FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

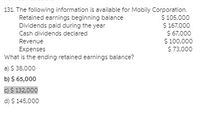

Transcribed Image Text:131. The following information is available for Mobily Corporation.

$ 105,000

$ 167,000

$ 67,000

$ 100,000

$ 73,000

Retained earnings beginning balance

Dividends paid during the year

Cash dividends declared

Revenue

Expenses

What is the ending retained earnings balance?

a) $ 38,000

b) $ 65,000

C)$ 132,000

d) $ 145,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ee 467.arrow_forwardThe following data apply to ABC Company (millions of dollars): Cash and equivalents $150.00 Fixed assets $300 Sales $900.00 Net income $50.00 Current liabilities $105.50 Current ratio 2.5 DSO 45 days (based on a 365-day year) ROE 12% ABC has no preferred stock—only common equity, current liabilities, and long-term debt. Find ABC’s accounts receivable, current assets, total assets, ROA, common equity, quick ratio, long-term debt and equity multiplierarrow_forwardA corporation has $91,000 in total assets, $30, 500 in total liabilities, and a $18,600 credit balance in retained earnings. What is the balance in the contributed capital accounts? Multiple Choice $79, 100 $49, 100 $60,500 $41,900arrow_forward

- Origami Inc. reported the following items on its financial statements for the year ended December 31, 2020: Sales $780,000 Selling and general expenses 20,000 Dividends 5,000 Cost of sales 700,000 Other expenses 15,000 Income tax expense 12,500 What amount will be reported as retained earnings on the December 31, 2020 balance sheet, assuming this is the first year of operations? Select one: a. Cannot be determined from the information provided b. $22,500 c. $42,500 d. $27,500arrow_forwardFor the year ending December 31, 2022, Sheridan Inc. reports net income $147,000 and cash dividends $88,500. Determine the balance in retained earnings at December 31, assuming the balance in retained earnings on January 1, 2022, was $223,500. Balance in retained earnings %24arrow_forwardQuality Instruments had retained earnings of $320,000 at December 31, 2020. Net income for 2021 totaled $215,000, and dividends declared for 2021 were $95,000. How much retained earnings should Quality report at December 31, 2021? OA. $415,000 OB. $440,000 OC. $320,000 OD. $535,000arrow_forward

- Please help solving Example P20-7 from Chapter 20 in the Financial Reporting and Analysis 8th Edition Presented next are the balance sheet accounts of Bergen Corporation as of December 31, 20X1 and 20X0. 20X1 20X0 Increase (Decrease) Assets Current assets: Cash $ 541,000 $ 308,000 $ 233,000 Accounts receivable, net 585,000 495,000 90,000 Inventories 895,000 780,000 115,000 Total current assets 2,021,000 1,583,000 438,000 Land 350,000 250,000 100,000 Plant and equipment 1,060,000 720,000 340,000 Accumulated depreciation (295,000 ) (170,000 ) (125,000 ) Leased equipment under capital lease 158,000 -0- 158,000 Marketable investment securities, at cost -0- 75,000 (75,000 ) Investment in Mason, Inc., at cost 180,000 180,000 -0- Total assets $ 3,474,000 $ 2,638,000…arrow_forwardAccounts Payable$ 46,000 Accounts Receivable23, 800Cash (balance on January 1, 2021)90, 400Cash ( balance on December 31, 2021)78,000Common Stock152, 500 Dividends0Equipment137, 700Income Tax Expense10, 200Interest Expense 29, 600Inventory 17, 300Notes Payable25,000Office Expense 14, 400Prepaid Rent7, 100 Retained Earnings (beginning)6, 800Salaries and Wages Expense35, 800Service Revenue139,800 Utilities Expense25, 200Salaries and Wages Payable9, 000 Other cash flow information: Cash from issuing common stock$ 22,000Cash paid to reacquire common stock24, 500Cash paid for income taxes11, 100Cash paid to purchase long-term assets53, 400Cash paid to suppliers and employees84, 400Cash received from customers139,000 Prepare a statement of retained earnings for 2021.arrow_forwardCotton Company has the following balance sheets and retained earnings statements: 2022 2021 Cash $10,000 $15,000 Receivables 15,000 10,000 Inventories (FIFO) 18,000 23,000 Other Assets 40,000 15,000 $83,000 $63,000 Capital Stock $40,000 $30,000 Retained Earnings 43,000 33,000 $83,000 $63,000 Retained Earnings Jan 1 $33,000 $35,000 Income 15,000 12,000 Dividends -5,000 -14,000 Retained Earnin Dec 31 $43,000 $33,000 The above incomes and Retained Earnings balances are based on FIFO Cost of Goods Sold. Cotton changed from FIFO to LIFO on January 1, 2022. December 31, 2022 inventory at LIFO is $17,000 while December 31, 2021 inventory at LIFO is $21,000. Inventory at January 1, 2021 was zero. a. Prepare statements in the format above assuming 2022 will…arrow_forward

- 10 - T&T Company's selected financial statements items are given as following. Total net sales equals to 100.000 TL, COGS equals to 50.000 TL, operating expenses equals to 20.000 TL, interest expenses equals to 10.000 TL, tax expenses 5.000 TL, total depreciation & amortization expenses equals to 15.000 TL. Calculate the EBITDA/Interest Expense ratio of the company for the year 2020. a) 2,50 b) O 01374 3,00 c) O 4,50 d) 5,00arrow_forwardBalance sheet and income statement data indicate the following: Company A Company B $1,200,000 495,000 75,000 50,000 21,000 Bonds payable, 8%, 24-year bonds Income before income tax for year Income tax for year Interest payable Interest receivable 28,000 a. For each company, what is the times interest earned ratio? (Round to one decimal place.) $900,000 130,000 12,000 Company A Company B b. Which company gives potential creditors more protection?arrow_forwardA company has the following data for a year: Revenue 250 MM Deprecation 20 MM Other Operating Costs 240 MM Financing Costs 0 Profits Tax 25% Dividends Distributed 25MM Q Before-Tax Profits/Loss, Tax, Change in Book Value equals, Net Change in Cash (on Balance Sheet),arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education