FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

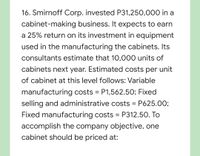

Transcribed Image Text:16. Smirnoff Corp. invested P31,250,000 in a

cabinet-making business. It expects to earn

a 25% return on its investment in equipment

used in the manufacturing the cabinets. Its

consultants estimate that 10,000 units of

cabinets next year. Estimated costs per unit

of cabinet at this level follows: Variable

manufacturing costs = P1,562.50; Fixed

selling and administrative costs = P625.00;

%3D

Fixed manufacturing costs = P312.50. To

accomplish the company objective, one

cabinet should be priced at:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2. An audio equipment manufacturer produced and sold 725 sound systems and made a net income of $50, 000 last year, with a total revenue of $1, 015, 000. The manufacturer's break-even volume is 600 units. a. Calculate the selling price of each sound system. b. Calculate the variable costs for each sound system. c. Calculate the fixed costs per year.arrow_forwardThe following data refer to the Daniels division of Tippett Inc. Daniels sells variable- speed drills. The standard drill sells for $ 40, and Daniels plans to sell 30,000 units in 2017. Tippett treats Daniels as an investment center with a total attributable investment of $ 800,000. Daniels' annual fixed costs are $ 200,000. Variable cost per standard drill is $ 24. The firm's required rate of return on investment is 15%. 1.1 What is the expected Return on Investment in 2017? 1.2 What is the expected residual income for Daniels in 2017? A special order from a unit of the US Government has been received to buy from Daniel 10,000 units every year of the device at the price of $30 each. If the order is accepted, Daniels will have to incur additional annual fixed costs of $30,000 for administration and $150,000 to modify and expand the manufacturing facilities. 1.3 Based on the effect on ROI and/or Residual Income for the first year , will the manager accept this order? Why and why not?arrow_forwardA4arrow_forward

- Comfort Ride manufactures seats for airplanes. The company has the capacity to produce 100,000 seats per year, but currently produces and sells 75,000 seats per year. The following informatio relates to current production of seats: Sale price per unit Variable costs per unit: Manufacturing $400 $230 Marketing and administrative $60 Total fixed costs: Manufacturing $790,000 Marketing and administrative $210,000 A. Increase by $49,000 B. Increase by $60,000 OC. Decrease by $49,000 OD. Increase by $229,000arrow_forwardCabin Creek Company is considering adding a new line of kitchen cabinets. The company's accountant provided the following estimated data for these cabinets: Annual sales Selling price per unit Variable manufacturing costs per unit Variable selling costs per unit Incremental fixed costs per year: 800 units. $ 3,680 $ 1,680 $ 530 $ 493,400 Manufacturing Selling Allocated common costs per year: Manufacturing Selling and administrative $ 73,000 $ 98,000 $ 130,000 If the kitchen cabinets are added as a new product line, the company expects that the contribution margin earned from selling products will decrease by $236,000 per year. Required: 1. What is the annual financial advantage (disadvantage) of adding the new line of kitchen cabinets? 2. What is the lowest selling price per unit that could be charged for the cabinets and still make it economically desirable for th company to add the new product line? Complete this question by entering your answers in the tabs below. Required 1…arrow_forwardFrank Co. is currently operating at 80% of capacity and is currently purchasing a part used in its manufacturing operations for $25 unit. The unit cost for Frank Co. to make the part is $30, which includes $4 of fixed costs. If 20,000 units of the part are normally purchased each year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease for making the part rather than purchasing it? a. $40,000 decrease b. $50,000 increase c. $20,000 increase d. $30,000 increasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education