FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

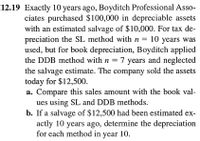

Transcribed Image Text:12.19 Exactly 10 years ago, Boyditch Professional Asso-

ciates purchased $100,000 in depreciable assets

with an estimated salvage of $10,000. For tax de-

preciation the SL method with n = 10 years was

used, but for book depreciation, Boyditch applied

the DDB method with n = 7 years and neglected

the salvage estimate. The company sold the assets

today for $12,500.

a. Compare this sales amount with the book val-

ues using SL and DDB methods.

b. If a salvage of $12,500 had been estimated ex-

actly 10 years ago, determine the depreciation

for each method in year 10.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Aa.2arrow_forwardd. The depreciation deduction for year 11 of an asset with a 20-year useful life is $3,600. If the salvage value of the asset was estimated to be zero and straight line depreciation was used to calculate the depreciation deduction for year 11, the initial cost of this asset is most closely equal to which of the following values? (a) $42,000 (b) $67,750 $72,500 (d) $80,000 e. Consider the following data extracted from an After Tax Cash Flow calculation. Before Tax Cash Flow = $22,500 Loan Principal Payment = $7,434 Loan Interest Payment = $892 MACRS Depreciation Deduction = $7,405 Taxes Due = $5,397 Which of the following is closest to the After Tax Cash Flow? (a) $1,372 $8,777 (c) $8,806 (d) $16,211arrow_forward2arrow_forward

- Please help me with this question: Holmes Packaging sold a machine for $49,500. The company bought this machine for $120,000 seven years ago and was depreciating it on a straight-line basis over ten years to a $12,000 salvage value. What is the gain (loss) that Holmes Packaging should report?arrow_forward2 Blue inc. Purchases and assets for $100,000. The asset has a useful life of ten years and no salvage value. In year 6, Blue inc. sold the assets for $60,000. What is the reported gain or loss for this transaction assuming straight-line depreciation. Gain Loss Gain 20,000arrow_forwardN6 A new machine tool is being purchased for $260,000 and is expected to have a $36,000 salvage value at the end of its 5-year useful life. Assume any remaining depreciation is claimed in the last year. Compute the depreciation schedules for this capital asset, using the following methods: (a) Straight-line depreciation (b) MACRS Note: No statement is required for this problem.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education