FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

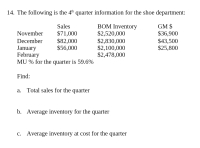

Transcribed Image Text:14. The following is the 4th quarter information for the shoe department:

BOM Inventory

$2,520,000

$2,830,000

$2,100,000

$2,478,000

GM $

$36,900

$43,500

$25,800

Sales

November

$71,000

$82,000

$56,000

December

January

February

MU % for the quarter is 59.6%

Find:

a. Total sales for the quarter

b. Average inventory for the quarter

c. Average inventory at cost for the quarter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide correct answer for this questionarrow_forward[The following information applies to the questions displayed below.] A company began January with 4,000 units of its principal product. The cost of each unit is $7. Inventory transactions for the month of January are as follows: Date of Purchase January 10 January 18 Totals * Includes purchase price and cost of freight. Date of Sale January 5 January 12 January 20 Total Average Cost Total Sales Beginning Inventory Purchases: January 10 January 18 Units 3,000 4,000 7,000 Units 5,000 units were on hand at the end of the month. 4. Calculate January's ending inventory and cost of goods sold for the month using Average cost, periodic system. 2,000 1,000 3,000 6,000 Number of units Purchases Unit Cost* $8 9 Cost of Goods Available for Sale Unit Cost 4,000 $7.00 3,000 $8.00 4,000 $9.00 11,000 Cost of Goods Available for Sale $ 28,000 Total Cost $ 24,000 36,000 $ 60,000 24,000 36,000 $ 88,000 Answer is not complete. Cost of Goods Sold - Average Cost Number of units sold 77,000 X Average Cost…arrow_forwardThe records of Vaughn's Boutique report the following data for the month of April. Sales revenue $97,100 Purchases (at cost) $47,800 Sales returns 2,100 Purchases (at sales price) 86,100 Markups 10,400 Purchase returns (at cost) 2,100 Markup cancellations 1,500 Purchase returns (at sales price) 3,100 Markdowns 10,200 Beginning inventory (at cost) 24,251 Markdown cancellations 2,900 Beginning inventory (at sales price) 44,800 Freight on purchases 2,500 Compute the ending inventory by the conventional retail inventory method. (Round ratios for computational purposes to 0 decimal places, eg. 78% and final answer to 0 decimal places, eg. 28,987.) Ending inventory using conventional retail inventory method %$4arrow_forward

- Beginning Inventory at FIFO: 15 Units @ $16 = $240 Beginning Inventory at LIFO: 15 Units @ $12 = $1801. Compute the inventory turnover ratio for the month of January under the FIFO and LIFO inventory costing methods. 2. Which costing method is the more accurate indicator of the efficiency of inventory management?arrow_forwardThe beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period ending March 31 are as follows: Date Jan. Feb. Mar. Transaction Number of Units 9,000 21,000 10,250 5,750 3,500 1 Inventory 10 Purchase 28 Sale 30 Sale 5 Sale 10 16 28 5 Purchase 14 25 30 Purchase Sale Sale Sale Purchase Sale 39,500 15,000 10,000 25,000 30,000 10,000 19,000 Per Unit $60.00 70.00 140.00 140.00 140.00 75.00 150.00 150.00 82.00 150.00 88.40 150.00 Total $540,000 1,470,000 1,435,000 805,000 490,000 2,962,500 2,250,000 1,500,000 2,050,000 4,500,000 884,000 2,850,000 Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 3, using the first-in, first-out method. 2. Determine the total sales and the total cost of goods sold for the period. Journalize summary entries for the sales and corresponding cost of goods sold for the period. Assume that all sales were on account and date your…arrow_forward32. Calculate inventory turnover. (Hint: Food costs for the month must first be calculated.) Show your calculations. Beginning Inventory/month Food Purchases/month Ending Inventory $2,000 9,000 4,000arrow_forward

- Keep Calm Company provided the following information for the current year: Accounts receivable, January 1 2,100,000 Accounts receivable, December 31 2,700,000 Collections of accounts during the year 9,000,000 Inventory, January 1 4,500,000 Purchases during the year 5,800,000 All sales are made on account. The mark up on cost is 20% What is the estimated inventory at December 317arrow_forwardPlease Do both questions Delphino’s has sales for the year of $127,300 and cost of goods sold of $86,700. The firm carries an average inventory of $14,300 and has an average accounts payable balance of $13,600. What is the inventory period? 81.36 days 60.20 days 58.68 days 89.02 days The Lumber Yard has projected sales for April through July of $152,400, $161,800, $189,700, and $196,400, respectively. The firm collects 52 percent of its sales in the month of sale, 46 percent in the month following the month of sale, and the remainder in the second month following the month of sale. What is the amount of the July collections? $181,508 $122,852 $189,819 $192,626arrow_forwardCase D Tompkins Company reports the following Inventory record for November. Date November 1 November 4 November 7 November 13 November 22 INVENTORY Activity Beginning balance Purchase Sale (@ $53 per unit) Purchase Sale (@ $53 per unit) # of Units 135 320 Cost/Unit $ 18 19 245 525 21 520 Selling, administrative, and depreciation expenses for the month were $15,500. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending Inventory and the cost of goods sold under each of the following methods using periodic Inventory system: 2-a. What is the gross profit percentage under the FIFO method? 2-b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to value its Inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that Inventory had a market replacement value of $17.70 per unit, what would Tompkins report on the balance sheet for Inventory? Complete this question by…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education