Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:S

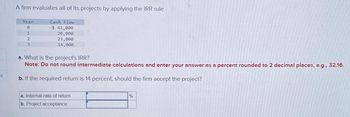

A firm evaluates all of its projects by applying the IRR rule.

Year

0

1

2

3

Cash Flow

-$ 41,000

20,000

23,000

14,000

a. What is the project's IRR?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

b. If the required return is 14 percent, should the firm accept the project?

a. Internal rate of return

b. Project acceptance

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- an.3 answer must be in proper format or i will give down votearrow_forwardDyer Furniture is expected to pay a dividend of D1 = $1.25 per share at the end of the year and that dividend is expected to grow at a constant rate of 6.00% per year in the future. The company's beta is 1.15. the market risk premium is 5.50%, and the risk-free rate is 4.00% What is Dyer's current stock price? a. $28.90 b. $29.62 C. $31.12 d. $30.36 e. $31.90arrow_forwardHelp pleasearrow_forward

- Kara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Assume the company has the following two projects available. Year Cash Flow (A) 0 -$56,000 1 2 3 4 22,500 29,600 24,500 10,500 Cash Flow (B) -$ 101,000 a. Project A Project B b. Project acceptance 24,500 29,500 29,500 239,000 a. What is the payback period for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. Which, if either, of the projects should the company accept? years yearsarrow_forwardConsider a project lasting one year only. The initial outlay is $1,000 and the expected inflow is $1,290. The opportunity cost of capital is r = 0.29. The borrowing rate is rD calculations. Round your answers to 2 decimal places. Leave no cells blank - be certain to enter "O" wherever required.) 0.21. (Do not round intermediate 0.08, and the tax shield per dollar of interest is Tc a. What is the project's base-case NPV? Base-case NPV b. What is its APV if the firm borrows 39% of the project's required investment? Adjusted present valuearrow_forwardNikul Don't upload image pleasearrow_forward

- How I resolve this problems please give me the detail A firm has the following investment alternatives: Year A B C 1 $400 $--- $---- 2 400 400 ---- 3 400 800 ---- 4 400 800 1,800 Each investment cost of capital is 10 percent a. What is each investment's internal rate of return? b. Should the firm make any of theses investment? C. What is each investemtn's net present value? d. Should the firm make any of these investmentarrow_forwardMansukhbhaiarrow_forwardManshukharrow_forward

- Please do not give solution in image format thankuarrow_forward1. Kara, Incorporated, imposes a payback cutoff of three international investment projects. Year Cash Flow (A)Cash Flow (B) -$ 73,000 0 1 2 3 4 $63,000 24,500 31,000 22,500 9,500 16,500 19,500 29,000 233,000 What is the payback period for both projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) What is the payback period for both projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardanswer need..arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education