ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

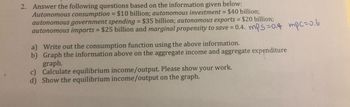

Transcribed Image Text:2. Answer the following questions based on the information given below:

Autonomous consumption = $10 billion; autonomous investment = $40 billion;

autonomous government spending = $35 billion; autonomous exports = $20 billion;

autonomous imports = $25 billion and marginal propensity to save = 0.4. mps = 0.4 mpc=0.6

a) Write out the consumption function using the above information.

b) Graph the information above on the aggregate income and aggregate expenditure

graph.

Calculate equilibrium income/output. Please show your work.

d) Show the equilibrium income/output on the graph.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please answer everything in the photo including the graph.arrow_forwardThe Image attached titled Table 1 is data for a hypothetical private-closed economy. Use the information in the Table 1 to analyze aggregate expenditures (AE) model attached (Figure 1. Equilibrium in a Private Closed Economy). Question 1 Identify the mistake and explain why the graph of the aggregate expenditures line does not correctly illustrate the economy's equilibrium. Question 2 Chart the aggregate expenditures (AE) model in Excel using the data from Table 1: A Private Closed Economy. Remember, the 45degree line (also known as the Keynesian Cross) is a tool that shows how differences in aggregate expenditures and real GDP can affect business inventories which will affect future levels of real GDP. Aggregate expenditure and GDP are both function of consumption, investment, government spending, and net exports. So, the equations for the two are identical: Y = C + I + G + NX, and AE (aggregate expenditure) = C + I + G + NX For private closed economy the equation…arrow_forward5. Graphing the saving and consumption functions from MPC Consider a hypothetical economy in which the marginal propensity to consume (MPC) is 0.5. That is, if disposable income increases by $1, consumption increases by 50¢. Suppose further that last year, disposable income in the economy was $300 billion and consumption was $250 billion. Based on these data, use the blue line (circle symbols) to plot this economy's consumption function on the following graph. REAL CONSUMER SPENDING (Billions of dollars) 700 600 500 400 300 200 100 0 Aa Aa -100 Consumption Fn. O O 0 100 200 300 400 500 600 700 800 REAL DISPOSABLE INCOME (Billions of dollars) Help Clear All Suppose that this year, disposable income is projected to be $340 billion. Based on your analysis, you would expect consumption to be and saving to bearrow_forward

- How would I do g?arrow_forwardQ1:You are given the following income-expenditures model for an economy : Consumption C = 300 + .64Yd Tax (T) = $60 Government expenditure G = $100 Investment (I) = $120 From above data calculate the follows: 1. Equilibrium level of income 2. At the equilibrium level of income, what is the amount of consumption?arrow_forwardAggregate Expenditures and Multipliers Assignment a. Using the aggregate expenditure function above, what is the current level of real GDP? b. Using the aggregate expenditure function above, what would be the level of real GDP if the aggregate expenditure function shifted up by $0.2T? c. If Investment expenditures increase by $300B and MPC is equal to 0.90, what will be the increase in real GDP? d. If Government expenditures increase by $800B and MPS is equal to 0.05, what will be the increase in real GDP?arrow_forward

- The graph represents consumption (C) as a function of disposable income (DI). Assume the consumption function is linear. What is the value of the marginal propensity to consume (MPC)? Round the value of the MPC to two decimal places. MPC = Consumption $1050 900 750 600 450 300 150 0 $150 300 450 600 C = DI C 750 900 1050 Disposable incomearrow_forwardQuestions attached belowarrow_forwardThis question has four parts, here is the fourth and final part. 1.4. Create a graph for the aggregate expenditures (AE) model in Excel using the data from Table 1: A Private Closed Economy. (table 1 is in the attachment) tips: Remember, the 45degree line (also known as the Keynesian Cross) is a tool that shows how differences in aggregate expenditures and real GDP can affect business inventories which will affect future levels of real GDP. Aggregate expenditure and GDP are both function of consumption, investment, government spending, and net exports. So, the equations for the two are identical: Y = C + I + G + NX, and AE (aggregate expenditure) = C + I + G + NX For private closed economy the equation is: Y = C + I , and AE (aggregate expenditure) = C + Iarrow_forward

- Assume a closed economy in which disposable income starts at 1,000 and increases by 500; consumption starts at 1,100 and increases by 300; investment spending is 1,000 and government spending is 500. 1. The marginal propensity to consume (MPC) is equal to: 0.5 0.6 0.7 6 2. The multiplier is: 0.25 2 2.5 3 3.The consumption equation is: C = 500 + 0.6DI C = 500 + 0.5DI C = 100 + 0.75DI C = 100 + 0.6DI 4. Let ∆I = 1,000. What is the new equilibrium GDP" 7,000 7,500 2,000 8,500arrow_forwardStiller 1. Suppose an economy is represented by the following equations. Consumption function C = 100 + 0.8Yd Planned investment I = 38 Government spending G = 75 Exports EX = 25 Imports IM= 0.05Yd Autonomous Taxes T = 40 Planned aggregate expenditure AE = C + I + G + (EX - IM) a. By using the above information calculate the equilibrium level of income for this economy, b. Calculate the value of expenditure multiplier. c. Suppose that government spending is increased by 5, what will happen to the equilibrium income level?arrow_forwardThe economy is in equilibrium such that Planned Aggregate Expenditure (AE) = Aggregate Output (Y) = 1,200. We have earlier observed that when Y increased from 900 to 1,200 Aggregate Consumption (C) increased from 800 to 1000. If investments increase by 55, how much will Aggregate Income change from its current value of 1,200? 110 82.5 165 1,365 1,310arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education