ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

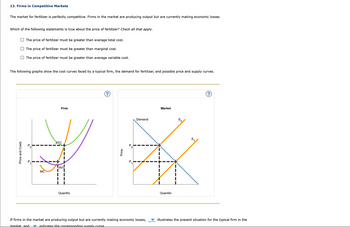

Transcribed Image Text:13. Firms in Competitive Markets

The market for fertilizer is perfectly competitive. Firms in the market are producing output but are currently making economic losses.

Which of the following statements is true about the price of fertilizer? Check all that apply.

The price of fertilizer must be greater than average total cost.

The price of fertilizer must be greater than marginal cost.

The price of fertilizer must be greater than average variable cost.

The following graphs show the cost curves faced by a typical firm, the demand for fertilizer, and possible price and supply curves.

Price and Costs

MC

Firm

ATC

AVC

Quantity

Price

No

U

1

Demand

If firms in the market are producing output but are currently making economic losses,

market and

indicates the corresponding supply curve

Market

Quantity

52

S

illustrates the present situation for the typical firm in the

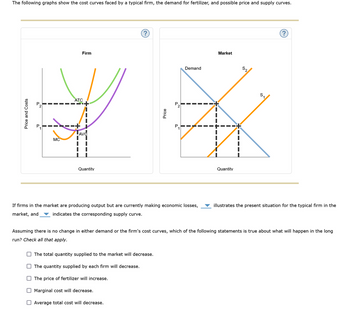

Transcribed Image Text:The following graphs show the cost curves faced by a typical firm, the demand for fertilizer, and possible price and supply curves.

Price and Costs

50

ס

MC

Firm

ATC

LAVC

Quantity

?

Price

P

The total quantity supplied to the market will decrease.

The quantity supplied by each firm will decrease.

The price of fertilizer will increase.

Marginal cost will decrease.

Average total cost will decrease.

Demand

I

■

If firms in the market are producing output but are currently making economic losses,

market, and indicates the corresponding supply curve.

"

I

Market

Quantity

52

?

illustrates the present situation for the typical firm in the

Assuming there is no change in either demand or the firm's cost curves, which of the following statements is true about what will happen in the long

run? Check all that apply.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Use the following data to analyze the condition when the product price is set at $56. A. How much would be the total revenue? B. What will be the profit-maximizing or loss-minimizing output? C. How much would be the total cost?arrow_forwardLisa lawn company (LLC) is a lawn mowing business in a perfectly competitive market for lawn moving services. The following tables set out Lisa's costs Quantity(lawn per hour) Total Cost(dollars per lawn) 0 $30 1 $40 2 $55 3 $75 4 $100 5 $130 6 $165 A. If the market price is $30 per lawn, How many lawns per hour does Lisa's LLC now? B. If the market price is 30 per lawn, What is Lisa"s profit in the short run? C. if the market price falls to $20 per lawn, how many lawns per hour does Lisa's LLC now? D. if the market price falls to $20 per lawn, what is Lisa's profit in the short run? E. At What market price will Lisa shut down?arrow_forward3. Profit maximization in the cost-curve diagram Suppose that the market for frying pans is a competitive market. The following graph shows the daily cost curves of a firm operating in this market Hint: After placing the rectangle on the graph, you can select an endpoint to see the coordinates of that point. 100 90 Profit or Loss 80 70 ATC 60 50 40 30 AVC 20 MC 10 5 10 15 20 25 30 35 40 45 50 QUANTITY (Thousands of pans per day) In the short run, at a market price of $50 per pan, this firm will choose to produce 37,500 pans per day. PRICE (Dollars perpan)arrow_forward

- Brody's firm produces trumpets in a perfectly competitive market. The table below shows Brody's total variable cost. He has a fixed cost of $240, and the price per trumpet is $60.-Calculate the average total cost of producing 6 trumpets. Show your work. -Calculate the marginal cost of producing the 11th trumpet. -What is Brody's profit-maximizing quantity? Use marginal analysis to explain your answer. -At the profit-maximizing quantity you determined in part (c), calculate Brody's profit or loss. Show your work. -Brody also produces saxophones at a loss in a perfectly competitive market. Draw a correctly labeled graph for Brody's firm showing the following at a market price of $200. -Brody's profit-maximizing quantity of saxophones -Brody's loss, completely shaded Quantity Total Variable cost 6 $120 7 $145 8 $165 9 $220 10 $290 11 $390arrow_forwardThe table below shows the weekly marginal cost (MC) and average total cost (ATC) for Buddies, a purely competitive firm that produces novelty ear buds. Assume the market for novelty ear buds is a competitive market and that the price of ear buds is $6.00 per pair. Buddies Production Costs Quantity MC ATC of Ear Buds ($) ($) 20 1.00 25 2.00 1.20 30 2.46 1.41 35 3.51 1.71 40 4.11 2.01 45 5.43 2.39 50 5.99 2.75 55 8.47 3.27 Instructions: In part a, enter your answer as the closest given whole number. In parts b-d, round your answers to two decimal places. a. If Buddies wants to maximize profits, how many pairs of ear buds should it produce each week? pairs b. At the profit-maximizing quantity, what is the total cost of producing ear buds? 2$ c. If the market price for ear buds is $6 per pair, and Buddies produces the profit-maximizing quantity of ear buds, what will Buddies profit or loss be per week? 2$arrow_forwardAstro Computers makes onboard vehicle control computers for the Tesla. The production department has gathered data on the costs of several yearly production levels and asked you to help interpret these for them. 1. The data for Astro appear in the graph below. The COO asks what production level he should set for the coming year, if Astro operates in a perfectly competitive market. (the graph is in the picture) 2. Is Astro earning “excess profit” (explain what that means if you think they are) and how other firms will react when they see Astro’s performance? 3. The production department has also done a bit of research on other firms operating in the market for onboard control computers. The graph below shows the relative sizes and cost structures of the four largest firms in the market (Data, Astro, Consolidated and BCS); these four firms combined account for 35% of business in the market for onboard control computers. There are over fifteen firms that supply onboard control computers…arrow_forward

- In Problem 5, the market demand decreases and the demand schedule becomes: If firms have the same costs set out in Problem 5, what is the market price and the firm’s economic profit or loss in the short run? Problem 5 The market for paper is perfectly competitive and 1,000 firms produce paper. The table sets out the market demand schedule for paper. The table in the next column sets out the costs of each producer of paper. Calculate the market price, the market output, the quantity produced by each firm, and the firm’s economic profit or loss.arrow_forward9. Problems and Applications Q9 The market for apple pies in the city of Ectenia is competitive and has the following demand schedule: Each producer in the market has a fixed cost of $6 and the following marginal cost: Quantity Marginal Cost (Dollars) 1 1 2 3 4 5 6 Complete the following table by computing the total cost and average total cost for each quantity produced. Quantity Total Cost Average Total Cost (Ples) (Dollars) (Dollars) 1 2 3 4 3 8 10 12 14 The price of a pie is now $11. At a price of $11, making a profit of O True O Fal pies are sold in the market. Each producer makes True or False: The market is in long-run equilibrium. Suppose that in the long run there is free entry and exit. In the long run, each producer earns a profit of each producer makes pies, so there are The market price is producers operating. pies, so there are At this price, producers in this market, each pies are sold in this market, andarrow_forwardAnswer question 6D onlyarrow_forward

- A firm is selling apples is profit-maximizing, but they're in a constant cost industry. The industry is perfectly competitive and currently in long-run equilibrium. Assume apples are a normal good and consumer income falls, and the firm continues to produce. 1. Illustrate the decrease in income in the short run with a cost curves graph. Make sure to highlight the area of loss.arrow_forwardAnswer Question 6arrow_forward7. You are economic consultant for Jack, who farms raw cotton in a perfectly competitive market. One day he gives you the following data at his present level of production: Output = 2000 pounds, market price = $5.00, total cost =$8000, fixed cost=$2000, marginal cost=$5. The minimum of AVC occurs at {1000 pounds at $2} and the minimum of ATC at {1500 pounds at $3.5}. Please help Jack with the following questions based on the above figures: a. Draw a graph for the raw cotton market and a graph for Jack’s farm current situation that includes MC, ATC, and AVC, labeling all relevant points on axes with numerical values. Is Jack maximizing the profit (minimizing the loss)? Why or why not? Label the total profit/loss area. b. Suppose more farmers enter the raw cotton market until the market price is $3.00 per pound. On the same graphs, show the effect of this change in the market place. Would you like to suggest Jack leaving the market in the short run? Explain your answearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education