FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:19

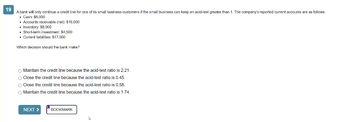

A bank will only continue a credit line for one of its small business customers if the small business can keep an acid-test greater than 1. The company's reported current accounts are as follows:

. Cash: $6,000

• Accounts receivable (net): $19,000

• Inventory: $8,000

• Short-term investment: $4,500

• Current liabilities: $17,000

Which decision should the bank make?

Maintain the credit line because the acid-test ratio is 2.21.

O Close the credit line because the acid-test ratio is 0.45.

O Close the credit line because the acid-test ratio is 0.58.

Maintain the credit line because the acid-test ratio is 1.74.

NEXT >

BOOKMARK

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Explainations would help a lot as well!arrow_forwardQuestion 8 to Question 10 are based on the Balance Sheet information of Good Bank Bad Bank below: Good Bank: Cash Good loans Bad Loans Total Bad Bank: Cash Loans A) $1,500. B) $1,200. C) $380. $200 Deposits $1,000 Purchased funds $380 Equity D) $300. $1,580 $240 Bonds Total $240 Bad Bank buys the bad loans for $300. In order to finance the purchase of the bad loan from the Good Bank, the Bad Bank issues additional bonds in the amount of $60. What will be the total assets of Good Bank after the sale of the loans? E) None of the above. O Preferred stock Common stock $1,000 $300 $280 $1,580 $120 $40 $80 $240arrow_forward9arrow_forward

- Please give answer for this questionarrow_forwardthempt 1 You just deposited $4,000 in cash into a checking account at the local bank. Assume that banks lend out all exces reserves and there are no leaks in the banking system. That is, all money lent by banks gets deposited in the banking system. Round your answers to the nearest dollar. If the reserve requirement is 12%, how much will your deposit increase the total value of checkable bank deposits? 0.14 Incamect If the reserve requirement is 4%, how much will your deposit increase the total value of checkable deposits? 0.04 $. Inomect Increasing the reserve requirement increases. the Incorect money supply.arrow_forwardCurrent Attempt in Progress Bramble Company is a very profitable small business. It has not, however, given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and bookkeeper. As a result, Bret Turrin handles all cash receipts, keeps the accounting records, and prepares the monthly bank reconciliations.The balance per the bank statement on October 31, 2020, was $17,820. Outstanding checks were No. 62 for $150.10, No. 183 for $186, No. 284 for $267.75, No. 862 for $200.70, No. 863 for $232.00, and No. 864 for $177.10. Included with the statement was a credit memorandum of $179.80 indicating the collection of a note receivable for Daisey Company by the bank on October 25. This memorandum has not been recorded by Daisey.The company’s ledger showed one Cash account with a balance of $21,870.00. The balance included undeposited cash on hand. Because of the lack…arrow_forward

- Which of the following statements about the company's financial operations and financial decisions is FALSE? If your company overdraws its checking account, the Global Community Bank will automatically issue your company a 1-year loan in an amount sufficient to bring your ending cash balance up to zero. The interest rate charged on overdraft loans is always 2% above whatever interest rate your company would otherwise pay on a 1-year loan from the GCB (for example, if your company's B credit rating entitled your company to a 1-year loan carrying a 6.5% interest rate, then the interest rate on a 1-year overdraft loan would be 8.5%). If the company needs to secure additional capital, it can take out loans with 1-year, 5-year. and/or 10-year terms from the Global Community Bank and/or it can issue new shares of common stock. The company's banking arrangement with the Global Community Bank calls for the company to be paid interest on any positive cash balance in the company checking…arrow_forward5arrow_forward11 When credit card sales occur, the seller may receive cash immediately, or within a few days, depending upon the specific credit card program being used. Group starts True or Falsearrow_forward

- Need Answer with calculationarrow_forwardSETUP FOR QUESTIONS 6: Titan Bank is a community bank and its balance sheet is reported below.[1] The "total equity/total asset ratio" is 9.91 percent ($11.00/S120.00) and is defined as the capital ratio. Assume bank regulators require the capital ratio to be at least 8.00 percent at all times. If the capital ratio falls below 8.00 percent, the bank regulators immediately shut down the bank and fire the managers. Thus, the capital ratio is very important to the managers who are constantly evaluating "what if" scenarios to make sure they are not shut down. Use Titan Bank's balance sheet to evaluate the two scenarios described below. Balance Sheet (as of 12/31/2020 and in millions) Assets Liabilities Assets have a duration of 4.00 years and a Liabilities have a duration of 1.00 years and a yield to maturity of 3.00%. yield to maturity of 6.00%. Total Assets $111.00 Total Liabilities $100.00 Equity Total Equity $11.00 Scenario 2: Federal Reserve actions force an immediate non-parallel…arrow_forwardhow to solve these?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education