ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

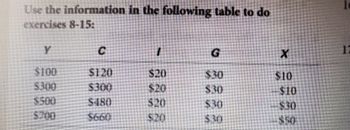

Transcribed Image Text:Use the information in the following table to do

exercises 8-15:

Y

$100

$300

$500

$700

C

5120

$300

$480

$660

$20

$20

G

$30

$30

$30

$30

$10

$10

$30

$50

Transcribed Image Text:13. hat

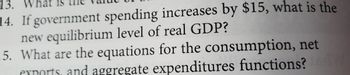

14. If government spending increases by $15, what is the

new equilibrium level of real GDP?

15. What are the equations for the consumption, net

exports, and aggregate expenditures functions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Homework: Demand-Side Equilibrium: Unemployment or Inflation? The following graph shows the total expenditure line (TE) for an economy where current equilibrium output is $400 billion and potential output is $650 billion. REAL EXPENDITURE (Billions of dollars) § 2 600 500 400 300 200 100 0 0 100 45-degree ling 200 300 400 500 600 REAL GDP (Bilions of dollars) The economy is experiencing TE Potential GDP 700 800 TE equal to $ by billion. Thus, the value of the multiplier for this economy is billion. To close the output gap, government purchases could On the previous graph, shift the TE line to show the change in total expenditure necessary to close the output gap. Note: Select and drag the curve to the desired position. The curve will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther.arrow_forward17. Suppose MPC = 0.6, and G increases by $350 and Tax increases by $350 simultaneously. How much would GDP change? (NOTE: Refer to your answers from #14 & #15) 18. Suppose MPC = 0.8, and the government intends to increase GDP by $300. To achieve the goal, tax must (increase decrease ) by $arrow_forwardK The following equations describe consumption, investment, government spending, taxes, and net exports in the country of Economika. In Economika, equilibrium GDP is equal to $. (Round your asnwer the nearest dollar.) If real GDP in Economika is currently $4,850, which of the following is true? A. There will be an unplanned decrease in inventories, and real GDP will increase next period. OB. There will be an unplanned increase in inventories, and real GDP will increase next period. OC. There will be an unplanned decrease in inventories, and real GDP will decrease next period. O D. There will be an unplanned increase in inventories, and real GDP will decrease next period. OE. There will be no unplanned change in inventories, and real GDP will stay the same next period. C=200+0.80(Y-T) 1=400 G=350 T=350 X = 100arrow_forward

- How would I do D?arrow_forward4. Planned expenditure and income The following table shows consumption (C), investment spending (I), and government purchases (G), in a hypothetical economy for various levels of income. Also assume that there is an income tax rate of 25%, that base consumption is $100 billion, and that the MPC is 0.333, or 1/3. This economy is closed, with no international trade, therefore net exports are equal to zero and should not be considered. Use the given information to fill in disposable income, consumption, and planned expenditures in the following table. Income: Real Disposable (After Tax) Planned GDP Income C I, G Expenditures (Billions of (Billions of dollars) (Billions of (Billions of (Billions of (Billions of dollars) dollars) dollars) dollars) dollars) 100 50 150 100 50 150 200 50 150 300 50 150 400 50 150 500 50 150arrow_forward3. Many parts of the economy are related to one another. In particular, a decrease in spending in one area may have an impact somewhere else. Provide an example of this scenario. Economic theory tells us that "one person's spending is another person's income." What is meant by this phrase? Explain in your own words.arrow_forward

- Based on the chart in question 8.06, if investment rises from $120 to $130 and the price level is fixed. By how much will the equilibrium real GDP increase?arrow_forward4. Assume a closed economy in which disposable income starts at 1,000 and increases by 500; consumption starts at 1,100 and increases by 300; investment spending is 1,000 and government spending is 500. The MPC is 0.6, The multiplier is 2.5, and The consumption equation is C = 500 + 0.6DI Equilibrium GDP is? A 3,500 B 3,000 C 4,000 D 5,000arrow_forwardQUESTION 6 Refer to the table. If the full-employment real GDP is $100, the: Consumption (after taxes) $-20 Real GDP Government Purchases $15 Gross Investment Net Exports $0 $10 $+5 10 10 +5 15 40 20 10 +5 15 70 40 10 +5 15 60 80 100 inflationary expenditure gap is $30. 100 10 +5 15 130 10 +5 15 160 10 +5 15 inflationary expenditure gap is $10. recessionary expenditure gap is $30. recessionary expenditure gap is $10. O hyper recessionary expenditure gap is $100. O O O Carrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education