Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

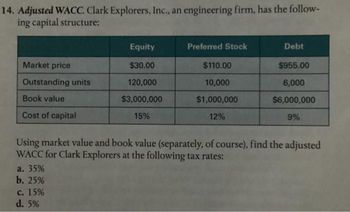

Transcribed Image Text:14. Adjusted WACC. Clark Explorers, Inc., an engineering firm, has the follow-

ing capital structure:

Market price

Outstanding units

Book value

Cost of capital

a. 35%

b. 25%

Equity

$30.00

120,000

$3,000,000

15%

c. 15%

d. 5%

Preferred Stock

$110.00

10,000

$1,000,000

12%

Debt

Using market value and book value (separately, of course), find the adjusted

WACC for Clark Explorers at the following tax rates:

$955.00

6,000

$6,000,000

9%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume Skyler Industries has debt of $4,386,000 with a cost of capital of 7.5% and equity of $5,814,000 with a cost of capital of 10.2%. What is Skyler’s weighted average cost of capital? Round your intermediate calculations and final answer to 3 decimal places. _____%arrow_forwardWeighted average cost of capital A. The capital for investment of Executive Consultants, Inc. is as follows: Sources of capital Capital Debt (corporate bonds) $4,100,000 Prefferent shares $2,200,000 Common shares $2,800,000 B. To generate the $ 4.1 million of corporate bond capital, they issued bonds at $ 965 par value, with an annual coupon of $ 100 for the next 10 years, with a flotation cost of $ 10 per bond.C. The issue of preferred shares has a cost of $ 5 per share and will pay a dividend of 10% of its par value of $ 110 per preferred share.D. The risk-free rate is 3.45% and the market return is 11.25%. The company's beta coefficient is 1.23.E. Executive Consultants, Inc. has a tax liability of 35%.Problems:You must submit the procedure and all the calculations.1. Determine the capital structure of Executive Consultants, Inc.2. Calculate the cost of debt after taxes.3. Calculate the cost of preferred equity.arrow_forwardCan you help me with B and c?arrow_forward

- Determine Garneau's optimal capital structure based on the following information: Debt EPS DPS Stock Price 20% 2.2 1.1 40.12 30% 2.4 40% 2.6 50% 2.8 Equity 80% 70% 60% 50% O a. 20% debt; 80% equity O b. 40% debt; 60% equity O c. 50% debt; 50% equity O d. 30% debt; 70% equity 1.2 1.3 1.4 41.34 40.52 39.42arrow_forwardPercent of capital structure: Preferred stock Common equity (retained earnings) Debt Additional information: Corporate tax rate Dividend, preferred Dividend, expected common Price, preferred Growth rate Bond yield Flotation cost, preferred Price, common 15% 45 40 35% Debt Preferred stock Common equity (retained earnings) Weighted average cost of capital $ 8.00 $ 3.50 $ 105.00 98 8% $ 10.40 $ 78.00 Calculate the weighted average cost of capital for Digital Processing Incorporated Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places. Answer is complete but not entirely correct. Weighted Cost 5.20 % 8.33 11.50 25.03 %arrow_forwardI need help solving FCFE and Cash Flow per Share. See below and advise. All in MM. Exploration Expense: -12.8 Asset Retirement Obligation Accretion: -6.0 Depreciation, Depletion and Amortization: -378.9 Working Capital (Increase) / Decrease: (30.0) Capital Expenditures: 156.1 Net Debt: -11.0 Number of Shares Outstanding: 251arrow_forward

- Table 9.1 A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions. Source of Capital Long-term debt Preferred stock Common stock equity Target Market Proportions OA. 8.13 percent OB. 4.67 percent OC. 8 percent O D. 3.25 percent 20% 10 70 Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of 2 percent of the face value would be required in addition to the discount of $40. Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share. Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new…arrow_forwardPercent of capital structure: Preferred stock Common equity (retained earnings) Debt Additional information: Corporate tax rate 45 25 15% 40 35% Dividend, preferred $ 10.00 Dividend, expected common $ 5.50 Price, preferred $ 98.00 Growth rate 10% Bond yield 11% Flotation cost, preferred $ 8.20 $ 77.00 Price, common Calculate the weighted average cost of capital for Digital Processing Incorporated Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places. Answer is complete but not entirely correct. Debt Preferred stock Common equity (retained earnings) Weighted average cost of capital Weighted Cost 7.15% 11.14x 7.86 X 26.15 %arrow_forwardCapital structure of the ABC PJSC is as follows: Equity share capital market value $ 200 million, dividend $ 4 , market price per share $88, dividend growth 4%. Bond $ 300 million, Yield to maturity 4% , tax rate 20% Calculate weighted average cost of capital.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education