ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

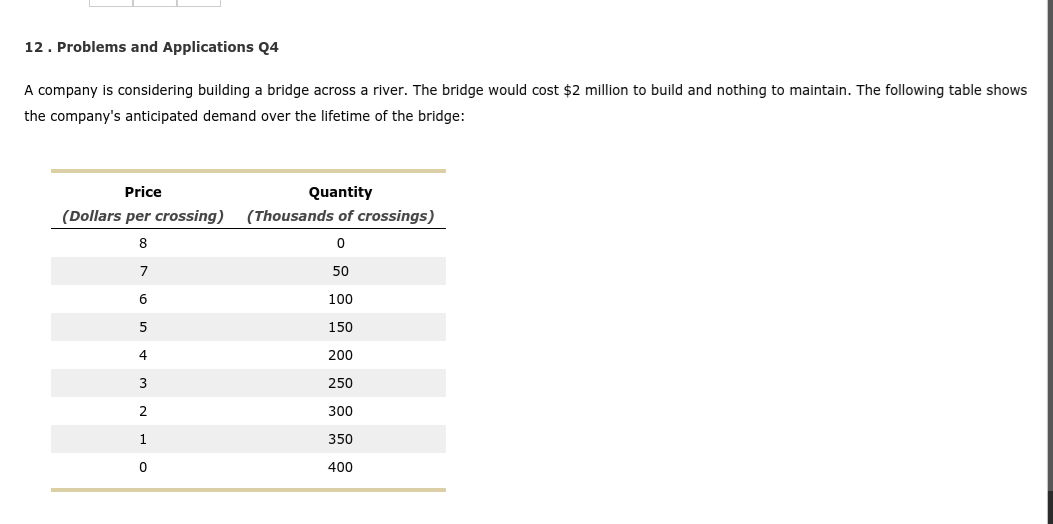

Transcribed Image Text:12. Problems and Applications Q4

A company is considering building a bridge across a river. The bridge would cost $2 million to build and nothing to maintain. The following table shows

the company's anticipated demand over the lifetime of the bridge:

Price

Quantity

(Dollars per crossing) (Thousands of crossings)

8

50

100

150

4

200

3

250

2.

300

350

400

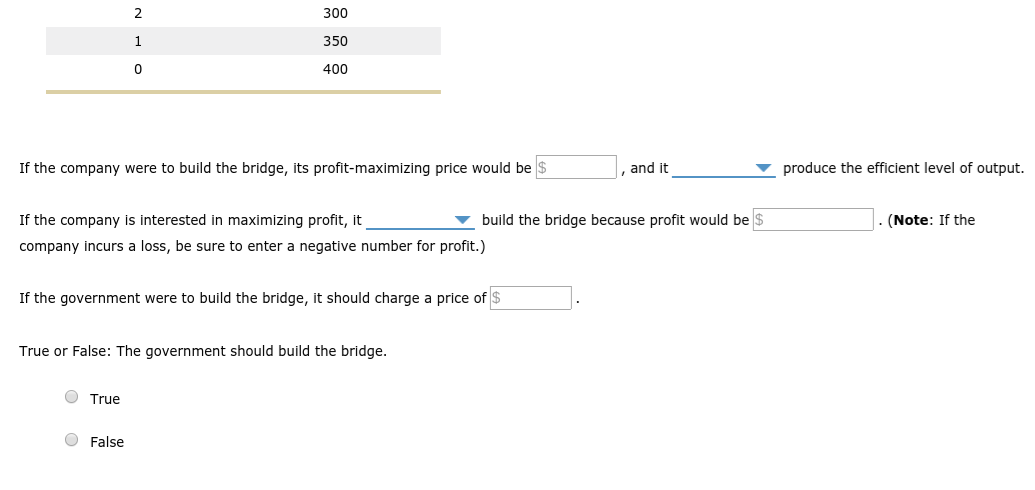

Transcribed Image Text:2

300

350

400

If the company were to build the bridge, its profit-maximizing price would be $

, and it

produce the efficient level of output.

If the company is interested in maximizing profit, it

build the bridge because profit would be $

(Note: If the

company incurs a loss, be sure to enter a negative number for profit.)

If the government were to build the bridge, it should charge a price of $

True or False: The government should build the bridge.

O True

O False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- 3arrow_forward21. Consider the market for jigsaw puzzles, which provide a delightful way to spend time indoors if you can't leave your home for some reason. a. How will a COVID-19 induced lockdown impact demand, equilibrium price and equilibrium quantity in the jigsaw puzzle market? For full points, explain any demand curve movers and/or shifters affected by the event, display these changes graphically, and analyze the new market equilibrium. b. Assume the event described above has taken place. Puzzle manufacturers expect that this new market demand will remain at its new level for the foreseeable future. Manufacturing companies that did not previously make puzzles noticed this change in demand, and re-allocated their resources to begin puzzle production. How will this event impact supply, equilibrium price, and equilibrium quantity in the jigsaw puzzle market? For full points, explain any supply curve movers and/or shifters affected by the event, display these changes graphically, and analyze the…arrow_forwardDo not use chatgpt.arrow_forward

- Question 4: a. The Best Computer Company just developed a new computer processor, on which it immediately acquires a patent. (i) Assuming that the production of the processor involves rising marginal cost, draw a diagram to illustrate Best Computer's profit-maximizing price and quantity. Also show Best Computer's profits. (ii) Now suppose that the government imposes a tax on each unit of the computer processor produced. On a new diagram, illustrate Best Computer's new price and quantity. How does each compare to your answer in part (i)? (iii) Draw a diagram that shows the consumer surplus, producer surplus and total surplus in the market for this new processor. iv) What happens to these three measures of surplus if the firm can perfectly price discriminate? What is the change in deadweight loss? What transfers occur?arrow_forward3. Assume inverse demand function for game console in an imaginary country is P=1200-4Q and the total cost function is TC=400+4Q². Government put $120 of specific tax on production. a. If the market is competitive what is the incidence of tax on consumer? b. If the market is monopolist what is the incidence of tax on consumer?arrow_forwardTitle Suppose that the fixed costs of 0.72 consist of an attributable fixed cost for good 1 of 0.12, an attributable cost of 0.12 for good 2, and a common fixed cost of 0.48. Are the Ramsey prices subsidy free? Description Suppose that there are two products. The demand function for good i is Qi = 1 − bi Pi where b1 = 1 and b2 = 0.5. There are no variable costs of production, but there is a common fixed cost equal to 0.72. (a) Show that the inverse demand curves are Pi = (1 − Qi )/bi . Using the inverse demand curves, show that consumer surplus in market i is CSi = Q2 i /(2bi ). (b) Let W = CS1(Q1) + CS2(Q2). Then iso-welfare contours are combinations of Q1 and Q2 that give the same level of W. Graph three iso-welfare contours in Q1, Q2 space. (c) Write the firm’s zero-profit constraint in terms of Q1 and Q2. Sketch the firm’s zero-profit constraint in Q1, Q2 space. (d) Using (b) and (c), graphically derive the quantities that maximize W subject to the firm breaking even.…arrow_forward

- Suppose that the government instituted a per-unit tax on the output of a monopoly firm. A. graph this situation? B. On the same graph show what would happen to the market equilibrium after implementation of such a tax? C. On the same graph how would you show which economic actor pays most of the tax? You are to not only draw the graph but also explain the answerarrow_forwardImagine a firm with a marginal abatement cost (MAC) function equal to: MAC = 25 - 5E. The government introduces a cap-and-trade policy and grandfathers the firm 2 permits initially. Assuming the market price of permits is $5, the firm will spend a total of $___ in order to buy permits.arrow_forward5. Given the input-output matrix: Education Education 40 Government 120 Final Demand 40 Government 120 90 90 Find the output matrix if the final demand changes to a) 200 for education, and 3000 for government b) 64 for education, and 64 for governmentarrow_forward

- Question 3 options: CBS is selling advertising for its broadcast of the AFC championship game. The station’s demand for minutes of commercial advertising time is the demand it faces from the companies to which it sells advertising time: PADS = 100,000 - 50Q. CBS has MC = $2000. Buyers pay CBS a price PCBS for each minute of advertising and add $1,000 for each ad to cover the tax they pay, so their MCADS= PCBS + 1000. No one has any fixed costs. The profit for CBS is (include dollar sign and any commas, no decimals)arrow_forwardSuppose Biwei is the only consumer in the apple market, why is his marginal use value equal to the apple price? Calculate his consumer surplus (net gain from consumption) and fill in the table. How many apples he would like to buy per week?arrow_forwardAlain Bertaud uses the example of Paris to explain how regulations can distort land prices. What is the regulation used in Paris and how did this impact the residential housing market in Paris?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education