ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

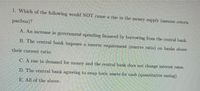

Transcribed Image Text:1. Which of the following would NOT cause a rise in the money supply (assume ceteris

paribus)?

A. An increase in government spending financed by borrowing from the central bank.

B. The centFal bank imposes a reserve requirement (reserve ratio) on banks above

their current ratio.

C. A rise in demand for money and the central bank does not change interest rates.

D. The central bank agreeing to swap toxic assets for cash (quantitative easing).

E. All of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statements is false A. Money is not a comsumption or a capital good B. An increase in the money supply does not confer a general benefit on society C. Economic theory cannot tell us generally which groups benefit and which groups are injured by inflation D. Economic theory cannot tell us the supply of money that is proper for an economy to havearrow_forwardIn an economy where the central bank implements negative interest rates as a monetary policy tool, what is the most likely short-term impact on consumer savings behavior and bank profitability? A. An increase in consumer savings as people seek to safeguard their money and a rise in bank profitability due to increased lending. B. A decrease in consumer savings as the incentive to save diminishes and a decrease in bank profitability due to lower interest margins. C. No significant change in consumer savings behavior but an improvement in bank profitability due to lower borrowing costs. D. A shift in consumer investment towards riskier assets and challenges in bank profitability due to compressed interest margins. Please don't use chatgpt it is giving wrong answer and please provide valuable answerarrow_forwardWhich of the following statements are true about the velocity of money? Choose one or more: A. Velocity is part of the equation of exchange. B. Velocity is the number of times a unit of currency exchanges hands in a given year. C. An increase in velocity, all else being equal, increases real GDP. D. An increase in velocity, all else being equal, increases nominal GDP.arrow_forward

- Which of the following statements about money that is correct? A. Inflation brings a rising value of money. B. A work of art is an example of money because it can act as a store of value. C. Money is a completely stable store of value. D. Without a medium of exchange, goods and services must be exchanged directly for other goods and services.arrow_forwardCurrency in Circulation (October 2020) 40.5 billion Nigerian currency Reserves (October 2020) 34.2 billion Nigeriancurrency M1 (October 2020) 2,465.9 billion Nigeriancurrency M2 (October 2020) 2,638.8 billion Nigeriancurrency Calculate the size of the actual money (M2) multiplier in October 2020. Round your answer to one decimal place. Nigeria's central bank, N. Bank, has not set a required reserve ratio (you can treat the required reserve ratio as 0%). Calcuate the excess reserve ratio for Norway in October 2020. Enter your answer in percent form without the percent sign. Round to one decimal place.arrow_forwardScenario: Money Supply Changes II Lucia withdraws $8,000 from her chequing account to pay tuition this semester. Assume that the reserve requirement is 20% and that banks do not hold excess reserves. As a result of the withdrawal, excess reserves. by a) increase; $8,000 b) decrease; $6,400 c) decrease; $1,600 d) decrease; $8,000arrow_forward

- A purchase of U.S. government securities by the Fed causes A. a multiple contraction of the money supply because deposits fall by more than the amount of the securities purchased. B. a contraction of the money supply equal to the amount of the securities because all other transactions occur within the banking system. C. an expansion of the money supply equal to the amount of the securities because all other transactions occur within the banking system. D. a multiple expansion of the money supply because the required reserve ratio is less than onearrow_forwardThe neutrality of money revisited a. Fill in the empty spaces after Year 1 in the chart below: b. What is the growth rate of the nominal money supply between years 1 and 2, 2 and 3, and 3 and 4? c. What is the rate of inflation between years 1 and 2, 2 and 3, and 3 and 4? d. What is the change in the real money supply between years 1 and 2, 2 and 3, and 3 and 4? e. What assumption has been made about real output growth if this data describe the medium run?arrow_forwardChoose the correct answer 1. The neutrality of money refers to the idea that: a) a change in money supply has no impact on output over any time period. b) a change in money supply has no short run impact on output. c) the real quantity of money is constant in the long term. 2. a) only the central bank can create money. b) commercial banks can create credit. c) all UK currency is backed by central bank holdings of gold. 3. a) UK currency is a commercial bank liability. b) UK currency is a Bank of England liability. c) UK currency is a central bank asset.arrow_forward

- 2arrow_forwardIn an economy, the banks prefer to keep 25% of their deposits in reserve. The population likes to keep their currency holdings equal to 10% of the deposits. Initially, there was zero money in the economy. Then the central bank buys $120 worth of T-bills from a household. The household receives $120 on its checking account. 1. the commercial bank formed reserves and gave out a loan. The population allocated the lent funds between the currency in pockets and checkable accounts. Before anything else happens, how much money is there in the economy at the end of Round 1? ANSWER: 288 For question 1 How is this answer obtained?, How would you solve question 2. 2. In Round 2, more lending, borrowing, and reserve formation takes place. How much is in DEPOSITS in the economy at the end of Round 2?arrow_forwardIf the central bank buys bonds from the market with open market operations when the money market is in equilibrium and money demand is stable, which of the following developments will occur? a. Interest rate doesn't change b. Investments increase c. Interest rate decrease d. Interest rate increasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education