FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

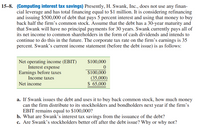

Transcribed Image Text:15-8. (Computing interest tax savings) Presently, H. Swank, Inc., does not use any finan-

cial leverage and has total financing equal to $1 million. It is considering refinancing

and issuing $500,000 of debt that pays 5 percent interest and using that money to buy

back half the firm's common stock. Assume that the debt has a 30-year maturity and

that Swank will have no principal payments for 30 years. Swank currently pays all of

its net income to common shareholders in the form of cash dividends and intends to

continue to do this in the future. The corporate tax rate on the firm's earnings is 35

percent. Swank's current income statement (before the debt issue) is as follows:

$100,000

Net operating income (EBIT)

Interest expense

Earnings before taxes

Income taxes

$100,000

(35,000)

$ 65,000

Net income

a. If Swank issues the debt and uses it to buy back common stock, how much money

can the firm distribute to its stockholders and bondholders next year if the firm's

EBIT remains equal to $100,000?

b. What are Swank's interest tax savings from the issuance of the debt?

c. Are Swank's stockholders better off after the debt issue? Why or why not?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In year 1, AMC will earn $2,900 before interest and taxes. The market expects these earnings to grow at a rate of 2.7% per year. The firm will make no net investments (i.e., capital expenditures will equal depreciation) or changes to net working capital. Assume that the corporate tax rate equals 45%. Right now, the firm has $7,250 in risk-free debt. It plans to keep a constant ratio of debt to equity every year, so that on average the debt will also grow by 2.7% per year. Suppose the risk-free rate equals 4.5%, and the expected return on the market equals 9.9%. The asset beta for this industry is 1.93. Using the WACC, the expected return for AMC equity is 25.71%. Assuming that the proceeds from any increases in debt are paid out to equity holders, what cash flows do the equity holders expect to receive in one year? At what rate are those cash flows expected to grow using the FTE method? (Hold all intermediate calculations to at least 6 decimal places and round to the…arrow_forwardcriticism. structure? Explain M-M Theory with their 5 The Holland Company expects perpetual earnings before interest and taxes (EBIT) of $4 6 million per year. The firm's after-tax, all-equity discount rate (ro) is 15%. Holland is subject to a corporate tax rate of 35%. The pretax cost of the firm's debt capital is 10% per annum, and the firm has $10 million of debt in its capital structure. i. ii. iii. Question: 7 What is Holland's value? What is Holland's cost of equity (rs)? What is Holland's weighted average cost of capital (Twacc)?arrow_forwardEf 45.arrow_forward

- Fujita, Incorporated, has no debt outstanding and a total market value of $250,000. Earnings before interest and taxes, EBIT, are projected to be $42,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 18 percent higher. If there is a recession, then EBIT will be 30 percent lower. The company is considering a $100,000 debt issue with an interest rate of 8 percent. The proceeds will be used to repurchase shares of stock. There are currently 10,000 shares outstanding. Ignore taxes for this problem. a-1. Calculate earnings per share, EPS, under each of the three economic scenarios before any debt is issued. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. a-2. Calculate the percentage changes in EPS when the economy expands or enters a recession. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded…arrow_forwardNielson Motors (NM) has no debt. Its assets will be worth $600 million in one year if the economy is strong, but only $300 million if the economy is weak. Both events are equally likely. The market value today of Nielson's assets is $400 million. Suppose the risk-free interest rate is 3%. If Nielson borrows $157 million today at this rate and uses the proceeds to pay an immediate cash dividend, then according to MM, the expected return of Nielson's stock just after the dividend is paid would be closest to (%) (2 decimal places):arrow_forwardTool Manufacturing has an expected EBIT of $74,000 in perpetuity and a tax rate of 21 percent. The company has $131,500 in outstanding debt at an interest rate of 6.8 percent and its unlevered cost of capital is 13 percent. What is the value of the company according MM Proposition I with taxes? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Company valuearrow_forward

- Viserion, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 16 years to maturity that is quoted at 107 percent of face value. The issue makes semiannual payments and has an embedded cost of 4 percent annually. a. What is the company's pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If the tax rate is 25 percent, what is the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) а. Pretax cost of debt % b. Aftertax cost of debt %arrow_forwardSandyhorse Corp. has $370 million of debt outstanding at an interest rate of 14 percent. What is the present value of the interest tax shield if the debt has no maturity and if Sandyhorse is subject to a 30 percent marginal tax rate? $_________arrow_forwardEf 314.arrow_forward

- Target Corporation (TGT) has $2.14 million in assets that are currently financed with 100% equity. TGT’s EBIT is $385,000, and its tax rate is 25%. If TGT changes its capital structure to include 50% debt, its return on equity will increase. Assume the interest rate on debt is free. (justify your answer with numerical calculation) True Falsearrow_forwardHunter Corporation expects an EBIT of $30,000 every year forever. The company currently has no debt and its cost of equity is 14 percent. The tax rate is 20 percent. The company is able to borrow at 8 percent. What will the value of the company be if it takes on debt equal to 60 percent of its levered value? [Note: the proceeds from issuing new debt are used to repurchase Hunter's equity.] O $251,488.1 $194,805.2 O $274,285.8 O $171,428.6arrow_forwardMarcus Inc., a manufacturing firm with no debt outstanding and a market value of $100 million is considering borrowing $ 40 million and buying back stock. Assuming that the interest rate on the debt is 9% and that the firm faces a tax rate of 21%, answer the following question: Estimate the present value of all future interest tax savings, assuming that the debt change is permanent. Group of answer choices a. 21m b. 8.4m c. 0.756m d. 1.89marrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education