Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

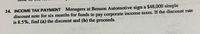

Transcribed Image Text:14. INCOME TAX PAYMENT Managers at Benson Automotive sign a $48,000 simple

discount note for six months for funds to pay corporate income taxes. If the discount rate

is 8.5%, find (a) the discount and (b) the proceeds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Gross wages at the Timberwolf Company are $100,000. The Social Security tax rate is 6.0% The Medicare tax rate is 1.5% Amount withheld from employee paychecks for the United Way, a charitable organization, is $2,000. Amount withheld from employee paychecks for retirement savings is $4,000. Make the journal entry (debit and credits) for recording the payroll.arrow_forwardInnovative Engineering received a promissory note of $15500 at 11% simple interest for 15 months from one of its customers. After 3 months union Bank discounted the note at a discount rate of 13% calculate the proceeds that Innovative Engineering will receive from the discounted note $18,855.17 $16,495.62 $15,339.19 $12,456.22arrow_forwardMichael have regular savings account with an available balance 5,000.00. How much net interest is earned by this deposit account for a month of the prevailing bank's interest rate is 0.5% per annum and the withholding tax is 20%.arrow_forward

- Rosewood Company made a loan of $7,000 to one of the company's employees on April 1, Year 1. The one-year note carried a 6% rate of interest. What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2, respectively? Multiple Choice O O $420 in Year 1 and $0 in Year 2 $0 in Year 1 and $420 in Year 2 $105 in Year 1 and $315 in Year 2 $315 in Year 1 and $105 in Year 2arrow_forwardOn September 1, Year 1, West Company borrowed $30,000 from Valley Bank. West agreed to pay interest annually at the rate of 5% per year. The note issued by West carried an 18-month term. West Company has a calendar year-end. What is the amount of interest expense that will be reported on West's income statement for Year 1? Multiple Choice $500 $375 $-0- $150arrow_forwardA company borrows $60,000 by signing a $60,000, 8% 6-year note that requires equal payments of $!2,979 at the end of each year. The first payment will record an interest expense of $4,800 and will reduce principal by $__________.arrow_forward

- You make the following monthly payments. Your total net income (net of taxes) is $3,000. Calculate your total debt-to-income ratio. The minimum payment on the credit card is $30. Assume rent as debt. Entertainment Rent $600 Car payment $253 Credit card payment $100 Utilities $200 Groceries $250 36%. 42%. 34%. 39%. Health insurance Taxes Gasoline Retirement savings Student loan payment $300 $500 $450 $185 $150 $300arrow_forwardRM is amount and PTPTN is student loanarrow_forwardA consumer loan of 1000 is being repaid with 24 monthly installments of 50 at the end of each month. Rather than making payments as originally scheduled, the borrower repaid the outstanding principal immediately after the 10th regular installment. Determine the unearned finance charge recovered by the borrower. A. 200.00 B.116.65 C. 83.35 D. 73.40 E. 67.85arrow_forward

- Want helparrow_forwardClayton Company borrowed $7, 300 from the State Bank on April 1, Year 1. The one-year note carried a 19% rate of interest. The amount of interest expense that Clayton would report in Year 1 and Year 2, respectively would be: Multiple Choice $1, 387 and $o. $1,040 and So. So and $1,387. $1,040 and $347.arrow_forwardShadyTree Company issued a note receivable to a customer. The face value of the note was $12,000 at 4% interest for 5 months. How much interest revenue should ShadyTree recognize for the entire term of the note? $280 $480 $200 $40arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education