FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:2

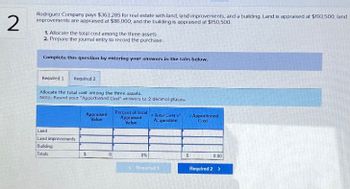

Rodriguez Company pays $363,285 for real estate with land, land improvements, and a building Land is appraised at $193,500, land

improvements are appraised at $86,000, and the building is appraised at $150,500.

1. Allocate the total cost among the three assets.

2. Prepare the journal entry to record the purchase.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Allocate the total cost among the three assets.

Note: Round your "Apportioned Cost" answers to 2 decimal places.

Land

Land improvements

Building

Totals

Appraised

Value

Percent of Total

Appraised

Value

Total Cost of

Acquisition

Apportioned

Cost

0%

Required 1

S

0.00

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please complete all parts do not give solution in image formatarrow_forwardOo. 68. Subject ;- Accountarrow_forwardof3 Required information [The following information applies to the questions displayed below] On November 10 of year 1, Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,200,000 $300,000 was allocated to the basis of the land, and the remaining $900,000 was allocated to the basis of the building. (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. b. What would be the year 3 depreciation deduction if the building was sold on August 1 of year 3? Answer is complete but not entirely correct. Year 3 depreciation deduction $102.0000arrow_forward

- Pls do journal entry 1-6! Thanksarrow_forwardQuestion is attached in SS below tahnks for hepl phl 3 p3 p5 3lh5h5 h5lharrow_forwardA v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentM... Q ☆ Tp * pter 10 HW eBook Allocating Payments and Receipts to Fixed Asset Accounts The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk. a. Fee paid to attorney for title search $3,200 b. Cost of real estate acquired as a plant site: Land 335,600 Building (to be demolished) 31,900 C. Delinquent real estate taxes on property, assumed by purchaser 18,900 Cost of tearing down and removing building acquired in (b) 5,300 e. Proceeds from sale of salvage materials from old building 3,100* Special assessment paid to city for extension of water imain to the property 12,600 9. Architect's and engineer's fees for plans and supervision 46,100 h. Premium on one-year insurance policy during construction 4,400 i. Cost of filling and grading land 18,500 Money borrowed to pay building contractor 787,000* k. Cost of…arrow_forward

- eBook Show Me How Determining cost of land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $41,000 in cash and giving a short-term note for $282,000, Legal fees paid were $2,290, delinquent taxes assumed were $14,200, and fees paid to remove an old building from the land were $21,000. Materials salvaged from the demolition of the building were sold for $4,800. A contractor was paid $981,900 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet. X Feedback Check My Work Costs incurred to ready the asset for use are added to the asset account. Materials salvaged and sold during the process reduce the cost of the land.arrow_forwardPlease only answer the amount fields. Thanksarrow_forwardA-2arrow_forward

- Colleges Software Guides Search Contact A sale of OMR 39 to S. Yusof was entered in the books as OMR 29, correction will be: O a. Debit Cash 10 and Credit Sales 10 O b. Debit Sales 10 and Credit S. Yusof 10 O c. Debit S. Yusof 10 and Credit Sales 10 O d. Debit S. Yusof 10 and Credit Bank 10 is that part of the original cost of a fixed asset that is consumed during its period of a. Debtorsarrow_forwardOnline teachin x n/takeAssignment/takeAssignmentMain.do?invoker3&takeAssignmentSessionLocator=&inprogress%3false еВook Discussion Question 13-6 (LO. 4) On July 16, 2020, Logan acquires land and a building for $500,000 to use in his sole proprietorship. Of the purchase price, $400,000 is allocated to the building, and $100,000 is allocated to the land. Cost recovery of $4,708 is deducted in 2020 for the building (nonresidential real estate). a. What is the adjusted basis for the land and the building at the acquisition date? Land Building b. What is the adjusted basis for the land and the building at the end of 2020? Land Building $ 40 Previous Next Check My Work 10:57 PM 28°F Clear 2/14/2022arrow_forwardOnly typing answer Please answer explaining in detail step by step Without table and graph thankyouarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education