mheducation.com/#/epub/sn_7cac#epubcfi(%2F6%2F422%5Bdata-uuid-49fada7a8= 15. Determining the Cost of Insurance. Suppose you are 45 and have a $50,000 face E LC amount, 15-year, limited-payment, participating policy (dividends will be used to build up the cash value of the policy). Your annual premium is $1,000. The cash value of the policy is expected to be $12.000 in 15 years. Using time value of money and assuming you could invest your money elsewlhere for a 7 percent annual yield, calculate the net cost of insurance. 30 ond hove n $25 000 facearrow_forward

- Mookie the Beagle Concierge makes a payment on the VISA credit card on 01/31/2023 in the amount of $800. Required: To record the payment on the VISA credit card: 1. From the Navigation Bar, select Expenses > select Expenses tab 2. From the New transaction drop-down menu, select Pay down credit card 3. For Which credit card did you pay?, select 2100 VISA Credit Card 4. For How much did you pay?, enter 800.00 5. For Date of payment, enter 01/31/2023 6. For What did you use to make this payment?, select 1001 Checking 7. Select Save and close 8. What is the balance of the VISA Credit Card account after the credit card payment is recorded? Note: Answer this question in the table shown below. Round your answer to the nearest dollar amount. X Answer is complete but not entirely correct. $ 800.00 x 8. Balance of the VISA credit card accountarrow_forwardSubject - account Please help me. Thankyou.arrow_forwardSolvearrow_forward

- EB3. LO 7.2Match the special journal you would use to record the following transactions. A. Cash Receipts Journal i. Took out a loan from the bank B. Cash Disbursements Journal ii. Paid employee wages C. Sales Journal iii. Paid income taxes D. Purchases Journal iv. Sold goods with credit terms 1/10, 2/30, n/60 E. General Journal v. Purchased inventory with credit terms n/90 vi. Sold inventory for cash vii. Paid the phone bill viii. Purchased stock for cash ix. Recorded depreciation on the factory equipment x. Returned defective goods purchased on credit to the supplier. The company had not yet paid for them.arrow_forwardplease helparrow_forwardI need help with 6 and 10arrow_forward

- Vishnuarrow_forwardplease help keep getting wrong answers in blue For each case, provide the missing information. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong.)arrow_forward00 X + Create 24 Find text or tools Q ℗ 4 Question 4 The following cash book receipts can be found in the books of Bushveld Traders for April 2024: X 2024 Al Assistant (Marks:15) Doc No Day e DR510 1 Jock Bush Α B/S 04 8 00 Jedi Dealers Internet sales A Details Fol. Analysis of Receipts (R) Bank (R) Debtors Control (R) Output VAT (R) Sales Sundries (R) Amount Fol. Details 82 080 00 82 080 00 82 080 00 Capital 75 753 00 9 880 83 65 872 17 B C B/S 04 15 Blah Bank: Interest 906 30 on deposit D E FL G DS327 21 Stuart Smith cash 17 907 12 17 907 12 sales H DS328 24 Commercial 8 406 36 8 406 36 B/S 04 DS329 27 DR511 30 26 Tenant: Bill Tong Norma Edwards J K L 6 947 35 6.947 35 B Belton cash sales 84 303 00 84 303 00 10 996 04 73 306 96 Steve Brown ? M N 352 431 01 O 154 750 54 ? Abbreviations in the Document Number column: DR, B/S, and DS, indicate Duplicate Receipts, Bank Statement and Duplicate Cash Slips respectively. Required: ments Fill in the missing amounts/details for the letters A…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education