FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

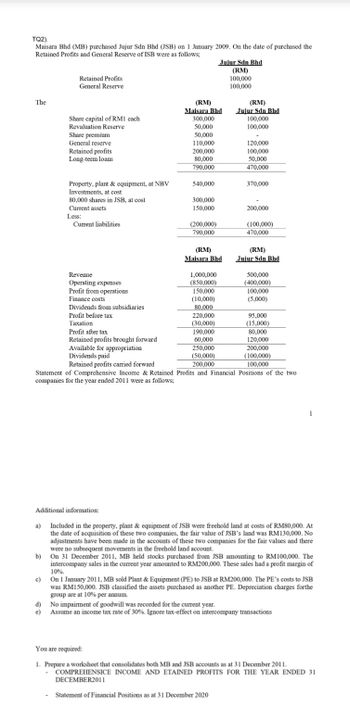

Transcribed Image Text:TQ2).

Maisara Bhd (MB) purchased Jujur Sdn Bhd (JSB) on 1 January 2009. On the date of purchased the

Retained Profits and General Reserve of ISB were as follows;

Jujur Sdn Bhd

(RM)

Retained Profits

General Reserve

100,000

100,000

The

(RM)

(RM)

Maisara Bhd

Jujur Sdn Bhd

Share capital of RM1 each

300,000

100,000

Revaluation Reserve

50,000

100,000

Share premium

50,000

General reserve

110,000

120,000

Retained profits

200,000

100,000

Long-term loans

80,000

50,000

790,000

470,000

Property, plant & equipment, at NBV

540,000

370,000

Investments, at cost

80,000 shares in JSB, at cost

300,000

Current assets

150,000

200,000

Less:

Current liabilities

(200,000)

(100,000)

790,000

470,000

(RM)

(RM)

Maisara Bhd

Jujur Sdn Bhd

Revenue

1,000,000

500,000

Operating expenses

(850,000)

(400,000)

Profit from operations

150,000

100,000

Finance costs

(10,000)

(5,000)

Dividends from subsidiaries

80,000

Profit before tax

220,000

95,000

Taxation

(30,000)

(15,000)

Profit after tax

190,000

80,000

Retained profits brought forward

60,000

120,000

Available for appropriation

250,000

200,000

Dividends paid

(50,000)

(100,000)

Retained profits carried forward

200,000

100,000

Statement of Comprehensive Income & Retained Profits and Financial Positions of the two

companies for the year ended 2011 were as follows;

Additional information:

a) Included in the property, plant & equipment of JSB were freehold land at costs of RM80,000. At

the date of acquisition of these two companies, the fair value of JSB's land was RM130,000. No

adjustments have been made in the accounts of these two companies for the fair values and there

were no subsequent movements in the freehold land account.

b) On 31 December 2011, MB held stocks purchased from JSB amounting to RM100,000. The

intercompany sales in the current year amounted to RM200,000. These sales had a profit margin of

10%.

c) On 1 January 2011, MB sold Plant & Equipment (PE) to JSB at RM200,000. The PE's costs to JSB

was RM150,000. JSB classified the assets purchased as another PE. Depreciation charges forthe

group are at 10% per annum.

d)

e)

No impairment of goodwill was recorded for the current year.

Assume an income tax rate of 30%. Ignore tax-effect on intercompany transactions

You are required:

1. Prepare a worksheet that consolidates both MB and JSB accounts as at 31 December 2011.

COMPREHENSICE INCOME AND ETAINED PROFITS FOR THE YEAR ENDED 31

DECEMBER2011

-

Statement of Financial Positions as at 31 December 2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Shohei Ltd owns 100% of Ohtani Ltd acquired on 1 July 2018 for $3 Million when the shareholders funds of Ohtani Ltd were: Share Capital 1,250,000 Retained Earnings 1,200,000 2,450,000 All assets of Ohtani Ltd were stated at fair value on the date of acquisition. (a) the directors believe that there has been an impairment loss on goodwill of $100,000 for the year ended 30 June 2021 (b) During the 2020-21 financial year Shohei Ltd sells inventory to Ohtani Ltd at a sales price of $800,000. The inventory cost Shohei Ltd $400,000 to produce. At 30 June 2021, 30% of the inventory is still on hand with Ohtani Ltd. The tax rate is 30% Record the consolidation entries for 30 June 2021arrow_forwardThe summarized statements of financial position of PT ABC and PT DEF as of December 31, 2018 are provided below. If PT ABC acquired a 30% interest in PT DEF on December 31, 2018 for Rp225.000 and the equity method of accounting for the investment were used, the amount of the debit to Equity Investments would have been ?arrow_forward.Miner Ltd acquired 75% of the share capital of Iver Ltd (Iver) for £1.2m three years ago, when Iver 's net assets were £1.4m. As at 31 August 2020, Iver has net assets of £1.75m.What figures would be included in the consolidated Statement of FinancialPosition as at 31 August 2020 for the Miner Group to reflect the ownership of Iver Ltd?a) Goodwill £200,000Non-controlling interest £1,312,500b) Goodwill £150,000Non-controlling interest £437,500c) Goodwill £150,000Non-controlling interest £1,312,500d) Goodwill £200,000Non-controlling interest £437,500 Show workingarrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education