ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

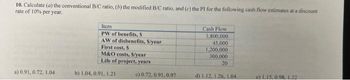

Transcribed Image Text:10. Calculate (a) the conventional B/C ratio, (b) the modified B/C ratio, and (c) the PI for the following cash flow estimates at a discount

rate of 10% per year.

a) 0.91, 0.72, 1.04

Item

PW of benefits, S

AW of disbenefits, S/year

First cost, S

M&O costs, S/year

Life of project, years

b) 1.04, 0.91, 1.21

c) 0.72, 0.91, 0.97

Cash Flow

3,800,000

45,000

1,200,000

300,000

20

d) 1.12, 1.26, 1.04

e) 1.15,0.98. 1.32

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The B/C ratio for a mosquito control program proposed by the Harris County Department of Health is reported to be 2.1. The person who prepared the report stated that the annual health benefits were estimated to be $400,000, and that disbenefits of $25,000 per year were used in the calculation. He also stated that the costs for chemicals, machinery, maintenance, and labor were estimated at $150,000 per year, but he forgot to list the cost for initiating the program (trucks, pumps, tanks, etc.). If the initial cost was amortized over a 10-year period at 8% per year, what is the estimated initial cost?arrow_forwardLocations under consideration for a border patrol station have their costs estimated by the federal government. Use the B/C ratio method at an Interest rate of 9.00% per year to determine which location to select, if any. (Round the final answer to three decimal places.) Location Initial Cost, $ Annual Cost, $ per Year Disbenefits, $ per Year Life, Years The AB/C ratio is -928888.889 ✪ Select location. N North N 1,360,000 480,000 70,000 South S 2,900,000 400,000 45,000 0arrow_forwardThe following data is provided for a PPP project. To the People To the Government Benefits $145,000 per year beginning now Cost $1.8 million now and $200,000 every 3 years Disbenefits $25,000 per year Savings $105,000 per year Calculate the conventional benefit/cost ratios using an interest rate of 9% per year and an infinite project period.arrow_forward

- ! Required information An airport Baggage Handing Department has evaluated two proposals for baggage delivery conveyor systems. A present worth analysis at i = 15% per year of estimated revenues and costs resulted in PWA = $460,000 and PWB = $395,000. In addition to this economic measure, three more attributes were independently assigned a relative importance score from 0 to 100 by the department manager and a senior team supervisor. Importance Scores Manager 45 Attribute Economics Durability Safety Maintainability 35 30 20 Attribute Economics Durability Safety Maintainability Separately, you have used the four attributes to value rate the two proposals on a scale of 0 to 1.0 as shown in the following table. (The economic attribute was rated using the PW values.) Value Rating Proposal A 1.00 0.35 1.00 0.25 Importance Scores Supervisor 40 35 Select the better proposal using the following method. Weighted evaluation of the department manager's method. The value of R; for A is The value…arrow_forwardI submitted the following question already once and recieved a response from an expert that it was incomplete. This is not true as it is straight out of the book. Please review the question again. Question: Use the B/C method to compare four mutually exclusive alternatives for recycling plastic bottles. Make any additional calculations necessary to determine which alternative should be selected.arrow_forwardA shopping center is to be built in one of four different cities. The cash flow estimates associated with each alternative are given below. You will be using the conventional B/C ratio method to determine which city should be selected at an interest rate of 15% per year. One alternative must be selected. The following table shows the details of each alternative. Alternative Benefits, s/year Disbenefits, $/year ERR City1 95 12 8 170 City2 Life, years First cost, $ M&O costs, $/year Please find the following - B/C of City1 ✓ Incremental B/C of City1 vs. City3 30 110 55 12 210 30 City3 90 12 8 160 30 City4 105 15 10 180 25 Based on the incremental B/C analysis applied to all four cities, choose one city among the four cities. A. 1.22 B. City3 C. 0.00 D. City2 E. 2.50 F. 1.00 G.1.19 H.City4 1. City1 J. 2.24 K. 1.48arrow_forward

- The federal government is considering three sites in the National Wildlife Preserve for mineral extraction. The cash flows (in millions) associated with each site are given below. Use the B/C method to determine which site, if any, is best, if the extraction period is limited to 5 years and the interest rate is 10% per year. Site A Initial cost, $ Annual cost, $/year Annual benefits, $/year Annual disbenefits, $/year 50 3 20 0.5 Site B 90 4 29 1.5 Site C 200 6 61 2.1arrow_forwardCalculate the conventional B/C ratio for the following cash flow estimates at a discount rate of 10% per year. Is the project justified? Item Estimate PW of Benefits, $ AW of Disbenefits, $/year PW Cost, $ Life, Years 4,150,000 45,000 1,325,000 20arrow_forwardA consultant, after 3 months of work, reported that the modified B/C ratio for a city-owned hospital heliport project is 2. If the initial cost is $2.1 million and the annual benefits are $165,000, what is the amount of the annual M&O costs used in the calculation? The report stated that a discount rate of 5% per year and an estimated life of 40 years were used. The M&O cost is $arrow_forward

- The estimated annual cash flows for a proposed municipal government project are costs of $750,000 per year, benefits of $950,000 per year, and disbenefits of $200,000 per year. Calculate the conventional B/C ratio at an interest rate of 10% per year, and determine if it is economically justified. The B/C ratio is The project is economically justifiedarrow_forwardIdentify the following funding sources as primarily public or private. (a) Municipal bonds (b) Retained earnings (c) Sales taxes (d) Automobile license fees (e) Bank loans ( f ) Savings accounts (g) An engineer’s IRA (Individual Retirement Account) (h) State fishing license revenues (i) Entrance fees to Tokyo Disneyland ( j) State park entrance feesarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education