Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

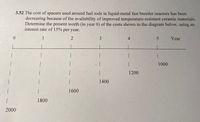

Transcribed Image Text:3.52 The cost of spacers used around fuel rods in liquid-metal fast breeder reactors has been

decreasing because of the availability of improved temperature-resistant ceramic materials.

Determine the present worth (in year 0) of the costs shown in the diagram below, using an

interest rate of 15% per year.

1

4

Year

5.

1000

1200

1400

|

1600

1800

2000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Technology Innovations is planning to purchase one of two chip insertion machines. Due to the pace of technological change in this area, it is realistic to assume that these are one-shot investments. The expected cash flows for each machine are shown below. MARR is 8%/year. Based on a present worth analysis, which machine is preferred?arrow_forwardQUESTION 3 You are considering starting a new factory producing small electric heaters. Each unit will sell at a price of $55. The production cost of each heater is $35. You are expecting to sell 9000 units per year. This project has an economic life of 6 years. The project requires an investment of $700000 in plants and equipment. This equipment will be depreciated to zero salvage value based on 5-year MACRS schedule. The depreciation rates from year 1 to 6 are 20 % ,32 %, 19.2 %, 11.52 %, 11.52 %, and 5.76 percent, respectively. The company will sell its old equipment for $100,000. The old machine is fully depreciated. The required rate of return for the project is 12 percent, the working capital requirement is 10 percent of the next year's sales revenue. The marginal corporate tax rate is 20 percent. At the termination of the project, the plant and equipment will be sold for an estimated value of $50000. Based on these assumptions, estimate the cash flow for capital expenditures.…arrow_forwardFablab Mindanao purchased a water jet cutter in which their total manufacturing cost is expected to decrease due to an increased productivity as shown on the table below. 4 190 185 180 7 175 170 Year 2 200| 195 3 6 1 Cost, PhP 1000 165 a) Draw the Cash Flow Diagram b) Determine the equivalent annual cost at an interest rate of 8% per yeariarrow_forward

- Question 07: Virat Kohli Welders is planning to replace an old machine with a new one to improve efficiency in its production process. The machine will increase the efficiency as it is more modern and will result in an incremental savings of $80,000 per year. The old machine was bought 3 years ago at a cost of $270,000. The new machine will cost $420,000. Both machines have useful lives of 6 years. The machines are depreciated to zero for tax purpose over the six-year life using a straight-line depreciation method. The tax rate is 34% and the required rate of return is 11%. The old machine has no salvage value at the end of its life but can be sold now at a cost of $100,000. The new machine will have a salvage value of $80,000 at the end of its life. Should the new machine be purchased?arrow_forwardA manufacturer of automated optical inspection devices is deciding on a project to increase the productivity of the manufacturing processes. The estimated costs for the two feasible alternatives being compared are shown below. Use the internal rate of return (IRR) method to determine which alternative should be selected if the analysis period is 8 years and the company's MARR is 4% per year. Alternative M N Initial costs $30,000 $45,000 Net annual cash flow $4,500 $7,000 Life in years 8 8 (a) IRR of base alternative = (b) IRR of incremental cash flow = (c) Choose Alternativearrow_forward13,000 6. The Imperial Chemical Company is considering purchasing a chemical analysis machine worth $13,000. Although the purchase of this machine will not produce any increase in sales revenues, it will result in a reduction of labour costs. In order to operate the machine properly, it must be calibrated each year. The machine has an expected life of 6 years, after which it will have no salvage value. The following table summarizes the annual savings in labour cost and the annual maintenance costs in calibration over 6 years: Year (n) Net Cash Flow ($) 0 Costs ($) Savings ($) -13,000 1 2,300 6,000 3,700 2 2,300 7,000 4,700 3 2,300 9,000 6,700 4 2,300 9,000 6,700 5 2,300 9,000 6,700 6 2,300 9,000 6,700 Find the internal rate of return for this project. [6]arrow_forward

- 2. A construction company must replace a piece of heavy earth-moving equipment. Cat and Volvo are the two best alternatives. Both alternatives are expected to last 8 years. If the company has a minimum attractive rate of return (MARR) of 11%, which alternative should be chosen? Use IRR analysis. Cat Volvo First cost $15,000 $22,500 Annual operating cost Salvage value 3,000 1,500 2,000 4,000arrow_forwardSolve all this question......you will not solve all questions then I will give you down?? upvote...arrow_forwardPlease don't give solution in image format...arrow_forward

- 9 Choose the correct answer below.arrow_forwardHelp Save & Exit Subm 16 Assume that a company is considering purchasing a machine for $50,000 that will have a five-year useful life and no salvage value. The machine will lower operating costs by $17,000 per year. The company's required rate of return is 18%. What is the net present value of this investment? Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Multiple Choice $3,159 О $3,896 О О $3,796 $3,359arrow_forward* 00 The management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $67000. The machine would replace an old piece of equipment that costs $18,000 per year to operate. The new machine would cost $8.000 per year to operate. The old machine currently in use could be sold now for a salvage value of $29,000. The new machine would have a useful life of 10 years with no salvage value. 1 What is the annual depreciation expense associated with the new bottling machine? 2 What is the annual incremental net operating income provided by the new bottling machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return? 4. What is the simple rate of return on the new bottling machine? (Round your enswer to 1 declmal place L.e. 0.123 should be considered as 12.3%.) Depreciation expense 2. Incremental net operating income Initial investment, 4. Simple rate of return < Prev 2 of 2…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education