Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

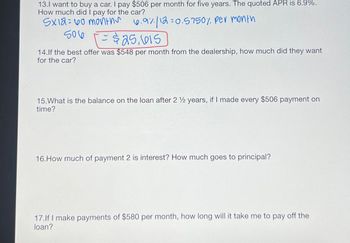

Transcribed Image Text:13.I want to buy a car. I pay $506 per month for five years. The quoted APR is 6.9%.

How much did I pay for the car?

SX12 60 months

6.9%/12=0.5750% per month

506

$25,615

14.If the best offer was $548 per month from the dealership, how much did they want

for the car?

15. What is the balance on the loan after 2 ½ years, if I made every $506 payment on

time?

16. How much of payment 2 is interest? How much goes to principal?

17.If I make payments of $580 per month, how long will it take me to pay off the

loan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have saved $5,000 for a down payment on a new car. The largest monthly payment you can afford is $500. The loan will have an 11% APR based on end-of-month payments. a. What is the most expensive car you can afford if you finance it for 48 months? Do not round intermediate calculations. Round your answer to the nearest cent. b. What is the most expensive car you can afford if you finance it for 60 months? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardUse the following to answer questions 31 – 33 You want a new car. At the dealership, you find a car that you like. The dealership gives you two payment options: 1. Pay $23,000 in cash for the car today...OR Pay $370.41 at the end of each month for six years at 5% (0.41667% monthly for 72n). 2. How much CASH (in total) up paying if you choose to make monthly 31. $ will you end payments for the car? 32. How much interest (in total) $ will you pay if you choose to make payments instead of paying cash for the car today? 33. $ How much interest has accrued by the time the first car payment is due (round to two decimal places)?arrow_forwardYou have decided to buy a car this year at a price of $18,000. You're planning to take out a loan for the full price of the vehicle at an interest rate of .5% per month. For the first two years (24 months), you decide to repay $600 per month. How much will you have to pay each month for the remainder of the three-year loan (12 months remain) to exactly pay off the car in full at the end of the three-year term? Hint: Consider the monthly interest rate, the number of periods in months, and the monthly cash flows. $433 $500 $443 $600 O $419arrow_forward

- You would like to buy a new car. The car costs will be $81 500. If you can earn 12% per annum, how much do you have to invest today to buy the car in three years? Select one: a. None of the given answers is correct. b. $58 244.14 c. $58 145.32 d. $58 010.09arrow_forwardSultan’s Used Cars just sold you a clunker (you need it to get to class on time). You financed the $8,000 purchase price for 48 months. They said your payment would be $250. What interest rate did they charge you (assume monthly compounding)?arrow_forward19) would love the help.arrow_forward

- Suppose you are in the market for a new car worth $18,000. You are offered a deal fo make a S1,800 down payment now and to pay the balance in equal end-of-month payments of $421.85 over a 48-month period. Consider the following situations:a.Instead of going through the dealer's financing, you want to make a down payment of $1,800 and take out an auto loan from a bank at 11.75% compounded monthly. What would be your monthly payment to pay off the loan in four years?b. If you were to accept the dealers offer, what would be the effective rate of interest per month charged by the dealer on your financing?arrow_forwardwhat would the formula be to solve for the table value? the table value is what i need to solve the problemarrow_forwardYou decided to save every month for the next ten years a certain amount so that you can make a down payment for a house in your early thirties. If you think you can make an annual return of 9% and you think you will need to save $50,000 for the down payment, how much should that monthly payment be? a. $258 b. $464 c. $3291 d. $536arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education