FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please solve 3 and 4

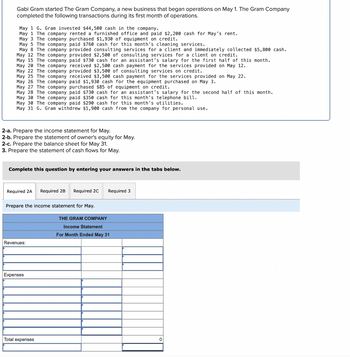

Transcribed Image Text:Gabi Gram started The Gram Company, a new business that began operations on May 1. The Gram Company

completed the following transactions during its first month of operations.

May 1 G. Gram invested $44,500 cash in the company.

May 1 The company rented a furnished office and paid $2,200 cash for May's rent.

May 3 The company purchased $1,930 of equipment on credit.

May 5 The company paid $760 cash for this month's cleaning services.

May 8 The company provided consulting services for a client and immediately collected $5,800 cash.

May 12 The company provided $2,500 of consulting services for a client on credit.

May 15 The company

May 20 The company

May 22 The company pro

May 22 The company

May 25 The company

May 26 The company

May 27 The company

purchased $85 of equipment on credit.

May 28 The company paid $730 cash for an assistant's salary for the second half of this month.

May 30 The company paid $350 cash for this month's telephone bill.

May 30 The company paid $290 cash for this month's utilities.

May 31 G. Gram withdrew $1,900 cash from the company for personal use.

2-a. Prepare the income statement for May.

2-b. Prepare the statement of owner's equity for May.

2-c. Prepare the balance sheet for May 31.

3. Prepare the statement of cash flows for May.

Complete this question by entering your answers in the tabs below.

Required 2A

paid $730 cash for an assistant's salary for the first half of this month.

received $2,500 cash payment for the services provided on May 12.

provided $3,500 of consulting services on credit.

received $3,500 cash payment for the services provided on May 22.

paid $1,930 cash for the equipment purchased on May 3.

Revenues:

Prepare the income statement for May.

Expenses

Total expenses

Required 2B Required 2C

Required 3

THE GRAM COMPANY

Income Statement

For Month Ended May 31

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- what are the solutions for questions 4 & 5?arrow_forwardI need answer typing clear urjent no chatgpt used i will give upvotes all answers plsarrow_forwardmyedio.com Question 12 Listen Use the function f(x)=2x-5 • Find the inverse of f(x). . . Graph f(x) and f(x) and state the domain of each function. Prove that f(x) and f¹(x) are inverses, both graphically and algebraically. ATTACHMENTS W Algebra2 U9 UnitTest_Q17 docx 146.32 KBarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education