ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Pleas help with parts D and E

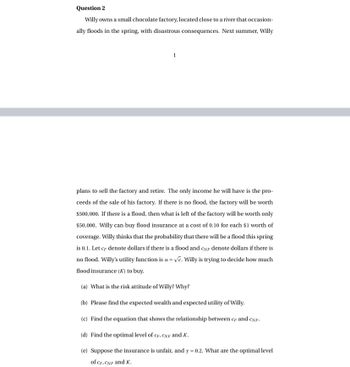

Transcribed Image Text:Question 2

Willy owns a small chocolate factory, located close to a river that occasion-

ally floods in the spring, with disastrous consequences. Next summer, Willy

1

plans to sell the factory and retire. The only income he will have is the pro-

ceeds of the sale of his factory. If there is no flood, the factory will be worth

$500,000. If there is a flood, then what is left of the factory will be worth only

$50,000. Willy can buy flood insurance at a cost of 0.10 for each $1 worth of

coverage. Willy thinks that the probability that there will be a flood this spring

is 0.1. Let cF denote dollars if there is a flood and CNF denote dollars if there is

no flood. Willy's utility function is u = √e. Willy is trying to decide how much

flood insurance (K) to buy.

(a) What is the risk attitude of Willy? Why?

(b) Please find the expected wealth and expected utility of Willy.

(c) Find the equation that shows the relationship between cF and CNF.

(d) Find the optimal level of CF, CNF and K.

(e) Suppose the insurance is unfair, and y = 0.2. What are the optimal level

of CF, CNF and K.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Fill in the blanksarrow_forwardJudging types O Miss deadlines Take a long time to make decisions Are judgmental people Come through with their decisions at the last minute O Are all about their schedule and making decision upfrontarrow_forwardSasha and Brian just bought their new home, a high-rise condo located downtown. They measured the main wall where they would like to put their couch and found that it won't fit. Seems like the couple may need new furniture. Sasha and Brian are in which stage of the consumer decision making process? Need recognition Information search Evaluation of alternative Post purchase behaviourarrow_forward

- High quality information gruarantees that every decisions made will be a successful one that benefits the organizationarrow_forwardTrying to figure out?arrow_forwardWhy do people share content via social media channels? They find it interesting and/or entertaining. They think it can be helpful to others. They want to get a laugh. A & B Only. All of these.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education