Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

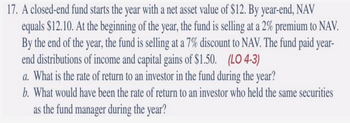

Transcribed Image Text:17. A closed-end fund starts the year with a net asset value of $12. By year-end, NAV

equals $12.10. At the beginning of the year, the fund is selling at a 2% premium to NAV.

By the end of the year, the fund is selling at a 7% discount to NAV. The fund paid year-

end distributions of income and capital gains of $1.50. (LO 4-3)

a. What is the rate of return to an investor in the fund during the year?

b. What would have been the rate of return to an investor who held the same securities

as the fund manager during the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Q4: For 19 years, Janet saved $600 at the beginning of every month in a fund that earned 3.5% compounded annually.a. What was the balance in the fund at the end of the period?Round to the nearest centb. What was the amount of interest earned over the period?Round to the nearest centarrow_forwardi need botharrow_forwardAn investor deposits $1000 at the beginning of each year for five years in a fund earning 5% effective. The interest from this fund can be reinvested at only 4% effective. Show that the total accumulated value at the end of ten years is 1250($111.04 - $1.04 −1).arrow_forward

- You pay $21,600 to the Laramie Fund, which has an NAV of $18 per share at the beginning of the year. The fund deducted a front-end load of 4% at the time of the purchase. The securities in the fund then increased in value by 10% during the year. The fund's expense ratio is 1.3% and is deducted from year-end asset values. What is your rate of return on the fund if you sell your shares at the end of the year? Select the answer closest to the correct return. (Hint: The formula on slide #23 in the "Mutual Funds, ETFs, ..." slide set solves for the gross return. Your rate of return would be the gross return minus 1. The formula on slide # 23 can be written as X(1-f)(1+r-a)" (1-b) Gross Return = (1 - f)(1+r-a)" (1-b) or as Gross Return = X where X is the dollar amount invested. The other variables in the formula (f, r, a, n, b) are all defined in the slide set and in the lecture.) 4.2% 10% 8.7% O 4.7%arrow_forwardYou have $5,000 to invest You are comparing two investment funds. Fund A returns 4%/yr compounded monthly Fund B returns 4.05% compounded quarterly. Which should you choose and why?arrow_forwardKenny decided to make a P1,000 monthly deposit in a fund that pays 6% compounded quarterly. How much will be in the fund after 15 years? a. P290,082.51 b. P118,729.52 c. P290,785.62 d. P199,567.25arrow_forward

- Red Company invested $20,000 in a fund that was earning interest at a rate of 3.00% compounded semi-annually. After 2 years and 9 months, the company transferred these funds to another investment that was earning interest at 5.50% compounded monthly.arrow_forwardB 2. Deposits of $6000 are made every 6 months into a fund starting today and continuing until 10 deposits have been made. Six months after the last deposit, there is $70 630 in the fund. What nominal rate of interest, j2, do the deposits earn?arrow_forwardA company has $44,000 today to invest in a fund that will earn 4% compounded annually. How much will the fund contain at the end of 6 years? (PV of $1 EV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Multiple Choice $55,673 $45,760 $55,550 $54,560 $59,862arrow_forward

- Vijayarrow_forwardH10.arrow_forwardWhat are the After-tax annualized returns from the following two funds if you invest $1000 in each of them? Assume: You invest for 4 years (hold investments till end of 4th year) and sell your shares at the beginning of 5th year. Tax rate is 25%. Fund B: Distributes 5% Distributed Income return per period. Provides 5% Capital Gain Return Per Period.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education