ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Engineering Econ HW8 Q2

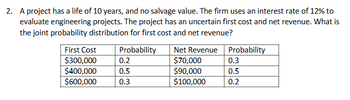

Transcribed Image Text:2. A project has a life of 10 years, and no salvage value. The firm uses an interest rate of 12% to

evaluate engineering projects. The project has an uncertain first cost and net revenue. What is

the joint probability distribution for first cost and net revenue?

Probability

0.2

First Cost

$300,000

$400,000

0.5

$600,000

0.3

Net Revenue

$70,000

Probability

0.3

$90,000

0.5

$100,000

0.2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- E2arrow_forward2. You have been asked to perform a sensitivity analysis on a plant modernization plan. The initial investment is $30,000. Expected annual savings is $13,000. Salvage value is $7,000 after a 7 year planning horizon. The MARR is 12% a. Determine the PW of this modernization. cion 4 2.b. -80% cion 5 2.c. -60% cion 6 2.d. -40% zion 7 2.e. -20% cion 8 2.f. +20% tion 9 2.g. +40% cion 10 2.h. Determine the percentage change in net annual savings that causes a reversal in the decision regarding the attractiveness of the project 10 10 00 00 10- 10 00arrow_forwardDon’t use excel Show workarrow_forward

- 11arrow_forwardThe annual profit from an investment is $20,000 each year for 5 years and the cost of investment is $80,000 with a salvage value of $50,000. The discount rate (cost of capital) at this risk level is 12%. Based on the given information, the net present value of the investment = $ 20,467 (round your response to the nearest whole number).arrow_forwardPlease do not give solution in image format thankuarrow_forward

- SHOW IN EXCEL SHOW EACH PROCESS IN EXCEL Gasoline EV Purchase Cost $50,000 $80,000 Annual - Maintenance $5,000 $2,500 Annual Fuel $7,500 $3,000 Service Life Probability Service Life Probability 55% 52% 6 10% 65% 7 25% 7 10% 8 35 % 8 25% 9 20% 9 50 % 10 5 % 10 8% a) (5 Points) What is the expected value of the present worth and expected value of the standard deviation of each option? b) (5 Points) Which option should be chosen, and why? c) (5 Points) If the company' s MARR is 20%, which option would they choose and why? d) (5 Points) What value of the MARR makes the company indifferent between choosing gasoline or electric vehicles?arrow_forwardSolve (c) and (d) pleasearrow_forward1. Find the breakeven market value.2. Find the breakeven annual expense.3. Is the decision more sensitive to changes in market value or annual expense? How doyou know?arrow_forward

- Nonearrow_forward80. Gridiron University is a private university. A successful alumnus has recently donated $1,000,000 to Gridiron for the purpose of funding a "center for the study of sports ethics." This donation is condi- tional upon the university raising matching funds within the next 12 months. The university administra- tors estimate that they have 50% chance of raising the additional money. How should this donation be ac- counted for? a. As a temporarily restricted support. b. As unrestricted support. c. As a refundable advance. d. As a memorandum entry reported in the footnotes.arrow_forwardDecision Alternative Up S₁ Stable s₂ Down S3 Investment A, d₁ Investment B, d₂ Investment C, d3 Probabilities Profit Investment A, d₂ Investment B, d₂ Investment C, dz 100 70 Economic Conditions 45 0.95 thousand thousand thousand 0.85 0.65 0.45 Profit Decision Maker A $70,000 $45,000 $20,000 20 (a) Using the expected value approach, which decision is preferred? E(d₂) $ 68 E(d₂) = $ 56.25 E(d3) = $45 The expected value approach recommends Investment A, d. ✔ Indifference Probability (p) 45 45 (b) For the lottery having a payoff of $100,000 with probability p and $0 with probability (1-p), two decision makers expressed the following indifference probabilities. Find the most preferred decision for each decision maker using the expected utility approach. 0.15 6.95 X Decision Maker A 0.6 Decision Maker B 0.35 0.2 Expected Utilities 0 20 45 0.20 Calculate the expected utility for each of the decision alternatives for each of the decision makers. (Assign a utility of 10 to the payoff of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education