ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

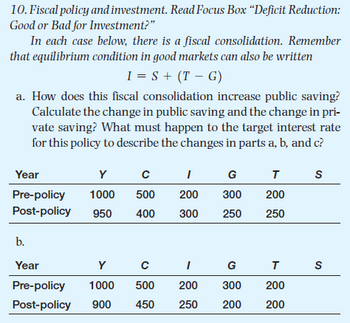

Transcribed Image Text:10. Fiscal policy and investment. Read Focus Box "Deficit Reduction:

Good or Bad for Investment?"

In each case below, there is a fiscal consolidation. Remember

that equilibrium condition in good markets can also be written

I = S + (TG)

a. How does this fiscal consolidation increase public saving?

Calculate the change in public saving and the change in pri-

vate saving? What must happen to the target interest rate

for this policy to describe the changes in parts a, b, and c?

Year

Y

C

I

Pre-policy 1000

500

200

300

Post-policy 950 400 300 250

GT S

-

b.

Year

Y

с

G

Pre-policy 1000

500

200

300

Post-policy 900 450 250 200

200

250

T S

200

200

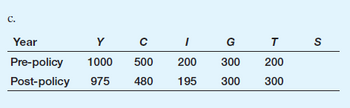

Transcribed Image Text:C.

Year

Y

C

I

Pre-policy 1000

500

200

Post-policy 975 480 195

G

300

300

T

200

300

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 60 Suppose the government, in an effort to avoid an increase in the deficit, votes for a budget neutral tax cut policy. Assume the marginal propensity to consume (MPC) is equal to 0.85 and taxes are cut by $8 billion. Round answers to the nearest billion, and specify decreases as a negative number. By how much will government spending change? change in government spending: $ What is the resulting change in the equilibrium level of real GDP? change in equilibrium level of real GDP: $ billionarrow_forwardThe program has provoked a lot of political discussions. Which of the following statementsare correct (assuming a closed economy)? 1. The higher the marginal propensity to consume, the lower will be investment multiplier.2. A reduction of the tax rate lowers the fiscal policy multiplier.3. The higher the marginal propensity to consume, the more consumption can be induced bymore government spending, and this will lead to a higher fiscal policy multiplier.4. When fiscal policy is not able to compensate fully for other demand reductions, anexpansionary monetary policy can be helpful to overcome a recession more quickly.5. An expansionary monetary policy by the ECB in combination with a fiscal expansion willalways lead to inflation.6. Only a consequent fiscal consolidation will help the economy out of a recession.7. In the liquidity trap there is no crowding-out effect to be expected.8. It is best to conduct fiscal consolidation when the economy is in a boom.arrow_forwardExpansionary fiscal policy include Select one: O a. an increase in net taxes O b. an increase in government spending O c. a decrease in government spendingarrow_forward

- In the first quarter 2020, the unemployment rate in the Gaza Strip reached to 69% due to COVID 19. If the Palestinian government decided to solve this problem by an expansionary fiscal policy. Explain the impacts of this policy on the interest rate and aggregate output? Using graph?arrow_forwardG= Government spending Tax revenues Real GDP $160 $100 $500 $160 $120 $600 $160 $140 $700 $160 $160 $800 $160 $180 $900 a) If GDP is $600, while full-employment GDP is $700, how large is the current budget deficit? How large is the structural budget deficit? b) Is Averna's current fiscal policy expansionary or contractionary? How can you tell? What would you expect to happen to GDP over the long run?arrow_forward07. What factors make an expansionary "stimulus" fiscal policy effective? One answer a) A government budget deficit associated with fiscal stimulus should should borrow money from those who spend less and save more, to those who spend more and save less. b) A permanent decrease in taxes is more effective in stimulating spending than a temporary one c) An increase in government purchases of goods and services should be temporary and should not permanently displace private spending d) The most expansionary way of financing the budget deficit associated with a fiscal stimulus policy is by the central bank expanding the quantity of money in circulation. e) Infrastructure investment belongs with long-term growth policy, but invariably makes a poor element in stimulus policy because such investment normally take a long time to implement. f) All the abovearrow_forward

- 3. Explain how expansionary fiscal policy can close a recessionary gap using an appropriate diagram. Note: Use the following terms. They are: Long-run aggregate supply curve (LRAS). short-run aggregate supply curve (SRAS), Aggregate demand (AD). Real GDP price level. potential GDP, etc.arrow_forwardAssume an economy where the government embarks on an expansionary fiscal policy, explain the effect on equilibrium and interest rate if: a. There is a crowding out of the Private sector. b. The initial expansionary fiscal Policy was accompanied by an increase in money supply Explain both scenarios with the aid of diagramsarrow_forwardThe overall effects of contractionary fiscal policy are a __________ in income, _________ in money demand, ____________ in the interest rate and a ________ in investment. a decrease, decrease, increase, decrease. b decrease, decrease, decrease, increase. c decrease, decrease, decrease, decrease. d none of the listed options. e decrease, increase, decrease, increase.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education