FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

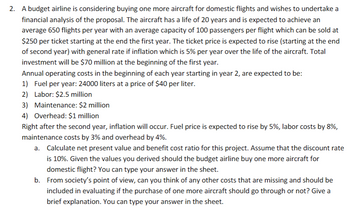

Transcribed Image Text:2. A budget airline is considering buying one more aircraft for domestic flights and wishes to undertake a

financial analysis of the proposal. The aircraft has a life of 20 years and is expected to achieve an

average 650 flights per year with an average capacity of 100 passengers per flight which can be sold at

$250 per ticket starting at the end the first year. The ticket price is expected to rise (starting at the end

of second year) with general rate if inflation which is 5% per year over the life of the aircraft. Total

investment will be $70 million at the beginning of the first year.

Annual operating costs in the beginning of each year starting in year 2, are expected to be:

1) Fuel per year: 24000 liters at a price of $40 per liter.

2) Labor: $2.5 million

3) Maintenance: $2 million

4) Overhead: $1 million

Right after the second year, inflation will occur. Fuel price is expected to rise by 5%, labor costs by 8%,

maintenance costs by 3% and overhead by 4%.

a. Calculate net present value and benefit cost ratio for this project. Assume that the discount rate

is 10%. Given the values you derived should the budget airline buy one more aircraft for

domestic flight? You can type your answer in the sheet.

b. From society's point of view, can you think of any other costs that are missing and should be

included in evaluating if the purchase of one more aircraft should go through or not? Give a

brief explanation. You can type your answer in the sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- We are examining a new project. We expect to sell 8,800 units per year at $191 net cash flow apiece (including CCA) for the next 16 years. In other words, the annual operating cash flow is projected to be $191 × 8,800 = $1,680,800. The relevant discount rate is 10%, and the initial investment required is $5,590,000. Suppose you think it is likely that expected sales will be revised upward to 9,550 units if the first year is a success a. If success and failure are equally likely, what is the NPV of the project? Consider the possibility of abandonment in answering. (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $ b. After the first year, the project can be dismantled and sold for $2,846,000. What is the value of the option to abandon? (Negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) The value…arrow_forwardEmerald Enterprises is developing a new product at the cost of $ 50,000. The new product is expected to increase the cash flow for the next five years as follows: $ 10000, $ 15000, $ 15000, $ 20000 and $ 20000. Find the payback period. (Note: Roundup the fractional values; that is if the payback period is 6.23 years, enter 7 years as payback period) 4 years 5 years 3 years 2 yearsarrow_forwardEmerald Enterprises is developing a new product at the cost of $ 50,000. The new product is expected to increase the cash flow for the next five years as follows: $ 10000, $ 15000, $ 15000, $ 20000 and $ 20000. If the discounting rate is 12%, what is the Net Present Value of the investment? $ 5622.08 $ 30000.00 $ 17022.81 $ - 560.90arrow_forward

- Beene Distributing is considering a project that will return $150,000 annually at the end of each year for the next six years. If Beene demands an annual return of 7% and pays for the project immediately, how much is it willing to pay for the project?arrow_forwardConsider a 200,000 SF office building complex, with NOI of $25/SF/year with rents and operating expenses paid in arrears (at the end of the year) annually, and no capital expenditures. The rent will increase by 3% per year. The discount rate is 10%/year. a. What is the value of this office building, assuming that the building is sold at the end of year 10 and the cap rate at that time is expected to be 10%? What is the cap rate at time 0? b. What is the value of this office building, assuming that the building will be held and rented indefinitely (perpetually)? What is the implied cap rate at time 0? c. What is the value if the rents are paid in advance (at the beginning of the year) and the building is rented perpetually?arrow_forwardNPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 36,000, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $40.00 and will grow at 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,100,000. It will be depreciated using MACRS, B, and has a seven-year MACRS life classification. Fixed costs will be $350,000 per year. Miglietti Restaurants has a tax rate of 40%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $130,000 at the end of the ten-year project and the cost of capital for this project is 8%. Data table What is the operating cash flow for this project in year 1? (Round to the nearest dollar.) MACRS…arrow_forward

- Development costs of a new product are estimated to be $100,000 per year for five years. Annual profits from the sale of the product, estimated to be $75,000, will begin in the fourth year and each year they will increase by ($10,000 + $10,000*4) through year 15. Compute the present value using an interest rate of 10%. Draw a cashflow diagram.arrow_forwardFargo Inc. is considering a project that will require an initial investment of $1.5 million. The project will provide incremental cash inflows of $600,000 for the next five years. If the required return on the project is 15%, what is its discounted payback? If the company’s investment cutoff threshold is three years, should the project be given the go-ahead? Select one: a. 3 years and 4.55 months; yes b. 3 years and 4.55 months; no c. 4 years and 11.55 months; yes d. 4 years and 11.55 months; no e. 5 years and 1 month; noarrow_forwardYou are considering a project which will cost $140,000. It is expected to bring in incomes of $45,000 per year for the next 5 years. You company's discount rate is 12%. What is the NPV of this project?arrow_forward

- NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 33,000, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $41.00 and will grow at 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,100,000. It will be depreciated using MACRS, and has a seven-year MACRS life classification. Fixed costs will be $360,000 per year. Miglietti Restaurants has a tax rate of 40%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $140,000 at the end of the ten-year project and the cost of capital for this project is 8%. MACRS Fixed Annual Expense Percentages by Recovery Class Year 3-Year…arrow_forwardA new project will have an intial cost of $10,000. Cash flows from the project are expected to be $3,000, $3,500, and $4,000 over the next 3 years, respectively. Assuming a discount rate of 8%, what is the project's Payback Period?arrow_forwardPeaceful Cruises wants to build a new cruise ship that has an initial investment of $400 million. It is estimated to provide an annual cash flow over the next 10 years of $57 million per year. The discount rate is 5%. What is the discounted payback period? Enter your answer rounded to two decimal placesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education