Question

None

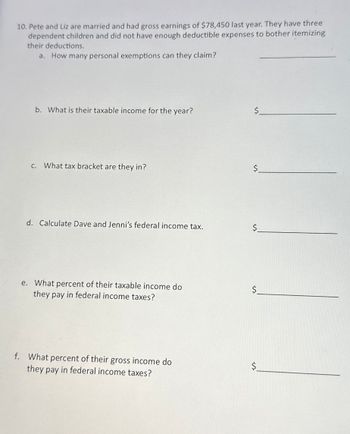

Transcribed Image Text:10. Pete and Liz are married and had gross earnings of $78,450 last year. They have three

dependent children and did not have enough deductible expenses to bother itemizing

their deductions.

a. How many personal exemptions can they claim?

b. What is their taxable income for the year?

$

c. What tax bracket are they in?

$

d. Calculate Dave and Jenni's federal income tax.

$

e. What percent of their taxable income do

they pay in federal income taxes?

$

f. What percent of their gross income do

they pay in federal income taxes?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 4 points QUESTION 14 What is a risk that a CMBS investor faces that an agency MBS investor avoids? A. Default risk OB. Prepayment risk OC. Interest rate risk D. Inflation riskarrow_forwardQuestion 3: Jerry has preferences over cats, c, and hats, h, that can be described by u(c, h) = min{2c, 2h}. Sketch the following curves (where pertinent, put c on the horizontal axis and h on the vertical axis): (1) Jerry's price consumption curve as the price of cats p. changes. (2) Jerry's demand curve for cats. (3) Jerry's income consumption curve. (4) Jerry's Engel curve for cats and Jerry's Engel curve for hats.arrow_forwardQuestion 5 Catherine purchased a segregated fund 12 years ago with a 10-year maturity and death benefit guarantee. She has conducted no transactions since then, and when she looks at her annual statement, she realizes that the market value of her fund is higher than the guarantee. She starts checking her annual statements of previous years and realizes for the first time that the market value in the 10th year was below the guarantee to which she was entitled. Is Catherine entitled to the guarantee top-up for the 10th year of the contract? a) Yes, it was automatically deposited in her account b) Yes, but it will be paid only on expiration of the contract c) No, because it's too late to claim d) No, there was no disposition to this effect.arrow_forward

- K Kamal Fatehl production manager of Kennesaw Manufacturing, finds his profit at $30,800 (as shown in the statement below) inadequate for expanding his business. The bank is insisting on an improved profit picture prior to approval of a loan for some new equipment. Kamal would like to improve profit line to $40,800 so he can obtain the bank's approval for the loan. Sales Cost of supply chain purchases Other production costs Fixed costs Profit 280,000 182,000 39,200 28,000 30,800 % of sales 100% 65% 14% 10% 11% a) What percentage improvement is needed in a supply chain strategy for profit to improve to $40,800? What is the cost of material with a $40,800 profit? A decrease of 5.5% in supply-chain costs is required to yield a profit of $40,800, for a new cost of supply chain purchases of $172,000. (Enter your response for the percentage decrease to one decimal place and enter your response for the new supply chain cost as a whole number.) b) What percentage improvement is needed in a…arrow_forwardchapter 3 2. Given this information, what is the profit dollars? Round your answer to the dollar and add a dollar sign and comma separator (i.e. $15,467) Net Sales $561,800 Cost of Goods Sold 275,280 Expenses 253,936arrow_forwardQuestion 3 The Canadian government usually runs A surplus An export surplus O A deficit A debtarrow_forward

- 1. Explain (2) possible risks of working at a fuel supply plant 2. Explain The important of training for those working at a fuel supply plant.arrow_forwardExplainarrow_forwardQ1. Dallas Mavericks’ owner Mark Cuban proved his business intelligence once again with the acquisition of star player Kristaps Porzingis. To benefit from this blockbuster trade even further, Cuban plans to sell one-time-only special edition Porzingis jerseys at a price of $380 each during the first month of the season (i.e., during October 2019 only). The production cost for each of these jerseys would be $100 thanks to their golden details, and any unsold jersey during October will be sold for $80 during November 2019. Knowing the fan base for years, Cuban estimates demand for these special edition jerseys to follow a normal distribution with a mean of 10,000 units and a standard deviation of 2,000. partc. Cuban also plans to sell these special edition jerseys in his vacation resort. Knowing that people are wealthier in the resort, he sets a price of $500 for each jersey (although production cost stays the same). This time however, he cannot sell any unsold jerseys outside the…arrow_forward

- Corporations are small percentage: however they earn the most revenue among U.S. busnessesarrow_forwardME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10 Cost…arrow_forward

arrow_back_ios

arrow_forward_ios