ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:10:55

All iCloud

December 2, 2019 at 10:55 AM

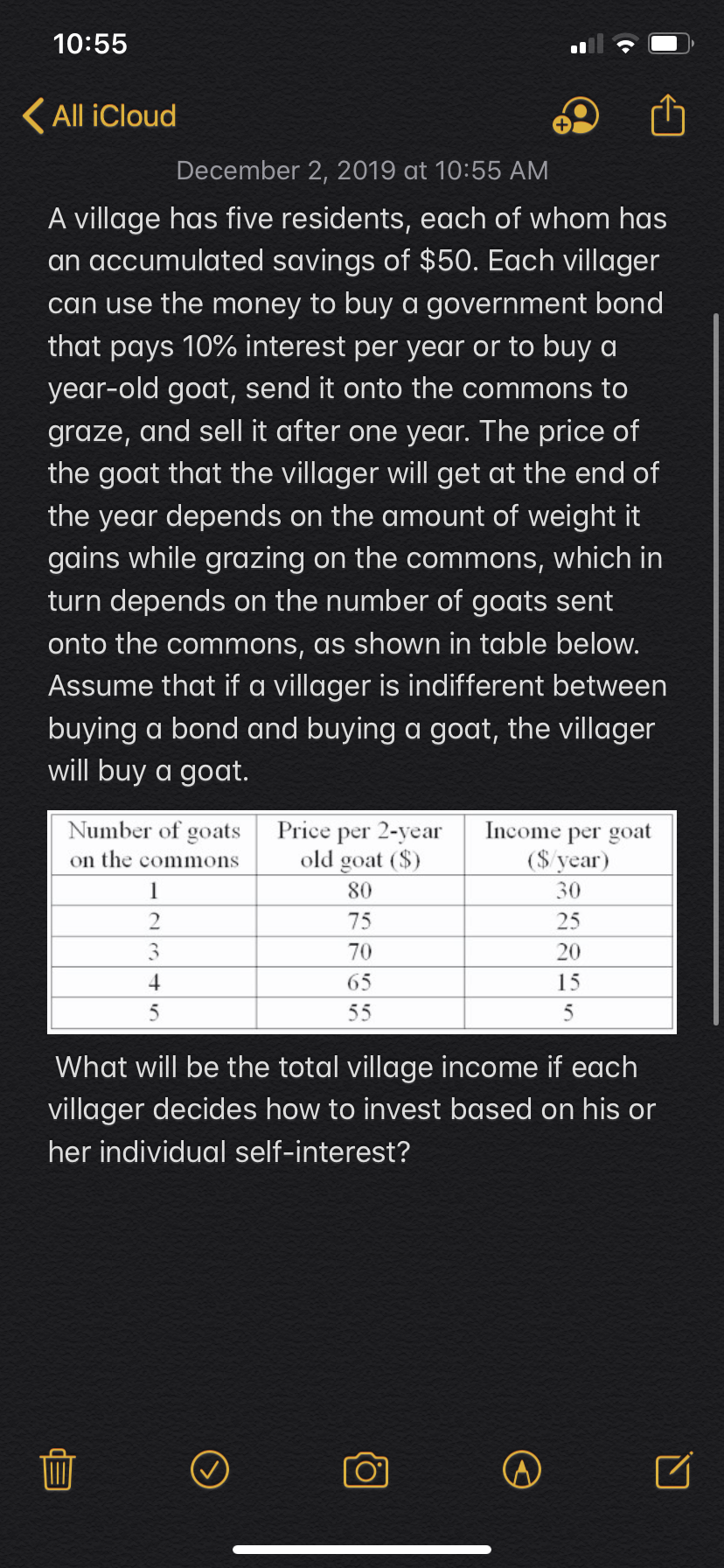

A village has five residents, each of whom has

an accumulated savings of $50. Each villager

can use the money to buy a government bond

that pays 10% interest per year or to buy a

year-old goat, send it onto the commons to

graze, and sell it after one year. The price of

the goat that the villager will get at the end of

the year depends on the amount of weight it

gains while grazing on the commons, which in

turn depends on the number of goats sent

onto the commons, as shown in table below.

Assume that if a villager is indifferent between

buying a bond and buying a goat, the villager

will buy a goat.

Number of goats

Income per goat

($vear

Price per 2-year

old goat (S)

on the commons

80

30

1

2

75

25

3

70

20

65

15

5

55

5

What will be the total village income if each

villager decides how to invest based on his or

her individual self-interest?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Mary is a corn farmer in Iowa. If she does not irrigate her field, she can produce 120 bushels of corn per acre. If she applies 4 inches of irrigation water, she can produce 140 bushels of corn per acre. The application of 8, 12, and 16 inches of irrigation water can result in 160, 180, and 200 bushels of corn per acre, respectively. Graph the relationship between the amount of water applied and corn yield for Mary. What is the slope?arrow_forwardIncorrect Question 9 The ability of forests to reduce soil erosion is an example of what type of economic value? Ecosystem service value Intrinsic value O Nonuse value Contingent value Revealed valuearrow_forwardNote: don't use chat gpt.arrow_forward

- 6arrow_forwardAntonio and Caroline are farmers. Each one owns a 20-acre plot of land. The following table shows the amount of alfalfa and barley each farmer can produce per year on a given acre. Each farmer chooses whether to devote all acres to producing alfalfa or barley or to produce alfalfa on some of the land and barley on the rest. Alfalfa Barley (Bushels per acre) (Bushels per acre) Antonio 40 8 Caroline 28 7 ___________has an absolute advantage in the production of alfalfa, and __________ has an absolute advantage in the production of barley. Antonio's opportunity cost of producing 1 bushel of barley is ____ bushels of alfalfa, whereas Caroline's opportunity cost of producing 1 bushel of barley is______ bushels of alfalfa. Because Antonio has a ______ opportunity cost of producing barley than Caroline,________ has a comparative advantage in the production of barley and_______ has a comparative advantage in the production of alfalfa.arrow_forwardQuestion 7 A project involves an immediate expenditure of $2 000, and will require additional expenditures of $150 a year for the next ten years, starting one year from now. After ten years it yields an income of $8 000, but a year later a further expenditure of $1 000 will be required to close down the project. What is its rate of return? 9% 10% 11% 12% 13% Savearrow_forward

- Mary is a corn farmer in Iowa. If she does not irrigate his field, she can produce 120 bushels of corn per acre. If she applies 4 inches of irrigation water, she can produce 140 bushels of corn per acre. The application of 8, 12, and 16 inches of irrigation water can result in 160, 180, and 200 bushels of corn per acre, respectively. Graph the relationship between the amount of water applied and corn yield for Mary (Assume a straight-line relationship). Find and interpret the slope and Y interceptarrow_forward6. A few months later, Mary is sick again but decides that she cannot afford to go to the doctor this time. Unfortunately, her condition worsens. She is hospitalized for two days and misses eight days of work. Her hospital stay, including medications, costs $2,500. How much does this hospital visit cost Mary (including deductible, co-pay, her 20% share of the cost, and missed work days)?arrow_forwardPleas help with parts D and Earrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education