Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

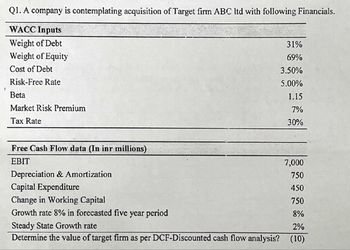

Transcribed Image Text:Q1. A company is contemplating acquisition of Target firm ABC ltd with following Financials.

WACC Inputs

Weight of Debt

Weight of Equity

Cost of Debt

Risk-Free Rate

Beta

Market Risk Premium

Tax Rate

Free Cash Flow data (In inr millions)

EBIT

31%

69%

3.50%

5.00%

1.15

7%

30%

7,000

750

450

750

8%

Steady State Growth rate

2%

Determine the value of target firm as per DCF-Discounted cash flow analysis? (10)

Depreciation & Amortization

Capital Expenditure

Change in Working Capital

Growth rate 8% in forecasted five year period

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- F1arrow_forwardBb.9.arrow_forwardEvans Technology has the following capital structure. Debt Common equity 35% 65 The aftertax cost of debt is 7.50 percent, and the cost of common equity (in the form of retained earnings) is 14.50 percent. a. What is the firm's weighted average cost of capital? Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places. Debt Common equity Weighted average cost of capital Weighted Cost % % An outside consultant has suggested that because debt is cheaper than equity, the firm should switch to a capital structure that is 50 percent debt and 50 percent equity. Under this new and more debt-oriented arrangement, the aftertax cost of debt is 8.50 percent, and the cost of common equity (in the form of retained earnings) is 16.50 percent. Debt Common equity Weighted average cost of capital b. Recalculate the firm's weighted average cost of capital. Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal…arrow_forward

- Debt Ratio Equity Ratio EPS DPS Stock Price 30% 70% 1.55 0.34 22.35 40% 60% 1.67 0.45 24.56 50% 50% 1.72 0.51 25.78 60% 40% 1.78 0.57 27.75 70% 30% 1.84 0.62 26.42 Which capital structure shown in the preceding table is Universal Exports Inc.’s optimal capital structure? Globex Corp. has a capital structure that consists of 40% debt and 60% equity. The firm’s current beta is 1.10, but management wants to understand Globex Corp.’s market risk without the effect of leverage. If Globex Corp. has a 25% tax rate, what is its unlevered beta?arrow_forwardDetermine Garneau's optimal capital structure based on the following information: Debt EPS DPS Stock Price 20% 2.2 1.1 40.12 30% 2.4 40% 2.6 50% 2.8 Equity 80% 70% 60% 50% O a. 20% debt; 80% equity O b. 40% debt; 60% equity O c. 50% debt; 50% equity O d. 30% debt; 70% equity 1.2 1.3 1.4 41.34 40.52 39.42arrow_forwardGive typing answer with explanation and conclusion If the company were to borrow more (or less), how would that impact the cost of debt and the WACC? Provide a specific assumed example. Weight of Equity 76.10% Weight of Debt 23.90% Cost of Equity 6.98% Cost of Debt 2.55% Tax Rate WACC 5.92%arrow_forward

- Can you explain the information below market value added (MVA) analysis and interpretation of results below. Market Value of Equity:$133,341,000,000.00 Plus: Market Value of Debt:$13,677,000.00 Equals: Market Value of Firm:$133,354,677,000.00 Minus: Total Invested Capital:($1,944,100.00) Equals: MVA$133,356,621,100.00arrow_forwardTable 9.1 A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions. Source of Capital Long-term debt Preferred stock Common stock equity Target Market Proportions OA. 8.13 percent OB. 4.67 percent OC. 8 percent O D. 3.25 percent 20% 10 70 Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of 2 percent of the face value would be required in addition to the discount of $40. Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share. Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new…arrow_forwardFinancials of X Ltd are as follows. 10% Debt 6500; Current Market Price 80.21; Equity Beta 1.25; Equity Capital (Rs 10) 1900; Market Risk Premium 6; PAT 1235; Retained Earnings 4100; Risk Free Return 7%; Tax 35%. Find market value added. a. Rs 9329.30 b. Rs 9932.90 c. Rs 9239.90 d. Rs 9329.90arrow_forward

- Complete a,b,&c pleasearrow_forwardAnswer the following questions given the information below: Equity Information 40 million shares $100 per share Beta = 1.15 Market risk premium = 8% Risk-free rate = 3% Debt Information $1 billion in outstanding debt (face value) YTM = 9% What is the cost of equity? What is the cost of debt? What is the after-tax cost of debt? What are the capital structure weights? What is the WACC?arrow_forwardEvans Technology has the following capital structure. Debt Common equity The aftertax cost of debt is 8.50 percent, and the cost of common equity (in the form of retained earnings) is 15.50 percent. a. What is the firm's weighted average cost of capital? Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places. 48% 60 Debt Common equity Weighted average cost of capital Weighted Cost % % An outside consultant has suggested that because debt is cheaper than equity, the firm should switch to a capital structure that is 50 percent debt and 50 percent equity. Under this new and more debt-oriented arrangement, the aftertax cost of debt is 9.50 percent, and the cost of common equity (in the form of retained earnings) is 17.50 percent. b. Recalculate the firm's weighted average cost of canitalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education