Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Good day! I need your help tutor please answer the question attached below. The answer is already provided, which means that will be your basis if your answers are correct or not.

Ps. In your solution, you identify the given and the what is being asked in the problem and I want to see the formula that you used and box your final answer. Don't give me a solution that is made in ms excel, I am not econ major so i'm asking for you to do the manual or the traditional computation.Lastly, don't give me a shortcut solution because i want to learn and study your computation :)

Pps. I want you to use the Present Worth Method,

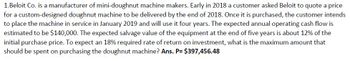

Transcribed Image Text:1.Beloit Co. is a manufacturer of mini-doughnut machine makers. Early in 2018 a customer asked Beloit to quote a price

for a custom-designed doughnut machine to be delivered by the end of 2018. Once it is purchased, the customer intends

to place the machine in service in January 2019 and will use it four years. The expected annual operating cash flow is

estimated to be $140,000. The expected salvage value of the equipment at the end of five years is about 12% of the

initial purchase price. To expect an 18% required rate of return on investment, what is the maximum amount that

should be spent on purchasing the doughnut machine? Ans. P= $397,456.48

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- For this intro accounting class, Are there any study tips you have used in this class and past classes that were particularly effective? Are there any habits you have used in prior courses that made you more successful? Provide a habit you found that you have not used before, that you think might help you in your classes?arrow_forwardYour friends were excited to hear you have chosen accounting for a career. They have several practical questions regarding money and interest (time value of money). Please assist your friends by answering their respective questions. For each question: Estimate without using a table, calculator, etc. Document the “step-by-step” detail showing them how you solved the question. NOTE: To solve use one of the following: EXCEL Include all the detail steps for whichever tool you choose. For example, if using EXCEL show all formulas (copy so reader could duplicate your work). If using a business calculator, in detail in proper order show numbers and buttons you input to obtain your answer. Provide a one to three sentence written explanation to your friend explaining the basic time value of money concept(s) impacting the solution. Problems start with “Friend #1” at the top of page 2.arrow_forwardOn Tuesday we had a quest speaker discuss his undergradaute experience and career path. Can you identify what Zach Hudson majored in while at Kennasaw State University? Business Administration English Math O Economicsarrow_forward

- Studying for my test and I need help with this question because I really don’t understand it. Please help me to solve it so I can understand it and be ready for the test. It will help a lot. Thank youarrow_forwardNeed help with Part 1 and 2 please.arrow_forwardRecommended Implementation Process Please do the following: Introduce yourself to your peers by sharing something unique about your background. Explain how you expect this course will help you move forward in your current or future career. Use the Internet or Strayer University Library databases and Internet, to select and review a firm that has multiple lines of businesses. For example, review the FedEx Corporation to see how it is a multiple-line business organization. You reviewed the FedEx Corporation's 2019 annual report and focused on the detailed accounting information. In this week's reading, Lin demonstrates that successful implementation of the shipping company's financial accounting information management systems must go through three steps; implementation of management system module; implementation of financial accounting function; and implementation of management accounting function. Review the recommended implementation suggested by Lin in Design and Implementation of…arrow_forward

- Instructions: 1. Make a double-entry journal about the different ethical principles. Write at least three ethical principles you like the most and your own ethical thoughts/ examples about them. Ethical Principles you like the most Your own ethical thought/descriptions about it. 2. Write your answer- own ethical thought in not less than 100 words per item. answer both question, thanks.arrow_forwardPlease explain why it is critically important for you to identify sources of information in both academic and business environments. Provide examples of possible consequences (both environments) when sources of information are not identified. (Minimum 200 words)arrow_forwardFor the next problem, I am going to explain a scenario and you need to state True OR False. You will then need a written rationale explaining your choice. Be sure to be specific in rationalizing your answer. You must use your own words. It is a good idea to provide a solved example to reinforce your point. To receive full credit, be sure to give a thorough explanation of why this statement is true or false (approximately 50 words). Michael decided that investing at a higher interest rate for 7 years is a better choice for his $7,500 investment (he got for his birthday). The company he chose offered 3.5% monthly, and the other company offered 3.425% continuously. Michael chose the better option! You will need to submit your work on this problem, giving a detailed explanation of WHY and how much more the better option will produce. O True O Falsearrow_forward

- can you help me on how to do my assignment?arrow_forwardnot use ai pleasearrow_forwardGood afternoon, I emailed you yesterday inquiring about missing solution on problem 14-1A in Financial and Managerial accounting book. I purchased the solution version and while working on my homework I realized that the second part on the problem I am working on is missing the solution. I am attaching complete instructions and the part where I am stuck. Would you, please, help me figure it out? Thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education