FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

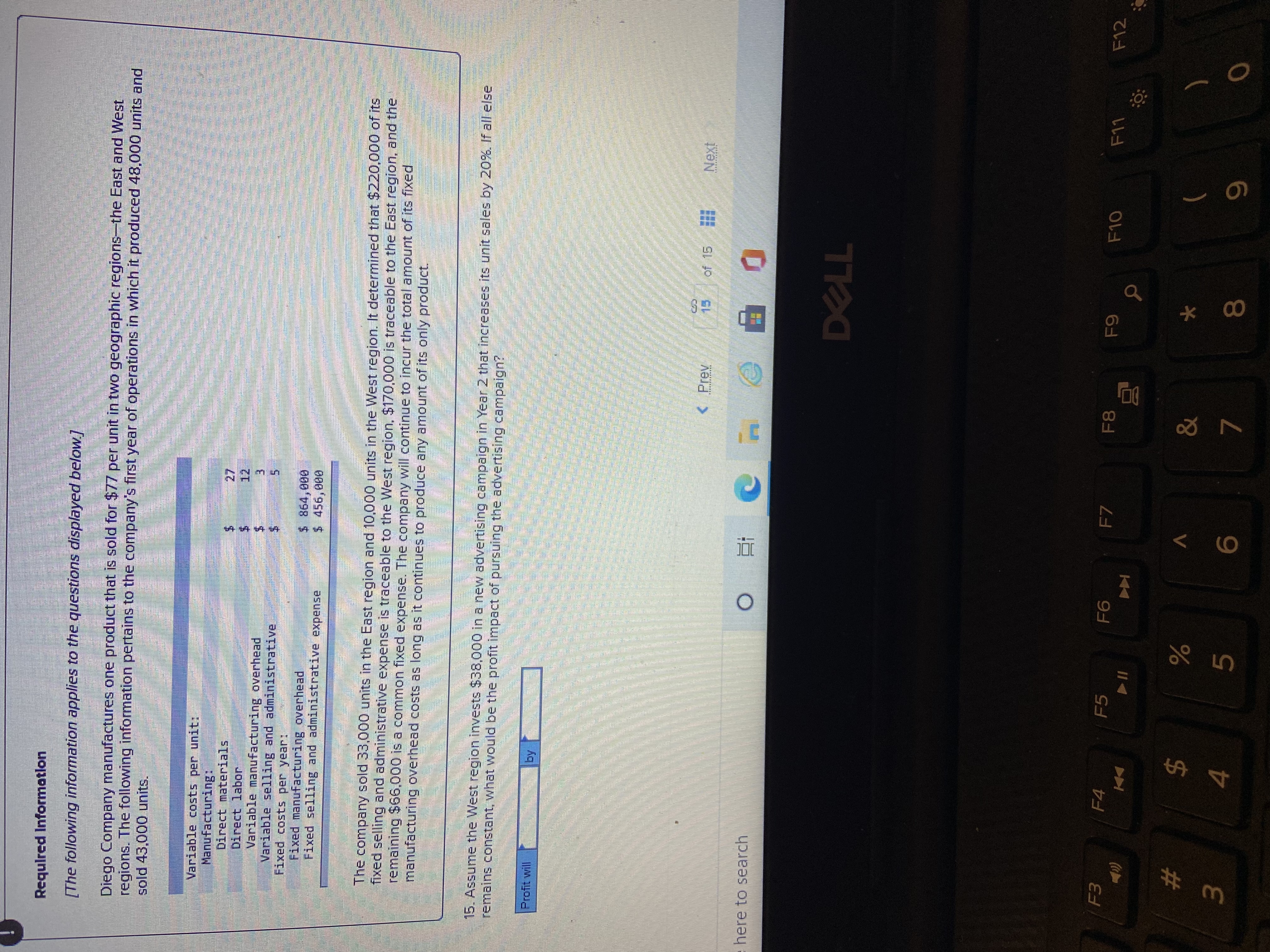

Transcribed Image Text:15. Assume the West region invests $38,000 in a new advertising campaign in Year 2 that increases its unit sales by 20%. If all else

remains constant, what would be the profit impact of pursuing the advertising campaign?

Profit will

by

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Revenues generated by a new fad product are forecast as follows: Year Revenues 1 $50,000 2 35,000 3 30,000 4 20,000 Thereafter 0 Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $60,000 in plant and equipment. a. What is the initial investment in the product? Remember working capital. b. If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm’s tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. c. If the opportunity cost of capital is 10%, what is the project's NPV? d. What is the project IRR?arrow_forward27.arrow_forwardA firm must decide between two designs A and B. Their effective income rate is 50%. If the desired after-tax return on investment is 8% per year, which alternative should be chosen? *Use repeatability assumption and AW method. Detail analysis is required*arrow_forward

- Financearrow_forwardou estimate that your cattle farm will generate $1 million of profits on sales of $5.7 million under normal economic conditions and that the degree of operating leverage is 8.a. What will profits be if sales turn out to be $5.0 million? (Negative amount should be indicated by a minus sign. Round your answer to 1 decimal place.) b. What if they are $6.4 million? (Round your answer to 1 decimal place.)arrow_forwardHw.20.arrow_forward

- Is the return on this investment proposal exactly 14%, more than 14%, or less than 14%? Explain. The Net Present Value Method-An Extended Examplearrow_forward6b) Kalvino Inc. has a new five-year project that produces high-end raincoats. The initial investment equals $85,000. The estimated selling price equals $102 per unit and variable costs equal $80 per unit. Fixed costs equal $29,000. Investors do require a 15% return. Calculate the cash break-even quantity? Interpret your answer. Calculate the accounting break-even quantity? Interpret your answer. Calculate the financial break-even quantity? Interpret your answer. What is the degree of operating leverage for this project? Assuming that sales are estimated at $249,900.arrow_forwardQuestion 2 A firm is considering an investment project that has a cost of $1 million and is expected to generate an annual after-tax cash flow of $250,000 for five years. It has already spent $25,000 in research and development (R&D) costs for the project. If the firm's required rate of return is 14 percent and consider R&D a sunck cost, what is the NPV of this project? A $25,000 B -$141,750 C +141,750 D $858,250arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education