FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

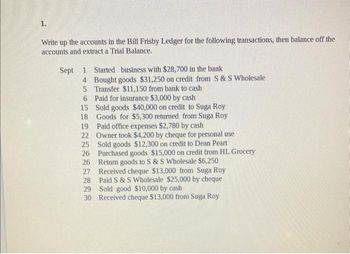

Transcribed Image Text:1.

Write up the accounts in the Bill Frisby Ledger for the following transactions, then balance off the

accounts and extract a Trial Balance.

Sept 1 Started business with $28,700 in the bank

4

5

Bought goods $31,250 on credit from S & S Wholesale

Transfer $11,150 from bank to cash

6 Paid for insurance $3,000 by cash

15

Sold goods $40,000 on credit to Suga Roy

Goods for $5,300 return from Suga Roy

18

19 Paid office expenses $2,780 by cash

22 Owner took $4,200 by cheque for personal use

25 Sold goods $12,300 on credit to Dean Peart

26 Purchased goods $15,000 on credit from HL Grocery

26 Return goods to S & S Wholesale $6,250

27

28

Received cheque $13,000 from Suga Roy

Paid S & S Wholesale $25,000 by cheque

Sold good $10,000 by cash

29

30 Received cheque $13,000 from Suga Roy

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- After posting the July 15 journal entry below to the cash account in the ledger, what would the updated balance in the cash account--the dollar amount on the debit or credit side? (Note: The company had a beginning debit balance of $50,000 on July 1 that should be included.) JOURNAL page 2 DATE DESCRIPTION POST. REF. DEBIT CREDIT 7/15/18 Cash $12,000 Fees Earned $12,000 GENERAL LEDGER ACCOUNT TITLE CASH ACCOUNT NO. 11 DATE ITEM PREF. DEBIT CREDIT DEBIT BALANCE CREDIT BALANCE 7/01/18 Balance $50,000 7/15/18 12,000 ? or ? Group of answer choices $12,000 credit balance $62,000 debit balance $12,000 debit balance $62,000 credit balancearrow_forwardHarrow_forwardThe bank statement for Jeffrey Co. indicates a balance of $8,785 on October 31. After the journals for October had been posted, the cash account had a balance of $8,998. a. Cash sales of $945 had been erroneously recorded in the cash receipts journal as $495. b. Deposits in transit not recorded by bank, $778. c. Bank debit memo for service charges, $40. d. Bank credit memo for note collected by bank, $23,985 plus $885 interest. e. Bank debit memo for $756 NSF (not sufficient funds) check from Calin Sams, a customer. f. Checks outstanding, $1,860. Record the appropriate journal entries that would be necessary for Jeffrey Co. Record the entry that increases cash first. If an amount box does not require an entry, leave it blank.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education