Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

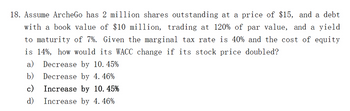

Transcribed Image Text:18. Assume ArcheGo has 2 million shares outstanding at a price of $15, and a debt

with a book value of $10 million, trading at 120% of par value, and a yield

to maturity of 7%. Given the marginal tax rate is 40% and the cost of equity

is 14%, how would its WACC change if its stock price doubled?

a) Decrease by 10.45%

b)

Decrease by 4. 46%

c)

Increase by 10.45%

d)

Increase by 4. 46%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 8. Use the following information:Debt: $79,000,000 book value outstanding. The debt is trading at 94% of book value. Theyield to maturity is 7%.Equity: 2,900,000 shares selling at $46 per share. Assume the expected rate of return onFederate d’s stock is 16%.Taxes: Federate d’s marginal tax rate is Tc = 0.21.Suppose Federated Junkyards decides to move to a more conservative debt policy. A yearlater, its debt ratio is down to 14.00% (D/V = 0.1400). The interest rate has dropped to6.6%. The company’s business risk, opportunity cost of capital, and tax rate have notchanged. Use the three-step procedure to calculate Federate d’s WACC under these newassumptions.arrow_forwardDorpac Corporation has a dividend yield of 1.6%. Its equity cost of capital is 7.1%, and its dividends are expected to grow at a constant rate. a. What is the expected growth rate of Dorpac's dividends? b. What is the expected growth rate of Dorpac's share price? a. What is the expected growth rate of Dorpac's dividends? The growth rate will be _____ %. (Round to one decimal place.) Part 2 b. What is the expected growth rate of Dorpac's share price? What is the expected growth rate of Dorpac's share price? (Select the best choice below.)arrow_forwardThe market value of Charcoal Corporation's common stock is $20 million, and the market value of its risk-free debt is $5 million. The beta of the company's common stock is 1.25, and the market risk premium is 8 percent. If the Treasury bill rate is 5 percent, what is the company's cost of capital? (Assume no taxes.) 15.0 percent 14.6 percent 13.0 percent 7.0 percentarrow_forward

- Assume Gillette Corporation will pay an annual dividend of $0.63 one year from now. Analysts expect this dividend to grow at 12.6% per year thereafter until the 6th year. Thereafter, growth will level off at 1.6% per year. According to the dividend-discount model, what is the value of a share of Gillette stock if the firm's equity cost of capital is 7.7%? The value of Gillette's stock is $ (Round to the nearest cent.)arrow_forwardK thereafter Assume Gillette Corporation will pay an annual dividend of $0.65 one year from now. Analysts expect this dividend to grow at 11.5% per year until the 6th year. Thereafter, growth will level off at 2:2% per year. According to the dividend-discount model, what is the value of a share of Gillette stock if the firm's equity cost of capital is 8.4%? The value of Galetle's stock is $ (Round to the nearest cont.) CIDarrow_forward8arrow_forward

- Project A has an internal rate of return of 10%. Project B costs £100 this year and will generate a cash flow of £105 next year. The two projects are not mutually exclusive. 1. The company should only undertake project A 2. If the appropriate discount rate is below 10%, the company should invest in both projects 3. If the appropriate discount rate is above 5% the company should invest in both projects 4. If the appropriate discount rate is above 5%, the company should not undertake project Barrow_forwardAm. 157.arrow_forward29. Mackenzie Company has a price of $36 and will issue a dividend of $2.00 next year. It has a beta of1.2, the risk-free rate is 5.5%, and the market risk premium is estimated to be 5.0%. a. Estimate the equity cost of capital for Mackenzie. What ___% b. Under the CDGM, at what rate do you need to expect Mackenzie's dividends to grow to get the same equity cost of capital as in part (a)? What __% **round to two decimal places**arrow_forward

- Your firm has $2,100,000 in stock assets with a duration of 12 and $900,000 in cash with a duration of 0. Your firm has issued debt with a present value of $1,700,000 and a duration of 16. The yield curve is flat at 4.35%. a) What is the value of equity? b) What is the duration of equity?arrow_forwardDorpac Corporation has a dividend yield of 1.4%. Its equity cost of capital is 7.8%, and its dividends are expected to grow at a constant rate. a. What is the expected growth rate of Dorpac's dividends? b. What is the expected growth rate of Dorpac's share price? a. What is the expected growth rate of Dorpac's dividends? The growth rate will be %. (Round to one decimal place.)arrow_forwardwhich option is correctarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education