FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

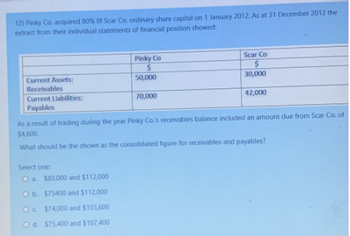

Transcribed Image Text:12) Pinky Co. acquired 80% of Scar Co. ordinary share capital on 1 January 2012. As at 31 December 2012 the

extract from their individual statements of financial position showed:

Current Assets:

Receivables

Current Liabilities:

Payables

Select one:

O a.

O b.

Oc.

O d.

Pinky Co

$

50,000

70,000

As a result of trading during the year Pinky Co.'s receivables balance included an amount due from Scar Co: of

$4,600.

What should be the shown as the consolidated figure for receivables and payables?

$80,000 and $112,000

$75400 and $112,000

$74,000 and $103,600

$75,400 and $107,400

Scar Co

$

30,000

42,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with all answers thankuh.arrow_forward(a) On 1 January 2023, the LW Group purchased 90% of the 3.75m £1 equity share capital of JL Ltd. The costs incurred by LW Group at the date of acquisition were as follows: Cash paid on 1 January 2023 Professional fees Bank fees and charges associated with the acquisition £'000 124,800 850 1,000 In addition to the costs shown above, LW issued 15,000,000 25p ordinary shares to the shareholders of JL Ltd as part of the consideration. As at 1 January 2023 the market value of LW shares were £1.50 each and JL Ltd shares were valued at £1.20 each. LW will also pay a further £5,000,000 in cash on 1 January 2024. An appropriate discount rate is 7%. A further 2,000,000 shares will be issued by LW to the shareholders of JL Ltd on 1 January 2024 if profits increase by 5% over the next 12 months. The directors believe there is a 60% likelihood of the contingent consideration being achieved and that the market value of LW shares are expected to rise to £1.80 each. A due diligence report indicates…arrow_forwardTQ2). Maisara Bhd (MB) purchased Jujur Sdn Bhd (JSB) on 1 January 2009. On the date of purchased the Retained Profits and General Reserve of ISB were as follows; Jujur Sdn Bhd (RM) Retained Profits General Reserve 100,000 100,000 The (RM) (RM) Maisara Bhd Jujur Sdn Bhd Share capital of RM1 each 300,000 100,000 Revaluation Reserve 50,000 100,000 Share premium 50,000 General reserve 110,000 120,000 Retained profits 200,000 100,000 Long-term loans 80,000 50,000 790,000 470,000 Property, plant & equipment, at NBV 540,000 370,000 Investments, at cost 80,000 shares in JSB, at cost 300,000 Current assets 150,000 200,000 Less: Current liabilities (200,000) (100,000) 790,000 470,000 (RM) (RM) Maisara Bhd Jujur Sdn Bhd Revenue 1,000,000 500,000 Operating expenses (850,000) (400,000) Profit from operations 150,000 100,000 Finance costs (10,000) (5,000) Dividends from subsidiaries 80,000 Profit before tax 220,000 95,000 Taxation (30,000) (15,000) Profit after tax 190,000 80,000 Retained profits…arrow_forward

- On 1 July 2014 Padma Ltd acquires 25 per cent of the issued capital of Jamuna Ltd for a cash consideration of $360 000. At the date of acquisition, the shareholders’ equity of Jamuna Ltd is:Share capital $450 000Retained earnings $300 000Total shareholders’ equity 750 000 Additional information• On the date of acquisition, buildings have a carrying amount in the accounts of Jamuna Ltd of $240 000 and a market value of $300 000. The buildings have an estimated useful life of 10 years after 1 July 2014.• For the year ending 30 June 2015 Jamuna Ltd records an after-tax profit of $90 000, from which it pays a dividend of $30 000.• For the year ending 30 June 2016 Jamuna Ltd records an after-tax profit of $300 000, from which it pays a dividend of $150 000.• Assume a tax rate of 30% is assumed Please answer: Apply equity method of accounting to:(a) Calculate the amount of goodwill at the date of acquisition (b) Prepare the journal entries for the year ending 30 June 2015 (c) Prepare the…arrow_forward1arrow_forwardLiabilities and assets of Dreamers Ltd. as on 31st March, 2016 stood as under : $ in Lakh Assets $ in Lakhs Liabilities Share Capital 10% Preference Shares of $ 100 each Fixed Assets 130 Investments 24 30 Current Assets 20 Equity Shares of $ 10 each General Reserve 60 36 12% Debentures 28 Current Liabilities 20 174 174 Performers Ltd. signified their agreement to takeover the assets and liabilities of Dreamers Ltd. as per the following terms and conditions : (i) Fixed assets at 90% of the book value. (ii) Investments at 10% above the par value. (iii) Current assets and liabilities at book value except that stock-in-trade at cost amounting to $10 lakh was agreed to be taken over at a discount of 20%. (iv) 12% Debentures are to be discharged at a premium of 15% by issuing 12% debentures of Performers Ltd. (v) Preference shareholders are to be discharged at a premium of 15% by issuing 10% preference shares of $100 each. (vi) Equity shareholders in Dreamers Ltd. are to be issued 5 equity…arrow_forward

- On 1 July 2015, Ausra purchased 75% of Danute by way of a share exchange oftwo new shares in Ausra for every three purchasedin Danute . Ausra's share price at the acquisition date was $4.70.] + Statement of Comprehensive Income for the year ended 31 December 2015 Ausra$ 000 120,000 Danute$ 000 Revernie 48,000 Cost of sales (84,000) (40,000) Gross profit Operating expenses Profit from operations 36,000 8,000 (11,900) (400) 7,600 24,100 Other income 300 Finance costs (1,200) Profit before tax 24,400 6,400 Income tax expense (6,000) 18,400 (1,200) 5,200 Profit for the year The following information is relevant 1JThe fair value of Danute's net assets differed from its carrying values at 1 July 2015. Plant was $8 million m excess of its net book value. Plant had 4 years remaiming at the date of acquisition. The group depreciation policy is to charge depreciation on a proportionate basis and should be included in cost of sales. No adjustment was made for this in Danute s fmancial statements.…arrow_forwardFAR5 - Chapter 7: Consolidated Statement of Financial Position Question 1 Dayang Berhad acquired 100% ordinary shares of Daia Berhad on 1st June 20XX. Below are the statements of financial position of Dayang Berhad and Daia Berhad. Machinery Plant, property and equipment Vehicles Inventories Account receivables Investment in Daia Berhad Account payables Long-term loans Ordinary shares Retained earnings Dayang Berhad (RM) 2,000,000 11,000,000 500,000 3,500,000 700,000 9,300,000 1,100,000 5,000,000 13,000,000 7,900,000 i. Calculate goodwill. ii. Record the relevant journal entries. iii. Prepare the consolidated statement of financial position. Daia Berhad (RM) 5,000,000 100,000 500,000 300,000 200,000 5,000,000 700,000arrow_forwardWhat is the net increase or (net decrease) in the identifiable assets of SD Corporation?a. 13,700,500b. 13,307,500c. 13,957,500d. 13,050,500arrow_forward

- A company repurchased 10,000 of its outstanding ordinary shares with par value 2$ for 6$ in 5/01/2024, at 31/01/2024 the company re-issued 5000 for 7.5, and in 28/02/2024 issued 4000 for 2.5 which recorded in the company books for: OA. debit retained earning for $6500 OB. debit premium treasury for 6500 OC. debit treasury shares for 10,000 OD. credit treasury premium for 7500arrow_forward9. Tiger acquired 20% share capital of Deer on 1 August 2021 at the cost of £5.5million. Tiger has classified Deer as an associate undertaking. For the year ended 31 October 2021, Deer has reported a net profit of £937,500. What is the value of the associate investment in the group statement of financial position of Tiger as at 31 October 2021? A. £5,546,875 B. £6,125,000 C. £5,968,750 D. £5,500,000 10. Hyperverse plc acquired 80% of the share capital of Lyca plc on 1/10/2018 for £340,600. The profit for the year ended 31/12/2018 for Lyca was £36,000. Profits are deemed to accrue evenly over the year. At 31/12/2018 the following extracts of the statement of financial position for Lyca has been provided: Equity share capital Retained earnings What is the goodwill on acquisition? A. £150,000 B. £184,650 C. £159,000 D. £177,000 £200,000 £180,000arrow_forward5. ABC Corp holds 1,000 shares of XYZ Corp.'s shares since 2010. The following are data available at Dec 31, 2020: Cost per share P3.00 Transaction cost per share (upon acquisition) P1 Most recent transaction price per share P2 Transaction cost per share (current) P.50 How much is the value of the investment at Dec 31, 2020? 2,000 2,500 3,000 4,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education