Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

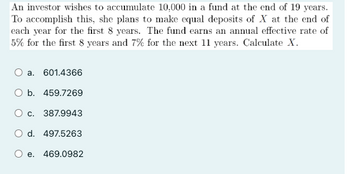

Transcribed Image Text:An investor wishes to accumulate 10,000 in a fund at the end of 19 years.

To accomplish this, she plans to make equal deposits of X at the end of

each year for the first 8 years. The fund earns an annual effective rate of

5% for the first 8 years and 7% for the next 11 years. Calculate X.

a. 601.4366

O b. 459.7269

O c. 387.9943

O d. 497.5263

O e.

469.0982

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Need help solvingarrow_forward2.arrow_forwardSerena Medavoy will invest $7,680 a year for 20 years in a fund that will earn 4% annual interest. Click here to view factor tables. If the first payment into the fund occurs today, what amount will be in the fund in 20 years? If the first payment occurs at year-end, what amount will be in the fund in 20 years? (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 458,581.) First payment today First payment at year-end $ +A $arrow_forward

- Jordan deposited $23,500 into a fund at the beginning of every quarter for 20 years. He then stopped making deposits into the fund and allowed the investment to grow for 3 more years. The fund was growing at 4.31% compounded monthly. a. What was the accumulated value of the fund at the end of year 20? Round to the nearest cent b. What was the accumulated value of the fund at the end of year 23? Round to the nearest cent c. What is the total amount of interest earned over the 23-year period? Round to the nearest centarrow_forwardVv john made a deposit of 1000 into a fund at the beginning of each year for 20 years. at the end of year 20 years, he began making semiannual withdrawls of 3000 at the beginning of each 6 months, with a smaller final withdrawl to exhaust the fund. the fund earned an annual effective rate of 8.16%. calculate the amound of the final withdrawlarrow_forwardUma plans on investing $215 monthly into a vehicle that will earn 9.75% for 12 years. At the end of the twelve years, Uma will stop making payments and the fund will move to a more modest 7.17% return vehicle. If Uma is invested for a total of 40 years, what will she have at the end of the 40-year investment? Assume monthly compounding for the entire investment.arrow_forward

- Fund A is invested at an effective annual interest rate of 5%. Fund B is invested at an effective annual interest rate of 4%. At the end of 10 years, the total of the two funds is 10,000. At the end of 15 years, the amount in fund A is triple the amount in fund B. Calculate the total of the two funds at the end of 20 years.arrow_forward1. Emily and Jimmy each make deposits of 150 at the end of each year for 30 years. Starting at the end of the 31st year, Emily makes annual withdrawals of K for 10 years and Jimmy makes annual withdrawals of L for 10 years. Both funds have a balance of 0 after the last withdrawal. Emily's fund earns an annual effective interest rate of 8%. Jimmy's fund earns an annual effective interest rate of 6%. Calculate K-L Solution:arrow_forwardJuliana invested $5000 in a fund at the beginning of every three months for five years. The fund was earning an interest rate of 5% compounded monthly. What was the future value of her investment? Fill in the calculator entries below, including the calculated answer in the appropriate location. BGN/END = N = I/Y = PV = PMT = FV = P/Y = C/Y =arrow_forward

- Salvatore will contribute $640 to a mutual fund at the beginning of each calendar quarter. a. What will be the value of his mutual fund after 6 1/2 years if the fund earns 9% compounded annually? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Value of mutual fund $ b. How much of this amount represents investment earnings? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Investment earnings $arrow_forwardBright Inc. will be receiving $5,500 at the end of every month for the next 2 years. If these payments were directly invested into a fund earning 6.00% compounded semi-annually, what would be the future value of the fund at the end of 2 years? Round to the nearest centarrow_forwardAn endowment fund is providing an annual scholarship of P50,000 for the first five years, P60,000 for the next five years, and P90,000 thereafter. The fund will be established today and will award the first scholarship after a year. The fund earns 4.5 % annual interest. Find the present worth of this cost.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education