Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

I need three a.b.c answers typing no chatgpt answer i will give 5 upvotes

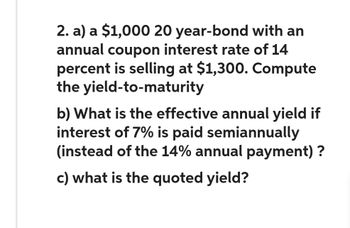

Transcribed Image Text:2. a) a $1,000 20 year-bond with an

annual coupon interest rate of 14

percent is selling at $1,300. Compute

the yield-to-maturity

b) What is the effective annual yield if

interest of 7% is paid semiannually

(instead of the 14% annual payment)?

c) what is the quoted yield?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Chrome File Edit View History Bookmarks People Window Help 52% !), Wed 3:48 PM d : The Charge Flas Sigma Chi-Initi My Questions l l (7) YouTube | Bb] Syllabus-ROST G where to find sc X x Х Χ Chapter 1 Home ← → C https://newconnect.mheducation.com/flow/connect.html?returnUrl=https%3A%2F%2Fconnect.mheducation.com%2Fpaamweb%2Findex.html%.··d-☆ . Chapter 1 Homework - Graded Saved Help Save & Exit Submit Check my work 4 Required: Use only the appropriate accounts to prepare an income statement. 7 points COWBOY LAW FIRM Income Statement For the Period Ended December 31 eBook etained earnings Hint ervice revenue Ask Expenses Salaries expense Print References Total expenses Mc Graw Hill KPrev4 of 11 Next>arrow_forward1 ← → C M Gmail of 4 Book rences Assignments: ACC 211 A F Prin X esc ! YouTube Maps M Question 7 - Chapter 5, Assign X M Connect ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252F... January 1 April 1 October 1 O Porter's Five Forc... Required information [The following information applies to the questions displayed below.] The following information pertains to the inventory of Parvin Company during Year 2. Beginning Inventory Purchased Purchased Parvin Company Cash Flows from Operating Activities FIFO Cash flows from operating activities: Cash inflow from customers Cash outflow for inventory Cash outflow for operating expenses Cash outflow for income tax expense Net cash flow from operating activities During Year 2, Parvin sold 3,500 units of inventory at $80 per unit and incurred $46,000 of operating expenses. Parvin currently uses the FIFO method but is considering a change to LIFO. All…arrow_forwardPlease rank the websites in order of total number of click-throughs from lowest to highest.arrow_forward

- AutoSave C. Home Insert Draw Page Layout Formulas Data Review X Times New Roman v 10 A A == Paste B I U v V A > Chapter 15 Build A Model.xlsx Automate General $%9 Read-Only Tell me Conditional Formatting Insert v Format as Table Delete v 00 20 .00 <-→0 Editing Cell Styles v Format View B C D E F G H I 0% 10% 20% 30% 40% 50% 60% 70% 80% 175 65 Xvfx A 66 67 68 69 Additional: using the (hypothetical) free cash flow stream below, calcuate and graph the NPVs (y-axis) against the various 70 Debt/Value Ratios (x-axis) in the space below (similar to Figure 15-8): 71 72 Time 73 FCF 74 0 1 2 3 4 5 -1200500 200000 350000 425000 350000 265000 Debt/Value WACC (from NPV (aka 75 Ratio above table) Firm Value) 76 0% 8.900% 77 10% 8.640% 78 20% 8.488% 79 30% 8.462% 80 40% 8.796% 81 50% 9.520% 82 60% 10.724% 83 70% 12.078% 84 85 86 $1.20 Build a Model + Ready Accessibility: Investigate MAY 6 44 Warrow_forwardhow do I do thisarrow_forwardD Chrome View Edit File Bookmarks History Profiles Tab Window Help bjs-Google Search x C The following financial statem × 0 xiConnect - Home M Question 18 - Chapter 1 Hom ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 1 Homework Saved 18 [Ine following information applies to the questions displayed below.j The following financial statement information is from five separate companies. Company A Part 5 of 5 Beginning of year Assets Liabilities $ 36,000 29,520 Company B $ 28,080 Company C Company D Company E $ 23,040 $ 64,080 $ 98,280 19,656 12,441 44,215 ? End of year Assets 41,000 4.03 points 29,520 ? 74,620 113,160 Liabilities ? 20,073 13,460 35,817 89,396 Changes during the year Owner investments 6,000 1,400 9,750 ? 6,500 Net income (loss) 9,470 ? 6,000 11,938 eBook Owner withdrawals 8,608 3,500 2,000 5,875 0 11,000 Ask Print References Mc Graw Hill Problem 1-2A (Algo) Part 5 5. Compute the amount of liabilities…arrow_forward

- e File Edit View History Bookmarks Profiles Tab Window Help C Netflix MInbox (228 X MACC101 Pr X Accounting X Accounting X M Question 1 X M Question 1 xb Answered: ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Chapter 9 Homework 13 30.12 points Saved Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 eBook Ask Print References February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. April 16 Privet dishonored her note. May 31 Midnight…arrow_forward同 Mail - Edjouline X Bb Content- ACG2 X CengageNOWv X (58) YouTube + Microsoft Office X PowerPoint from Towards a A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%=Dassignments&takeAssignmentSessionLocator=assignment-take&inpro. of mail YouTube Maps eBook Show Me How apter Nine Determine Due Date and Interest on Notes .09-03.BLANKSHEET Determine the due date and the amount of interest due at maturity on the following notes: L09-04.BLANKSHEET Date of Note Face Amount Interest Rate Term of Note 09-03.ALGO January 10* $40,000 90 days a. b. March 19 180 days 000 8. 09-04.ALGO June 5 30 days 000'06 d. September 8 90 days 90-60 3. 000'9E e. November 20 60 days 9-11 4. 000' *Assume that February has 28 days. 9-12 Assume 360-days in a year when computing the interest. -19 Note Due Date Interest > -20 (2) (b) 9-22 -24 (p) (a) 890- 8/12 items Check My Work ( Previous Next LE V O 10: Narrow_forwardBookmarks People Tab Window Help 192.168.1.229 60 83% Wed 12:20 PM Chapter 10 Homework (Applice X CengageNOWv2 | Online teach x lim/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false ☆ 青N Login Common A... A Common Black Co... *No Fear Shakespe... b Hamlet, Prince of... E 12th Grade PVA H.. O Paraphrasing Tool.. eBook Labor Variances. Verde Company produces wheels for bicycles. During the year, 656,000 wheels were produced. The actual labor used was 364,000 hours at $9.20 per hour. Verde has the following labor standards: 1) $10.40 per hour; 2) 0.48 hour per wheel. Required: 1. Compute the labor rate variance. 2. Compute the labor efficiency variance. Previous Next Check My Workarrow_forward

- e Chrome File Edit View History Gbjs - Google Search Bookmarks Profiles Tab x QuickLaunchSSO :: Single Siç x Window Help M Question 5- Chapter 3 Home .X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 3 Homework Saved 。 Help Save LO 5 9.25 points eBook Hint Ask Print References Exercise 3-8 (Algo) Adjusting and paying accrued expenses LO P3 a. On April 1, the company hired an attorney for April for a flat fee of $2,000. Payment for April legal services was made by the company on May 12. b. As of April 30, $2,102 of interest expense has accrued on a note payable. The full interest payment of $6,307 on the note is due on May 20. c. Total weekly salaries expense for all employees is $11,000. This amount is paid at the end of the day on Friday of each five-day workweek. April 30 falls on a Tuesday, which means that the employees had worked two days since the last payday. The next payday is May 3. The above…arrow_forwardI need typing clear urjent no chatgpt use i will give 5 upvotesarrow_forwardFile Edit View History Bookmarks Profiles estion 4 - Proctoring Enable X getproctorio.com/secured #lockdown ctoring Enabled: Chapter 6 Homework Assignm... i 4 kipped ic raw 511 F CUNY Login 2 Req 1 Req 2 to 4 #3 Complete this question by entering your answers in the tabs below. с Tab How many performance obligations are in this contract? Number of performance obligations $ Window Help st X 4 Barrick Gold Corporation is a mining company that produces gold and copper with 16 operating sites in 13 countries. It is headquartered in Toronto, Ontario, Canada. On March 1, 2024, Barrick Gold receives $150,000 from Citizen Bank and promises to deliver 95 units of certified 1-ounce gold bars on a future date. The contract states that ownership passes to the bank when Barrick Gold delivers the products to Brink's, a third-party carrier. In addition, Barrick Gold has agreed to provide a replacement shipment at no additional cost if the product is lost in transit. The stand-alone price of a gold…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education