ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

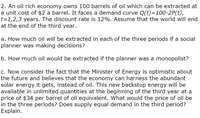

Transcribed Image Text:2. An oil rich economy owns 100 barrels of oil which can be extracted at

a unit cost of $2 a barrel. It faces a demand curve Q(t)=100-2P(t),

t=1,2,3 years. The discount rate is 12%. Assume that the world will end

at the end of the third year.

a. How much oil will be extracted in each of the three periods if a social

planner was making decisions?

b. How much oil would be extracted if the planner was a monopolist?

c. Now consider the fact that the Minister of Energy is optimistic about

the future and believes that the economy can harness the abundant

solar energy it gets, instead of oil. This new backstop energy will be

available in unlimited quantities at the beginning of the third year at a

price of $34 per barrel of oil equivalent. What would the price of oil be

in the three periods? Does supply equal demand in the third period?

Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Exercise 4. You are a manager at a certain factory that designs small gadgets. The factory has been quite successful in the past years. Your CEO is wondering whether or not it is a good idea to expand the factory this year. The cost to expand the factory is $1.5M. Doing nothing will result in expected $3M in revenue if the economy stays good and people continue to buy plenty of gadgets, but only $1M in revenue is expected if the economy is bad. On the other hand, expanding the factory carries an expected $6M in revenue if economy is good and $2M if the economy is bad. Assume there is a 40% chance of a good economy and a 60% chance of a bad economy. Also, assume the costs of operating the factory account to $.5M if the factory is expanded and $.3M if not. a. Illustrate a Decision Tree showing these choices. b. What should you do?arrow_forwardConsider a 2 period oil extraction setting. The inverse demand for oil is given as ?(?) = 20 − ?. The MC of extraction is MEC = Q. The discount rate is r = 0.05. a) If the initial stock of oil in the ground is S = 25, what will be the extraction and price each period? b) If S = 15, what will be the extraction and price each periods?arrow_forwardC = 500 +(0.8)*DI I = 200 T = 100 G = 100 (2 points) Solve for the good market equilibrium. (Find equilibrium Y, C, S and DI.) Graph (with correct labels) equilibrium Y and C, I, G (Consumption & Savings Function)arrow_forward

- Assume a two-period small open economy model, where the national product is 50 in the current period, and 88 in the future period. The world real interest rate is 10% per period. The representative consumer has the following utility function: U(c,G,c’,G’) = ln(c+G) + ln(c’+G’). a) What are the optimal consumption plus government spending in the current and in the future period? What is the current account surplus? Show this in a diagram. b) Now, suppose that governments in the rest of the world impose a tax on lending to foreigners of 5%. Determine how this affects consumption plus government spending in the present and the future, and the current account surplus. Explain your results. c) Suppose that governments in the rest of the world still impose a tax on lending to foreigners of 5%. However, the national country found a huge reserve of oil and the current period income increased to 100. The Determine how this affects consumption plus government spending in the present and the…arrow_forwardConsider a standard Heckscher-Ohlin (HO) Model, where two countries Home and Foreign produce two goods, sugar and milk, using labour (L) and capital (K). Home is relatively labour abundant and Foreign is relatively capital abundant. Assume that sugar is relatively capital intensive and milk is relatively labour intensive. Answer the following questions: (i) Discuss the pattern of trade between the two countries. (li) Under what conditions factor price equalization may be obtained Discuss with help of a diagram showing the segment of equalizatiearrow_forwardAssume that a country is endowed with 24 units of oil reserve. (a) the marginal willingness to pay for oil in each period is given by P = 13 – 0.56q(b) the marginal cost of extraction of oil is constant at $3 per unit(c) the discount rate is 1%(d) the marginal cost of renewable energy is $9, where c<d<a. How long will it take, for a country to transition to a renewable energy source?arrow_forward

- What are the final answers to each part.arrow_forwardAssume that a country is endowed with 2 units of oil reserve. There is no oil substitute available. How long the oil reserve will last if (a) the marginal willingness to pay for oil in each period is given by P = 8 - 0.61q, (b) the marginal cost of extraction of oil is constant at $4 per unit, and (c) discount rate is 2%?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education