ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

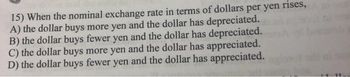

Transcribed Image Text:15) When the nominal exchange rate in terms of dollars per yen rises,

A) the dollar buys more yen and the dollar has depreciated.

B) the dollar buys fewer yen and the dollar has depreciated.

C) the dollar buys more yen and the dollar has appreciated.

D) the dollar buys fewer yen and the dollar has appreciated.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A consumer living in Ithaca, NY buys $1,000 dollars worth of toys from a company that manufactures toys in Tokyo, Japan. If we consider the US Balance of Payments and assume all foreign exchange transactions are between private citizens, this purchase results in to net exports and to private foreign assets in the US. a) a debit; a credit b) a credit; a debit C) a credit; a credit D) a debit; a debitarrow_forwardExplain the impact on US export and import if the US dollar has depreciated in comparison with other currencies. For example, the exchange rate for the Canadian dollar was 1.36 per U.S dollar in 2003. Now in 2020, it is 1.31 Canadian dollars per U.S.dollar under this case the dollar has suffered a slight depreciation. Also, when the dollar has depreciated in the case of the Chinese Yuan from 8.27 in 2003 to 6.69 yuans in 2020 per U.S dollar. Also, when there is not either appreciation or depreciation from 2003 to 2020 which is the case of Saudi Arabia currency its exchange rate remains the same 3.75 Riyals per dollar since 2003. Then explain the impact of U.S. exports and imports under these scenarios.arrow_forwardPlease help me figure out the answers to these two questions. Please also explain the correct answers to me and if you can highlight the correct choice.arrow_forward

- Based on the Exchange rates above, Which of the following is true? A)More pounds are needed to buy a dollar, so the dollar is appreciating B)The dollar is less expensive in pounds and is depreciating C)The dollar is growing stronger against the pound D)The dollar is more expensive in pounds and is appreciating Year 2014 2015 2016 US $ 1$ 1$ 1$ British Pound .85 .70 .60arrow_forwardThe current exchange rate is $1.00 = 1.50 Swiss franc. The exchange rate is expected to be $1.00 = 1.25 Swiss franc in six months. The U.S. dollar is expected to A. depreciate and the U.S. will import more from Switzerland B. appreciate and the U.S. will export more to Switzerland C. appreciate and the U.S. will import more from Switzerland D. depreciate and the U.S. will export more to Switzerlandarrow_forwardThe dollar appreciated by 25% relative to the yen and the direct exchange rate is now 0.01 in the US. Find the old exchange rate prior to the dollar appreciation.arrow_forward

- An appreciation of the exchange value of the U.S. dollar would: A) increase the dollar prices of U.S. imports and the foreign cost of exports from the U.S. B) decrease the dollar prices of U.S. imports and the foreign cost of exports from the U.S. C) increase the dollar prices of U.S. imports, but decrease the foreign cost of exports from the U.S. D) decrease the dollar prices of U.S. imports, but increase the foreign cost of exports from the U.S.arrow_forwardWhen the official dollar price of a foreign currency is set below its equilibrium level, the dollar a. is undervalued. b. is devalued. c. has been appreciated. d. is overvalued. e. is revalued.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education